- 212 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

-->

Singapore's fiscal strategies have helped sustain the country's growth as a small and open economy. This book is a pioneering effort in terms of providing a non-technical, holistic view of Singapore's strategies. The author, formerly Director of Fiscal Policy in Singapore's Ministry of Finance and the Principal Private Secretary to the President of Singapore, provides an insider's bird's eye view of how Singapore's fiscal strategies support monetary and economic policies, and address the needs of Singaporeans.

The book is structured to explain how the various aspects of Singapore's fiscal policies inter-relate and work together as a functioning system, enabling the small city-state to prosper and progress since its independence in 1965. Besides providing a documentation of the development of Singapore's fiscal strategies over the years, the current and impending national challenges to be addressed by fiscal strategies are also discussed. The author also addresses the importance of culture to a nation's success, and highlights the impact of fiscal policy in this regard.

--> Contents:

- Introduction:

- Much More than a Revenue and Expenditure Statement

- Historical Developments

- Building a Sustainable Budget from the Beginning

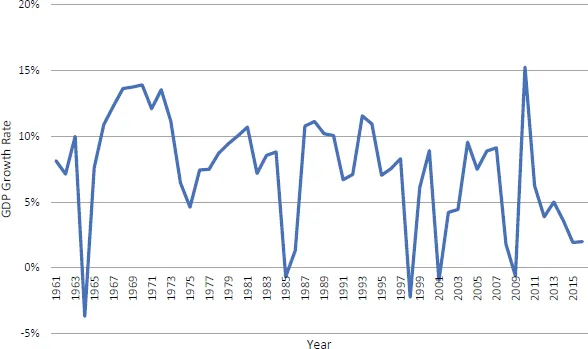

- Evolution of Growth Strategies over the Years

- Stability for Long-Term Growth:

