- 256 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Stochastic Drawdowns

About this book

-->

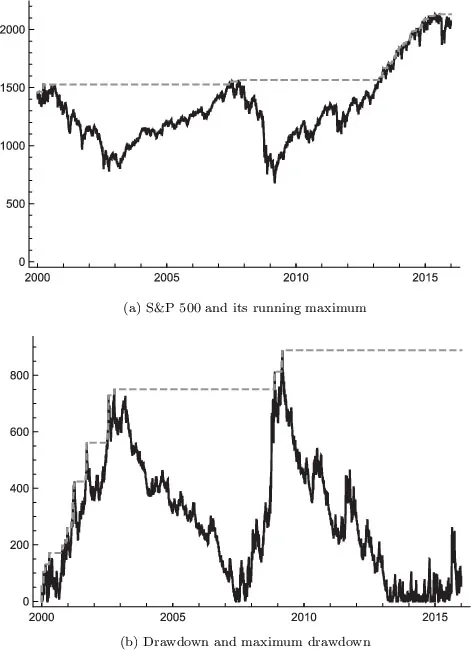

Stochastic Drawdowns consists of some recent advances on Dr Hongzhong Zhang's own quantitative research of the well-known risk measures, drawdowns and maximum drawdowns. In this book, the author provides an extensive probabilistic study of different aspects of drawdown risks, which include the drawdown risk in finite time-horizons, the speed of market crashes (drawdowns), the frequency of drawdowns, the occupation time (time in distress), and the duration of drawdowns. Leveraging the knowledge in stochastic calculus, Lévy processes and optimal stopping, these topics can be considered as problems in advanced applied stochastic processes, and insurance/financial mathematics.

The book also offers a number of applications of drawdowns in financial risk management, insurance, and algorithmic trading, including schemes on hedging and synthesizing of maximum drawdown options, (cancellable) drawdown insurance contracts and their fair premium, as well as optimal trading under drawdown-type constraints such as trailing stops.

It is the goal of this book to offer a comprehensive characterization of drawdown risks and a handful of applications of drawdown in practice. On the one hand, the book enables interested students and researchers to learn the state-of-art probabilistic research on drawdowns, and explore new mathematical problems that are of practical importance to the financial industry. On the other hand, the book provides financial practitioners with access to a variety of analytically tractable measurements of drawdown risks, and the insight into hedging, optimal trading and execution amid challenges of these risks.

--> Contents:

- Introduction

- Drawdown Measures:

- Drawdowns Preceding Drawups in a Finite Time-Horizon

- Drawdowns and the Speed of Market Crashes

- Frequency of Drawdowns in a Brownian Motion Model

- Occupation Times Related to Drawdowns

- Duration of Drawdowns under Lévy Models

- Applications of Drawdown:

- Maximum Drawdown Insurance Using Options

- Fair Premiums of Drawdown Insurances

- Optimal Trading with a Trailing Stop

- Appendix: Briefly on One-Dimensional Linear Diffusions

-->

--> Readership: Senior undergraduate and graduate students equipped with the knowledge of stochastic processes and financial practitioners who are interested in optimal trading and execution. -->

Keywords:Drawdown;Maximum Drawdown;Insurance;Optimal TradingReview: Key Features:

- The first book to touch on the advanced quantitative analysis of drawdowns in the current market

- A rigorous and extensive study of drawdowns from a probabilistic point of view

- Addressing of important practical problems related to drawdowns

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Chapter 1

Introduction

1.1.Chapter Outline

Table of contents

- Cover

- Halftitle

- Series Editors

- Title

- Copyright

- Dedication

- Preface

- Contents

- About the Author

- 1. Introduction

- Part I Drawdown Measures

- Part II Applications of Drawdown

- Appendix. Briefly on One-Dimensional Linear Diffusions

- Bibliography

- Index

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app