![]()

Chapter 1

Overview

1.1What Is FinTech?

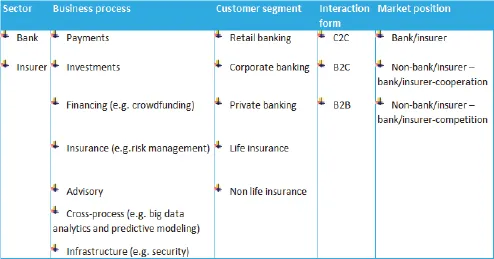

FinTech or financial technology refers to the new solutions which demonstrate innovation in the development of applications, processes, products or business models in the financial services industry using technology. FinTech should have four features. They need to be highly innovative, pioneering, disruptive and customer-focused. Technology will include the use of artificial intelligence (AI), big data, computational power, Internet of Things (IoT) or others. These solutions can be differentiated in at least five areas by customer segments like financial services or products built upon technology in the banking and insurance sectors shown in Table 1.1.

We have earlier defined FinTech to be as general as possible to embody a broad range of technology applications and to include payments, investment, financing, insurance, advisory, cross-processed (bank/insurer/non-bank/non-insurer) and infrastructure services. There is no one definition agreed by all. Some may define FinTech as technology that increases efficiency and creates new financial business models that utilise some or all of the followings: AI, Blockchain, Cloud and Data Analytics. Others have defined FinTech companies as those applying emerging technologies to alter the current financial landscape, while TechFin companies are those that utilise technology to enhance existing financial capabilities. Still, others have viewed FinTech companies as those driven by the desire to use emerging technologies to disrupt the financial landscape, while TechFin companies are those using technology to enable efficiency improvements, preferring a less disruptive and a more incremental approach.

Table 1.1.Coverage of FinTech.

Source: By authors; Alt and Pushchmann (2012).

However, Jack Ma, the founder of the world’s largest e-commerce platform Alibaba, has given an entirely different definition for TechFin. To Ma, FinTech takes the original financial system and improves its technology (Zen, 2016), and TechFin is to rebuild the system with technology and solve the problem of a lack of inclusiveness.

Before the use of the word FinTech, there were discussions in China between the utilisation of the two terms: Internet Finance and Internet Banking. These two concepts in the Chinese language are (i)

Internet Finance that focuses on providing innovative financial services via the Internet to the masses and (ii) Finance on the Internet

that provides traditional financial services on the Internet. The former uses AI, big data, and computing power to lower credit risk and provide innovative online and offline services, while the latter uses the Internet to provide old economy financial services. If that is not confusing enough, there is also the use of the terms Digital Banking, Virtual Banking, Online Banking, Mobile Banking, Social Banking in Europe that describe business models with digital or online services without any physical branches.

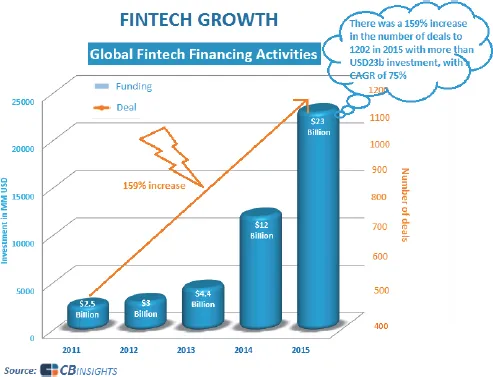

Figure 1.1.FinTech Growth: 2011–2015.

Source: By authors; CBInsights.

These debates on the use of the terms are fuelled by an exponential increase in the investment into FinTech start-ups and companies. Regarding FinTech growth in the world according to CB Insights, there was an estimated 260% increase in the number of deals from 2008 to reach 730 in 2014 with more than USD12 billion investment. By 2015, Figure 1.1 shows there was an increase of 159% in the number of deals to 1,202 in 2015, with more than USD23 billion in investment, with a compound average growth rate (CAGR) of 75%.

1.1.1FinTech and Silicon Valley

Silicon Valley has a start-up culture that is unmatched elsewhere. To understand FinTech, we need to understand the ecosystem and the underlying “3C” philosophy. In the Silicon Valley ecosystem, the three Cs are Community, Compassion and Creativity. Moreover, the raison d’etre for FinTech is three-pronged. One is the repression of the Financial Services Industry which offers the potential for FinTech, resulting in massive customer demand as yet to be met by the traditional financial industry. The second reason for the rapid commercial technology advances is providing tools for innovation as by mobile Internet, big data, cloud computing, and blockchain. In turn, rapidly changing customer behaviour is an impetus for innovation as customers want to have a decisive role in choosing financial services. The unmatched mindset of Silicon Valley, sometimes termed the Left Coast Culture, is supplemented by deep skills of those taking up the technology and start-ups’ challenges in the Bay Area. However, without the massive capital to fund the development of the ecosystem that sees 80% to 90% failure rates, it will be difficult for the deep skill and mindset to evolve. It is not the community alone that supports the ecosystem, but it is also the compassionate spirit that grows the investment culture into one that prides itself for buying into failures. However, more importantly, the creative culture is the consequence of the right environment to acquire the right skill set, the right mindset and the resilience of fundraising capabilities despite high rates of failures.

