![]()

1

CURTAIN RAISER

When we thought of writing a book about Singapore corporations, a journalist joked, “Are you writing about Singapore corporates?! You only have to cover MNCs, GLCs and PLCs — multinational companies, government linked companies and poor local companies.” The implication was that the corporate sector in Singapore comprised overseas companies that chose to make Singapore home because of its investor friendly climate, local companies that flourished because of government backing and a host of small and medium scale enterprises that barely survived.

The statement set us thinking. Was the Singapore corporate story so boring and uni-dimensional? Are there no lessons global investors can learn from this prosperous island state that rose from “Third World to First World” in less than 50 years? In this day and age how can an economy thrive by just being an MNC hub and home to a bunch of GLCs that depend heavily on government gratis? But as we delved deeper, a fascinating story emerged. It was that of a forward looking nation that constantly questioned its relevance in a dynamic global environment — re-positioning itself as a world-class financial centre willing to open its borders further to global commerce while showing it innovative capacity by leveraging on its skilled workforce.

In its Doing Business 2016 report, The World Bank ranked Singapore first globally for ease of doing business. Neighbouring city state Hong Kong is ranked fifth, despite having China as a hinterland. World Bank ranks countries in terms of the ease of doing business on ten parameters — starting business (Singapore is ranked 10th), dealing with construction permits (1st), getting electricity (6th), registering property (17th), getting credit (19th), protecting minority investors (1st), paying taxes (5th), trading across borders (41st), enforcing contracts (1st) and resolving insolvency (27th).

Transparency International ranks Singapore as the eighth least corrupt country in the world, after Denmark, Finland, Sweden, New Zealand, Netherlands, Norway and Switzerland. It is the only country in Asia to feature in the ten least corrupt nations. However, Singapore’s ranking has slipped to eight in 2015 from seven in 2014. Its score slipping from 87 in 2012 to 85 in 2015 is a cause for concern.

Singapore’s corporate tax rate is 17% which is marginally higher than Hong Kong’s 16.5% and more attractive than the Asian average of 21.91% and the global average of 23.68%. Singapore is a member of the Association of South East Asian Nations (ASEAN). Corporate tax rates in the other member nations are Indonesia (25%), Malaysia (24%), The Philippines (30%), Thailand (20%), Brunei (18.5%), Cambodia (20%), Laos (22%), Myanmar (25%) and Vietnam (20%).

According to the Business Environment Risk Intelligence (BERI) 2014 report, “Singapore enjoys the highest ranking for labour force in terms of workers, productivity and general overall attitude; as displayed by superior business performances with advanced technology and low labour unit costs in relation to the value of goods and services produced.” Singapore’s labour force evaluation score is 92, while USA is ranked a distant second at 80.

Singapore has essentially put together all the ingredients for a vibrant corporate sector — state of the art infrastructure, business friendly environment, low corruption, low tax rate and a high quality labour force. This has resulted in this 716 square km city state leading the 2014 foreign direct investment (FDI) rankings. In 2014, 409 greenfield projects were launched in Singapore with an aggregate capex of USD11.38bn creating 2,732 jobs through 390 companies. Following Singapore were the capitals and financial hubs of much larger economies like London (ranked 2nd), Shanghai (3rd), Dubai (4th), New York (5th) and Hong Kong (6th).

Ever since the city state secured independence in 1965, the economy has been among the most open in the world. This openness and has not only encouraged Singapore’s home grown corporates like DBS, CapitaLand, Keppel Corporation, Fraser & Neave, Singtel, ComfortDelGro and a host of others started acquiring and establishing overseas businesses within years of being incorporated but also the city state has served as a gateway for corporates in other ASEAN and Asian nations.

Singapore is the headquarters of agri-business companies like Golden Agri Resources, most of whose plantations are in Indonesia and Wilmar International, whose plantations are located in Malaysia and Indonesia. Singapore’s International Enterprises (IE) invited the agricultural and industrial raw materials supply chain manager, Olam International, to move its headquarters to Singapore from London. Olam acquiesced and expanded to become a significant global agribusiness player and was a constituent of the Singapore Stock Exchange’s (SGX) flagship index, the Straits Times Index (STI) till September 2015.

Does this imply that Singapore is a corporate utopia, whose companies are unlikely to be unaffected by global economic turmoil? Certainly not. The corporate sector faces multiple risks at the current juncture including an uncertain global macroeconomic environment that includes a slowdown in China, growing pessimism about the European Union, and rising corporate debt levels. At the corporate level one has to contend with low crude oil prices that benefits companies for whom fuel is an input but affects suppliers to oil companies who face shrinking order books amid reduced capital expenditure, thinning margins and slowing revenues. Human resources problems are mounting with labour mobility constrained by tightening immigration laws and amid inadequate gender diversity on company boards.