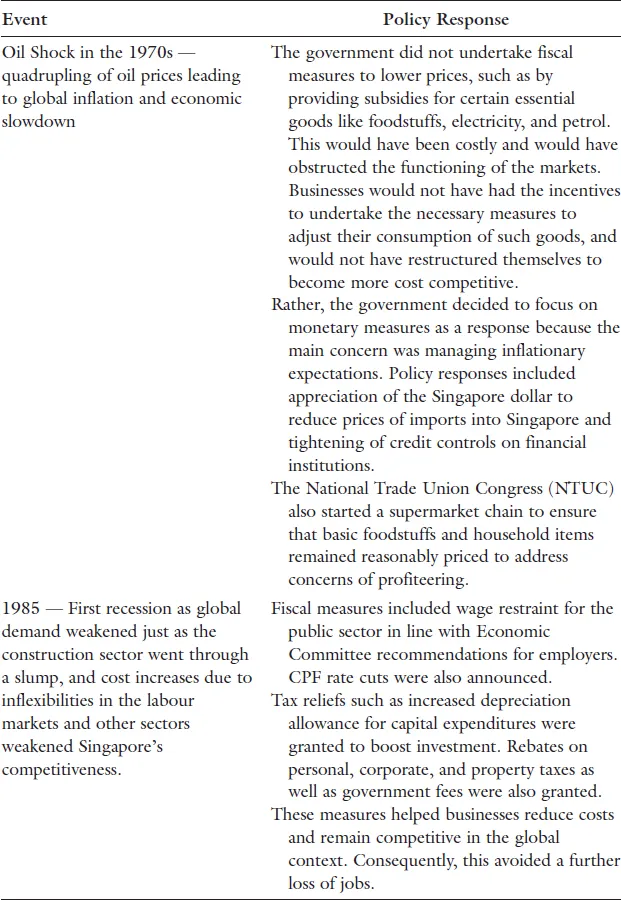

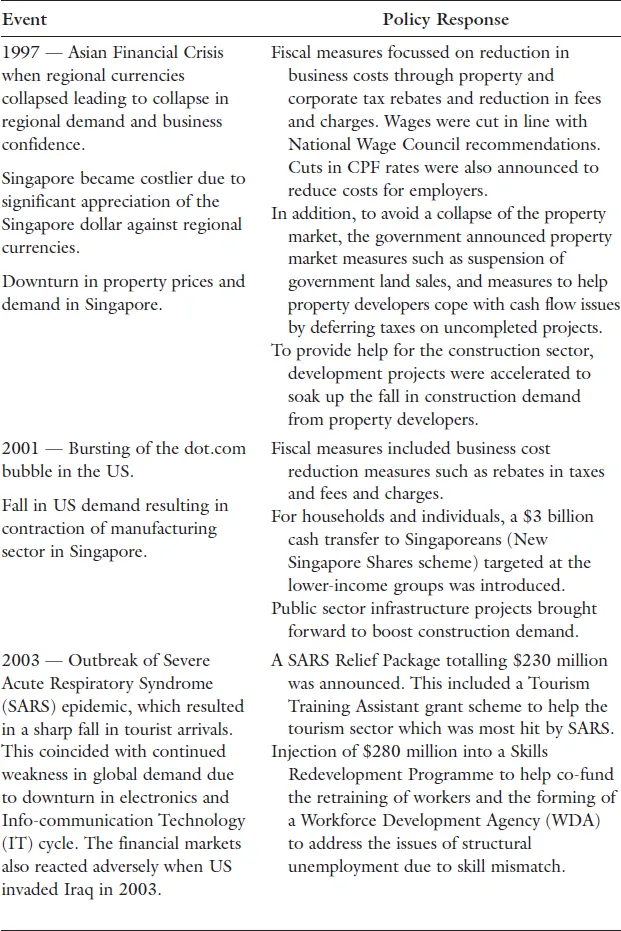

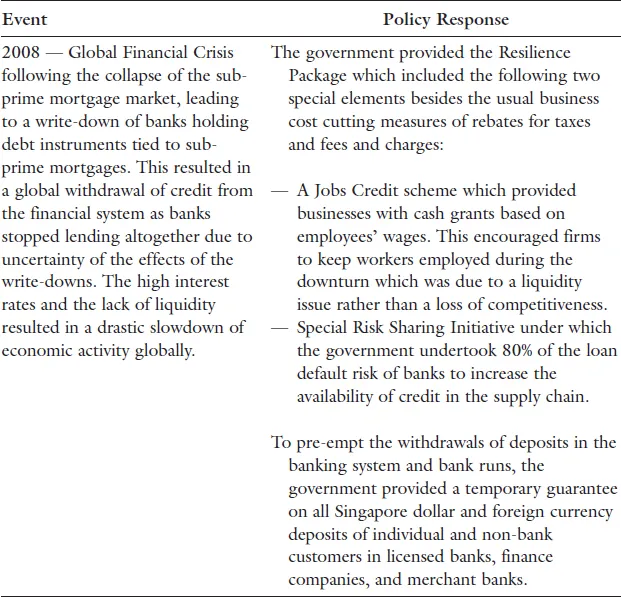

- Steering a Small Ship in Rough Seas

- Promoting Confidence through Budgetary Prudence

- Protection of Accumulated Surpluses

- Conservatism in Fiscal Planning

- Funding of Future Liabilities

- Capping Expenditures, Creating Value

- Marshalling Economic Resources for Productive Growth:

- A Pro-Enterprise and Pro-Work Fiscal Environment

- Optimise Usage of Limited Land Resources

- Efficient Infrastructure that Support Growth

- Regulating the Inflow of Foreign Workers

- Putting the Population to Productive Employment

- Addressing People's Needs:

- Jobs and Wage Growth

- Ensuring Visible Broad-Based Benefits

- Sharing of Surpluses

- Challenges and Issues for the Future:

