- 228 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Advanced Finance Theories

About this book

-->

For PhD finance courses in business schools, there is equal emphasis placed on mathematical rigour as well as economic reasoning. Advanced Finance Theories provides modern treatments to five key areas of finance theories in Merton's collection of continuous time work, viz. portfolio selection and capital market theory, optimum consumption and intertemporal portfolio selection, option pricing theory, contingent claim analysis of corporate finance, intertemporal CAPM, and complete market general equilibrium. Where appropriate, lectures notes are supplemented by other classical text such as Ingersoll (1987) and materials on stochastic calculus.

-->

--> Contents:

- Utility Theory

- Pricing Kernel and Stochastic Discount Factor

- Risk Measures

- Consumption and Portfolio Selection

- Optimum Demand and Mutual Fund Theorem

- Mean–Variance Frontier

- Solving Black–Scholes with Fourier Transform

- Capital Structure Theory

- General Equilibrium

- Discontinuity in Continuous Time

- Spanning and Capital Market Theories

-->

--> Readership: Graduates, doctoral students, researchers, academic and professionals in theoretical financial modeling in mainstream finance or derivative securities. -->

Keywords:Intertemporal Portfolio Selection;Capital Structure;General Equilibrium;Spanning;Mutual Fund Theorem;Jumps;Incomplete MarketsReview: Key Features:

- Complete and explicit exposition of classical finance theories core to theoretical finance research

- Modern treatments to some derivations

- Supplementary coverage on key related publications and more recent finance research questions

- Detailed proofs and explicit coverage to aid understanding by first year PhD students

- List of exercises with suggested solutions

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Chapter 1

Utility Theory

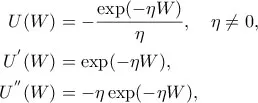

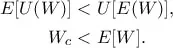

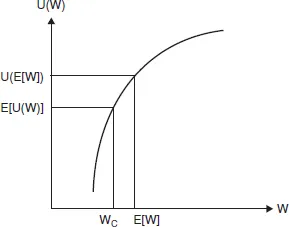

1.1Risk Aversion and Certainty Equivalent

Chapter 2

Pricing Kernel and Stochastic Discount Factor

2.1Arrow–Debreu State Prices

Table of contents

- Cover

- Halftitle

- Title

- Copyright

- Dedication

- Preface

- About the Author

- Acknowledgements

- Contents

- Note for PhD Students

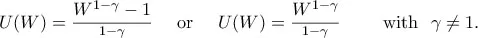

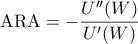

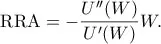

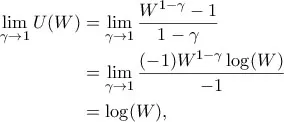

- 1 Utility Theory

- 2 Pricing Kernel and Stochastic Discount Factor

- 3 Risk Measures

- 4 Consumption and Portfolio Selection

- 5 Optimum Demand and Mutual Fund Theorem

- 6 Mean–Variance Frontier

- 7 Solving Black–Scholes with Fourier Transform

- 8 Capital Structure Theory

- 9 General Equilibrium

- 10 Discontinuity in Continuous Time

- 11 Spanning and Capital Market Theories

- Bibliography

- Calculus Notes

- Index