But these risks should be assessed against the backdrop of the dominant market positions, competitive advantages, performance and financial muscle of large corporations. The following chapters provide snapshots of some of the largest Singapore corporates, challenges these companies face and takeaways for novice investors or just business observers. The final chapter discusses challenges common to Singapore’s corporates and provides a summary of the stock performance of the listed companies covered in the book against the backdrop of these challenges.

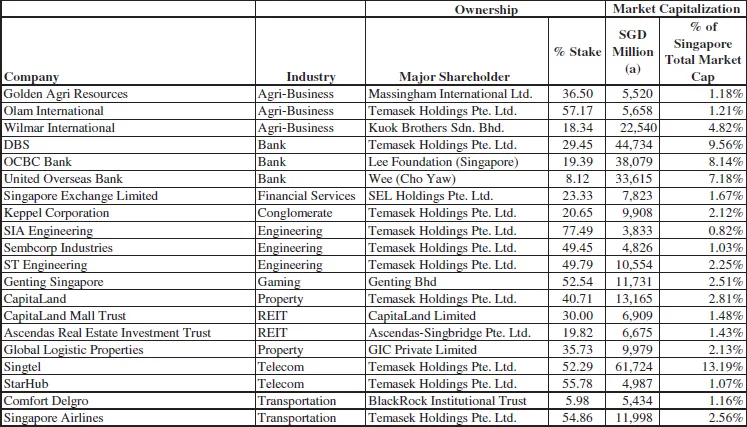

The flagship stock index of the Singapore Exchange (SGX) is the Straits Times Index (STI). The STI comprises thirty companies, both domestic and overseas, and operate across a wide spectrum of industries. We have covered twenty companies in this book, sixteen of which are STI constituents. The four non-STI constituents are Temasek Holdings, Fraser & Neave (F&N), Marina Bay Sands (MBS) and Olam International.

The Singapore government-owned investment company Temasek Holdings, as the controlling shareholder of several STI constituents including Singtel, DBS, Olam and Keppel Corporation, has played a very strategic role in shaping Singapore’s corporate landscape. Erstwhile STI constituent, F&N was purchased by the Thai conglomerate Thai Beverage, which subsequently became a STI constituent. This acquisition among several others is a testimony of the openness of Singapore’s economy that facilitates two way capital flows.

The unlisted MBS along with the STI constituent Genting Singapore Plc (GENS) enhanced Singapore’s attractiveness as a tourist destination. The two integrated resorts (IRs) operated by GENS and MBS, Resorts World Sentosa and Marina Bay Sands, are among the ten largest in the world and have transformed Singapore into the second largest gaming market in Asia Pacific after Macau within five years of starting operations. Olam, as mentioned earlier, relocated its headquarters to Singapore from London following IE’s invitation and has played a role in transforming Singapore into ASEAN’s agribusiness hub.

We have chosen the following companies as we believe that these companies best represent the Singapore corporate sector’s successes, opportunities, challenges and threats. These sixteen listed companies have a combined market capitalization of SGD311 billion, representing 35% of the Singapore Stock Exchange’s total market capitalization of SGD905 bn.

Source: Thomson Reuters & Yahoo Finance

(a) As of November 30, 2016

This book is a bird’s eye view on some of Singapore’s largest corporates, on each of whom a book may be written. It is meant to give those who do not have a background in finance but an interest in investing, a perspective of these companies performance, market position, earnings potential and risks so that investors may make informed decisions. We have tried to restrict financial jargon to a level that is absolutely necessary as avoiding financial jargon in a book of this nature is a near-impossible task. A glossary is provided at the end of this book.

Singapore has four public sector investors — the central bank Monetary Authority of Singapore (MAS), Central Provident Fund (CPF), Temasek Holdings (Temasek) and GIC Private Limited (GIC). Temasek has invested in several Singapore-based and overseas companies. GIC is tasked with managing Singapore’s foreign exchange reserves.

As GIC predominantly invests overseas, and in some instances in conjunction with Temasek and entities like Global Logistic Properties, its direct impact on Singapore’s corporate sector is limited.

So, we decided to present Temasek as the first company specific chapter in this book to provide a context for the significance of its investee companies in the STI and also explore the commonalities and differences between the Temasek Portfolio Companies (TPC) that are featured in this book.

We hope the readers find reading the book as enriching an experience as we found putting the book together.

