![]()

Chapter 1

South Korea’s Economy at a Crossroads

South Korea’s phenomenal economic success post-World War II (WWII) has been widely hailed as another economic miracle after Japan’s. In less than two decades after the war, South Korea had transformed from an agricultural nation to a major manufacturer in the world. The successful industrialisation from light to heavy industries had sustained the country’s high economic growth rates for nearly four decades since the 1960s; the exceptions were the oil crisis and Asian financial crisis that dragged down its economic growth to negative rates in 1980 (–1.9%) and 1998 (–5.7%). The quicker gross domestic product (GDP) expansion than population growth rapidly augmented South Korea’s GDP per capita from merely US$91.5 in 1961 to US$7,523 in 1991 and US$27,195 in 2015. The successful industrialisation also allowed manufacturing sectors to provide job opportunities for the mass labour released from the agricultural sectors, pulling tens of millions of people out of poverty. Despite the gradual relocation of manufacturing production to overseas countries since the 1990s, the unemployment rate continued to remain relatively low from 1990 to 2015 (between 2% and 4%) except for in 1998 and 1999.

The smooth economic development over the last few decades, however, is no shield for the problems and challenges that continue to plague South Korea’s economy today. The continuous economic slowdown in recent years indicated that the long-term economic growth model based on exports has encountered difficulties. Not only does South Korea has to contend with the Japanese, its long-term rival, it now also has to face another emerging but equally if not more competitive economic powerhouse, the Chinese. The unclear export prospect has already led policymakers in Korea to remain dependent on extra government spending for maintaining its economic growth. Korea’s heavy household and corporate debts are also the country’s major weakness as a spike in interest rate or a sharp economic slowdown could lead to serious debt default that will further erode the government’s financial strength.

This chapter aims to offer an overall evaluation of South Korea’s macroeconomic performance and main policy response to the sluggish economy in recent years in a few significant areas: the main components of GDP growth and the resultant reasons behind the recent economic slowdown; the external trade development; the foreign direct investment (FDI) in South Korea and South Korean companies’ expansion through outward direct investment (ODI); the piling South Korea’s household and corporate debts; and the growth potential of Korea, both short-term and long-term.

Explaining South Korea’s Economic Slowdown

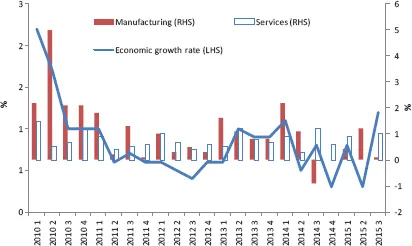

South Korea’s economy grew 2.6% in 2015, well below its projection of 3.9% at the beginning of the year, attributed largely to the weak exports and sluggish private consumption brought about by the spread of the Middle East respiratory syndrome (MERS) between May and July 2015. However, looking at Korea’s economic growth in a wider timespan, the slower economic expansion had taken place a few years ago. Between 2010 and 2012, the sluggish economic growth was accompanied by shrinking activities in both manufacturing and services (Figure 1-1). In 2013, economic growth rebounded with a more significant recovery in manufacturing than in services. However, since the second quarter of 2014, manufacturing growth has fluctuated while services have been relatively stable. The deceleration of domestic manufacturing production is linked to Korea’s slow growth in merchandise trade in the recent years. Korea’s total trade improved very slightly from US$1,145 billion in 2011 to US$1,150 billion in 2014. In 2015, exports and imports declined 8% and 17% respectively compared to that in the same period in 2014.

Figure 1-1 Growth Rate of South Korea’s GDP by Sector 2010–2015

(Percentage change from previous quarter)

Source: Korea’s Economic Statistics System, Bank of Korea, <http://ecos.bok.or.kr/> (accessed 11 December 2015).