1.1.2FinTech and corporate culture

FinTech is not only attractive to financial institutions, but it is also attracting the attention of non-financial services as shown in three different technological businesses represented by the three companies Google, Intel and Salesforce (the primary activity of the companies is in parenthesis): namely:

(1)Google has invested in OnDeck (loans and credit), Robinhood (investment), rippleLabs (payment), digit (finance tracking), puddle (L&C), Upstart (L&C), CircleUp (investment), Abacus (accounting), LedgerX (trading), Kensho (analytics);

(2)Intel has invested in iZettle (payment), fortumo (billing), technisys (banking), mFoundry (retail banking solutions), FundersClub (investment);

(3)Salesforce has invested in nCino (Cloud SaaS), Financial-Force.com (Cloud ERP), Moneytree (expenditure management).

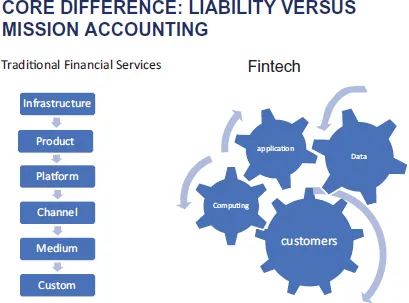

Figure 1.2.Core Difference between Traditional Financial Services and FinTech.

Source: By authors.

Corporate venture capital in financial services includes Citi Services with one to ten new deals per year and with median deal size of USD19 million. Corporate venture capital backs about half of such ventures. As shown in Figure 1.2, the core difference between traditional financial services and FinTech is of respectively, block and silo structure to a flat and interconnected structure. In conventional finance, processes are organised along infrastructure, product, platform, channel, medium and custom. In FinTech, it is a flat organisation structure that drives application, cloud and custom. The latter is smooth, interconnected and with few pain points.

Whereas traditional banks act openly to engage with technology solutions early and have their own intellectual property to generate new ideas, they also need to collaborate to co-innovate within the industry and engage with start-ups too. They do venture investing in start-ups.

However, traditional banks are matrix organisations, working according to marketing lines (investment, corporate, retail, wealth management, etc). They are sub-divided into product lines (loans, deposits, equity, fixed income, derivatives, structured, etc). A dotted line (indirect) and solid line (direct) reporting structure are super-imposed on existing structure.

In terms of their corporate governance and compliance as sacred, there is minimum discretion to prevent “mistakes”. The paper trail is essential for accountability of adherence. Incentives exist to encourage competition and innovation within the rules to maximise profits. Conflict of Interest and Interested Party Transactions are frowned upon. Whistleblowing to expose inefficiency and violations is the practice. Liability accounting means mistakes, not sunk cost, but the beginning of witch-hunting with punishment.

In Google Insurance Tech, for instance, it moves around investments (collective Health, OSCAR, Gusto, The Climate Corporation) and partnerships (American Insurance, CoverFund, Liberty Mutual Insurance, VSP and AXA). There is an increasingly diverse cast of tech players, stretching from the US in early-stage of insurance tech deals, to Germany, the UK and lately to India and China among others.

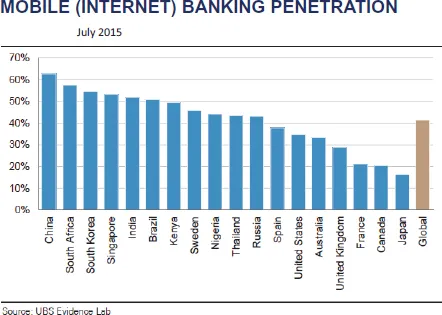

Figure 1.3.Mobile and Internet Banking Penetration.

Source: UBS Evidence Lab.

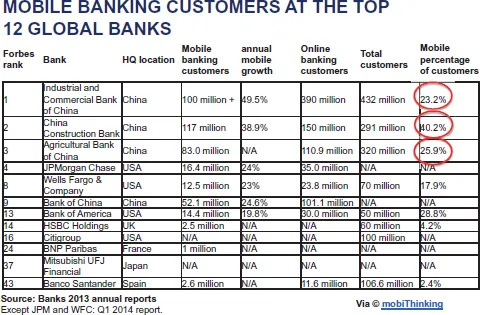

Figure 1.4.Mobile Banking Customers at the Top 12 Global Banks.

Source: Banks 2013 annual reports.

1.1.3FinTech and mobile banking

For mobile (Internet) banking penetration, by July 2015, Figure 1.3 shows the fast catch-up is by China of over 60%, followed by South Africa (near 60%) and South Korea (55%) while the US lags (35%) behind even the global as 45%.

Figure 1.4 shows for mobile banking customers at the top 12 global banks in 2013, China also excels, with top three from China, namely, Industrial and Commercial Bank of China (over 100 million mobile banking customers), China Construction Bank (117 million) and Agricultural Bank China (83.0 million).

1.2The Economics of Financial Inclusion

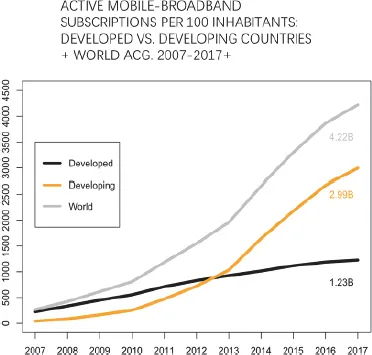

The economics of financial inclusion is evident with the global emergence of mobile technology to play a significant role in enabling financial inclusion. Through mobile and other smart devices, many unbanked and underbanked segments of the world will be able to gain access to financial services. Figures 1.5 and 1.6 show the growth in trends of financial inclusion by active mobile subscriptions in developed and developing countries, in 2007–2014. The potential in the developing countries is enormous to catch up with the developed.

Figure 1.5.The Economics of Digital Inclusion Active Users.

Source: By authors; ITU World Telecommunication/ICT Indicators Database.

FinTech companies work on the economics of financial inclusion which by na...