- Aging Population

- Headwinds in an Increasingly Turbulent World

- Double Edged Sword of Technology

- Self-Reliance

-->

--> Readership: Students and academics interested in public policy and Singapore's development model, local and foreign agencies interested in Singapore's fiscal policies, analysts and observers interested in Singapore's future. -->

Keywords:Fiscal Strategies;Fiscal Policy;Sustained Growth;Fiscal sustainability;Singapore;Budget;Taxes;Macroeconomic Stability;Productivity;Public Finance;Past ReservesReview:

"This penetrating and comprehensive book by Lee Kok Fatt is probably the first to be written by a practitioner on Singapore's fiscal policy since the early 1960s; and how that policy has contributed to the country's impressive non-inflationary and stable growth. Kok Fatt has served as Director of Fiscal Policy in the Ministry of Finance, and subsequently as the Principal Private Secretary to the President of Singapore; those two important positions have provided him with a deep and unique grasp of the factors determining the formulation and operation of the fiscal policy of Singapore. He has now compiled what may be regarded as an authoritative text book covering the diverse facets of the Island-State's fiscal policy. It is a valuable reference work for those, particularly students, who want to know more about an important pillar supporting Singapore's remarkable economic growth. Kok Fat deserves praise for his stamina and dedication in completing this important oeuvre."

J Y Pillay

Chairman of the Council of Presidential Advisers, Singapore

"Prudent fiscal policy has been and remains at the centre of the Singapore's success. To date knowledge of its intricacies has been the preserve of the small handful of civil servants charged with its conduct over the last half a century. Lee Kok Fatt has done a masterful job of illuminating this vital topic for the benefit not only of the general public but also for fiscal planners in Singapore and in the great number of other countries who rightly look to Singapore as an example of getting it right. This book should be required reading for students of Singapore's past success and for civil servants and politicians responsible for ensuring this success is continued."

Devadas Krishnadas

Chief Executive Officer, Future-Moves Group and

Author of FUSE: Foresight-driven, Understanding, Strategy and Execution

"Many analysts have rightly attributed Singapore's success to a visionary political leadership and an effective public service well-known for their integrity, efficiency and economic orientation. In contrast, the critical role played by Singapore's fiscal policy has not received the attention that it deserves. This gap in the explanations of the Singapore story is now filled by Kok Fatt's comprehensive account of Singapore's fiscal policy as national strategy. Written in a clear language that translates complex technical issues into simple terms that are easy to understand, this book is not just a useful resource but a 'must-read' for anyone interested in the secrets of Singapore's success."

Professor David Chan

Director, Behavioural Sciences Institute

Singapore Management University

Editor of 50 Years of Social Issues in Singapore

"This is an important, readable and lively book. Many developing countries have sought to emulate Singapore's remarkable success, but until now a clear and convincing account of the decisive role of fiscal policy in that story has been lacking. The author, a former Director of Fiscal Policy at Singapore's Ministry of Finance, has deftly remedied that omission, offering insights that development practitioners, government officials and scholars everywhere should study in detail."

Max Everest-Phillips

Director of UNDP Global Centre for Public Service Excellence

Key Features:

- The unique treatment of how fiscal policy interacts with monetary, economic and social policies distinguishes the book from other publications on the topic

- The author is well placed to be an authority on the topic given his experience as a practitioner in senior positions

- The writer also expresses his views on the future challenges and issues that could shape the development of Singapore's fiscal strategies into the future, which would guide analysts and observers interested in Singapore's future

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Table of contents

- Cover Page

- Title

- Copyright

- Endorsements

- Contents

- Preface

- About the Author

- SECTION I INTRODUCTION

- SECTION II STABILITY FOR LONG-TERM GROWTH

- SECTION III MARSHALLING ECONOMIC RESOURCES FOR PRODUCTIVE GROWTH

- SECTION IV ADDRESSING PEOPLE’S NEEDS

- SECTION V CHALLENGES AND ISSUES FOR THE FUTURE

- Notes