![]()

2

TEMASEK HOLDINGS

Temasek Holdings (“Temasek”), Singapore’s investment company, is not a listed entity. But it has played a pivotal role as an investor in large Singapore-based corporates and a dividend paying corporation to its shareholder, Singapore’s Minister for Finance, a body corporate under the Singapore Minister for Finance (Incorporation) Act (Chapter 183). The company is designated a Fifth Schedule Company under the Singapore Constitution along with Singapore’s central bank, the Monetary Authority of Singapore (MAS) and the company responsible for managing Singapore’s foreign reserves — GIC Private Limited ( GIC).

Temasek was incorporated in 1974 to commercially manage an initial portfolio, consisting of shares in companies, start-ups and joint ventures previously held by the Singapore Government. “This move enabled the Singapore Government to focus on its core role of policymaking and regulations.” Temasek’s investment strategy focuses on four investment themes — transforming economies, growing middle income populations, deepening comparative advantages, and emerging champions

Our analysis of Temasek is limited by the investment company’s not so detailed disclosures of portfolio and financial performance; a trait fortunately not shared by its investee companies. Temasek’s portfolio valued at SGD354 million in 1974 consisted exclusively of Singapore-based corporates. The company over the years has expanded and diversified its portfolio to include overseas investments. Over the forty one year period — 1974 to March 31 2016 — Temasek’s investment portfolio has grown by over 580 times to SGD242 billion. Temasek’s investment portfolio is quite granular, with the top 10 listed investments accounting for about 46% of its portfolio as of March 31 2016.

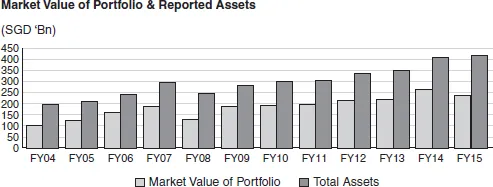

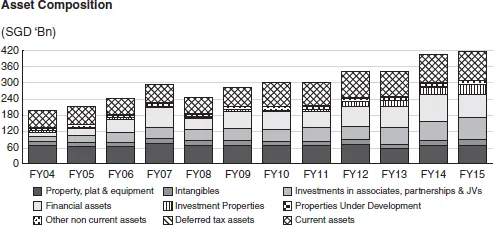

We have presented below in pictures Temasek’s performance during the last twelve years (FY041 to FY15) for two reasons. First, certain fundamental changes have occurred in Temasek’s investment philosophy during the past decade that has implications on the company’s long term return. Second, readers would be able to understand the impact of the 2007–08 Global Financial Crisis (GFC) on Temasek’s portfolio and deduce the likely impact when the next global downturn occurs. All figures reported are consolidated figures for Temasek Holdings.

Performance in Pictures

Temasek’s assets as reported in its balance sheet are a combination of assets reported at their historical acquisition costs less accumulated depreciation and assets reported at their market value. Temasek’s ‘portfolio’ is its core investment portfolio reported at its market value. Temasek’s portfolio is a subset of its total assets. In the last twelve years, FY04 to FY15, Temasek’s portfolio and total assets have more than doubled (Figure 1).

A fundamental change in asset composition has accompanied Temasek’s asset growth in the last twelve years (Figure 2). The company continues to allocate at least a quarter of its assets to liquid assets such as cash. These have been categorized as current assets. Financial assets accounted for 21% of total assets as of 31 March 2016 (FY04: 7%), while investments in associates, joint ventures and partnerships accounted for 19% (FY04: 9%).

Figure l

Source: Temasek Review 2005 to 2016.

Figure 2

Source: Temasek Review 2005 to 2016.

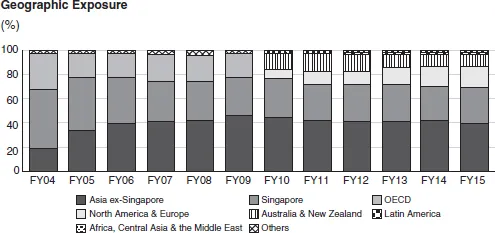

Temasek changed the classification, for the purposes of reporting, of the geographic composition of its portfolio in FY10. Prior to FY10, the company used to report assets domiciled in Singapore, Asia excluding Singapore, Organisation for Economic Co-operation and Development (OECD) members and others. From FY10, the OECD category was replaced by assets domiciled in North America & Europe, Australia & New Zealand, Latin America and Africa, Central Asia & the Middle East.

Figure 3

Source: Temasek Review 2005 to 2016.

Notwithstanding the change in reporting, there are two takeaways regarding the geographic exposure of Temasek’s portfolio (Figure 3). One, the company’s investments continue to be Asia-focussed with investments domiciled in Singapore and Asia ex-Singapore together accounting for about 70% of the portfolio during the last twelve years. But the percentage of investments domiciled in Singapore has declined to 29% in FY15 from 49% in FY04. Investments domiciled in Asia ex-Singapore has correspondingly increased to 40%...