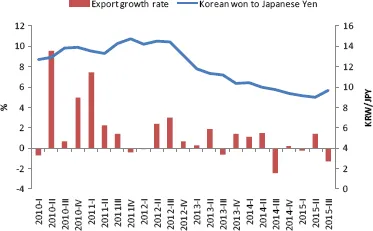

Several factors are behind South Korea’s weak exports. First, China’s increasing manufacturing strength may have reduced its reliance on importing intermediate goods from Korea. Indeed, China is no longer a low-end assembly location for South Korean manufacturers. Although intermediate goods continue to take a large portion of Korea’s total exports to China, the percentages have been declining over the last decade. Second, South Korea’s declining manufacturing investment in China might have reduced China-based Korean firms’ import of intermediate goods from home companies in South Korea. Third, Korea’s poor export performance is also related to the weaker Japanese yen. Korean Won (KRW) dipped from 13.8 won to 1 Japanese yen in the third quarter of 2010 to 9.7 won in the third quarter of 2015. During this period, the quarterly export growth rates had been waning as shown in Figure 1-2. Given the strong competition between Korean and Japanese manufacturers in the global market, especially in automobile, machinery and electronic sectors, yen’s depreciation has eroded the competitiveness of Korean products. About 70% of respondents surveyed in 2015 by Korea International Trade Association claimed that a weaker yen is wiping out their export business.1 The Bank of Korea (BOK) has limited tools to counterbalance the impact of a weaker yen despite its vast dollar reserves. Selling Korean won against US dollar and yen to depreciate KRW will impact on Korea’s business in the import of raw materials. Moreover, a weaker won could discourage foreign investors in the stock and bond market, thus destabilising the South Korean financial market.

Figure 1-2 Korean Export Growth Rate and Korean Won’s Exchange Rate to Japanese Yen 2010–2015

Source: CEIC.

In the face of weak exports, domestic consumption and investment became vital for supporting the country’s economic growth. The government expected the recovery of the housing market to contribute to the growth in private consumption. However, the accumulated household debt following rising housing prices might have restrained the growth in private consumption. Indeed, the key for promoting private consumption shall come from the steady growth in salary. The slow wage growth is a constraint on people’s propensity to consume. Over the last decade, the average monthly income of households with more than two persons increased by less than 2% annually. The most critical is the enlarging income gap. The gap between the average monthly incomes of the top 10% and the bottom 10% widened from 5.59 million won (US$4,847) in 2004 to 8.63 million won (US$7,483) in 2014.2 Although the figure in 2015 showed that unemployment rate remained low (3.2%), 51% of the employed was irregular workers (including temporary, daily and self-employed unpaid family workers).3 As irregular workers’ salary is lower and less stable compared to that of regular workers, their financial situation is vulnerable to an economic slowdown.

Even with the growing household debts, the government continued with its broad policy of stimulating economic growth by easing mortgage restrictions and cutting interest rates to 1.5% in June 2015.4 In August 2015, the government further announced a cut in consumption tax to spur private consumption. Excise taxes levied on cars, large household appliances and certain health food supplements had been reduced by 30% until the end of 2015.5

Private investment from corporates is another essential element in GDP growth. Nonetheless, the feeble exports had discouraged private sectors’ short-term investment in manufacturing goods for exports. The government’s investment was therefore important at the time when both private consumption and investment were fragile. In March 2015, Korea’s Ministry of Finance announced a budget of three trillion won (US$2.6 billion) for fiscal expenditure in the first half of the year.6 In July, it announced another fiscal stimulus package of 22 trillion won (US$19.6 billion) to spur anaemic growth. This stimulus package was mostly to be funded by issuing government debt and various state funds with a focus on financing MERS-hit businesses, reinforcing quarantine facilities and creating more jobs.7 In the face of a potential contraction in exports, the South Korean government planned to spend 386.7 trillion won (US$320 billion) in 2016, an increase of two trillion won (US$14 billion) from 384.7 trillion won (US$334 billion) in 2015 to maintain the country’s growth. Thirty-two per cent of the budget in 2016 would go to welfare programmes, followed by 16% to public administration, 14% to education and 10% to military defence.8 The growing budget is expected to widen the fiscal deficit to 37 trillion won (US$32 billion), representing 2.3% of Korea’s GDP in 2016, the highest since 2009. The wider fiscal deficit was also expected to push the country’s sovereign debt to a record high of 40.1% of its GDP in 2016, a rate which was still much lower than the Organisation for Economic Co-operation and Development (OECD) countries’ average of 114.6% in 2015.9

From a positive point of view, given South Korea’s relatively low government debt to GDP ratio compared to other OECD countries, the higher government expenditure is less likely to erode its financial soundness in the near term. However, the stimulus policy may not be sustainable if exports continue to fall. The decreasing exports mean that Korean firms are making less money and producing less tax revenues. As a consequence, the government will have less capacity to finance the extra spending for boosting the economy.

Growing Trade Surplus and Korea’s FTAs Expansion

Trade expansion has facilitated South Korea’s economic development over the last few decades. Being a resource poor country, South Korea has to rely on importing energy resources for domestic production. The domestically made products also need access to foreign markets for South Korea’s economy to continue its upward climb. The substantial commercial exc...