- 155 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Beyond Perceptions, Crafting Meaning

About this book

Researching accounting's participation in financial regulation, banking practices, managerial incentives and environmental disclosures this volume presents scholarly work adopting interdisciplinary approaches in auditing and accountability realms. Although conceptually accounting enhances public spheres and contributes to constraining overarching power, researchers question whether in practice accounting supports responsible activities. Among the provocations offered, authors ask: what is material? How are decisions to foster environmental protection best motivated? What is a set of public policies and practices by which responsible actions can be defined and fraud minimized? Questioning accounting as rational in how policy is established the authors delve into accounting interactions and conflicts. Their perspectives and insights enrich our understanding of accounting policies, organizations and relationships dismissing separate worlds of social, economic and political factors. Their research illustrates how dichotomies of private versus public and legal versus moral obscure important connections.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1

DO SUSTAINABILITY MEASURES MATTER IN MANAGERIAL APPRAISAL AND REWARDS?

ABSTRACT

This experimental study examined whether sustainability performance measures matter in managerial appraisal and bonus decisions. Participants received financial and non-financial information about four branch managers of a commercial bank, with different combinations of sustainability and financial performance. Participants perceived sustainability measures as being less important than financial ones; still, the experiment revealed that sustainability performance had some impact on appraisal and bonus decisions (albeit it mattered less than financial performance). Evaluators seemed to penalize inferior sustainability performance less than they penalized inferior financial performance. They also seemed to reward sustainability success less than financial success. These findings have practical implications for the implementation of sustainability measures in managerial evaluation systems. The experimental results indicated that incorporating these measures in evaluations does not necessarily mean they will have a sizable effect in decision-making. Results from a companion experiment suggested that organizations using a sustainability balanced scorecard for appraisal and bonus purposes might benefit from an increased emphasis on communication and evaluator training, with a focus on how sustainability performance impacts the attainment of strategic objectives.

Keywords: Appraisal; balanced scorecard; bonus; financial measures; sustainability measures; effect sizes

Accountants face a pressing challenge: to help organizations develop measurement systems and tools that communicate the importance of sustainability to managers in the frontlines. Performance measures focusing on sustainability are needed to support decision-making and reporting of how managerial actions impact an organization’s social, environmental, and economic performance, the three pillars of corporate sustainability (Epstein & Buhovac, 2014).

Sustainability concerns are receiving growing attention at the societal level, and advances have been made in the reporting of sustainability performance to external stakeholders (Global Reporting Initiative, 2015). In a survey by the United Nations and Accenture, an international consulting firm, 89% of chief executive officers (CEOs) responded that “commitment to sustainability is translating into real impact in their industry” and 86% “believed that standardized impact metrics will be important in unlocking the potential of business” with respect to sustainability goals (United Nations Global Compact & Accenture, 2016).

So far, however, most of the focus of the emerging accounting literature in this area has been on the external reporting of sustainability initiatives (Bebbington, Unerman, & O’Dwyer, 2014). Kloviene and Speziale’s (2014) review of sustainability studies published in the 2000–2014 period identified 117 journal articles on sustainability reporting and performance measurement; yet, their review did not include any empirical study dealing with the impact of sustainability measures on the evaluation of managerial performance. A similar focus on external reporting was present in Huang and Watson’s (2015) extensive review of corporate social responsibility (CSR) research in accounting, where they analyzed the previous 10 years of CSR studies in the top 13 accounting journals (47 original research papers).

This leaves a significant gap in our knowledge about how societal and corporate concerns regarding sustainability are being translated within organizations, all the way to the level of individual performance: can we assume that a manager’s sustainability performance matters for evaluators, just because it is being measured, and even formally included in the managerial performance appraisal and reward process? That is the question at the core of this study.

Here we examine whether sustainability “matters” when evaluators make key decisions: how are appraisal and bonus decisions influenced by different combinations of high or low performance in sustainability measures, vis-à-vis high or low performance in financial measures?

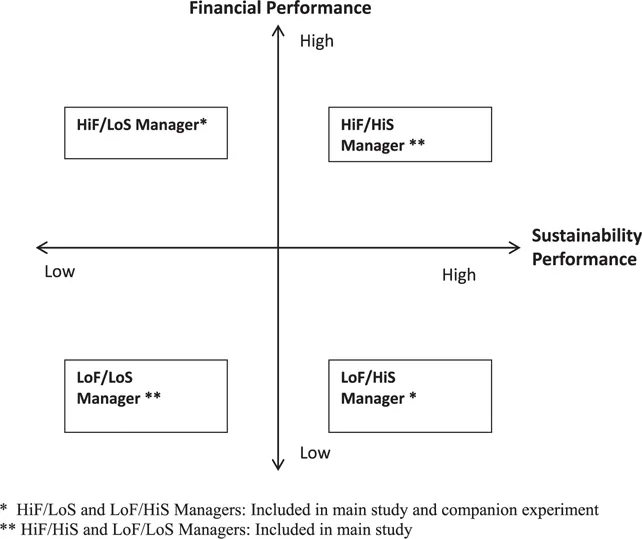

We addressed these questions in an experimental study where participants were asked to evaluate the performance of four branch managers of a commercial bank and make decisions on their appraisal and rewards. Participants received information about how the managers had performed along the sustainability perspective and the four perspectives (Financial, Customer, Internal Business, and Learning & Growth) that are typical for the balanced scorecard (BSC). Managerial performance was manipulated within subjects to generate the following four scenarios (illustrated in Fig. 1):

- “Both High” scenario: a win–win performance situation, where a manager had both high financial and high sustainability performance (HiF/HiS).

- “Both Low” scenario: a lose–lose performance situation, where a manager had both low financial and low sustainability performance (LoF/LoS).

- “Higher Finance” scenario: a mixed performance situation, where a manager had high financial performance, but low sustainability performance (HiF/LoS).

- “Higher Sustainability” scenario: a reverse, mixed performance situation, where a manager had low financial performance, but high sustainability performance (LoF/HiS).

Fig. 1. Managerial Performance Scenarios.

The next three sections review the literature and formulate the hypotheses for our study of the four scenarios, describe its methodology, and present its results. This is followed by a section about a companion experiment – a robustness test which focused on the two mixed performance scenarios (HiF/LoS vs LoF/HiS) –where we investigated how the perceived importance of sustainability might be affected by variables such as the presentation format of performance measures and the evaluators’ familiarity with those measures. This article concludes with a discussion about the implications and relevance of the study (including the companion experiment), as well as its limitations and directions for future research.

MAIN STUDY: LITERATURE REVIEW AND HYPOTHESES DEVELOPMENT

Corporate sustainability has been defined in many ways. At first, the term sustainability was mainly focused on environmental concerns, but it has evolved into a more comprehensive concept which also includes social and economic issues (Keijzers, 2002; Van Marrewijk, 2003); therefore, it has many similarities with the CSR paradigm which encompasses economic, social, and environmental aspects (Sharma & Mehta, 2012). Concerns about sustainability and CSR are increasingly being integrated into the corporate agenda (Massachusetts Institute of Technology (MIT) Sloan School of Management & Boston Consulting Group, 2011, cited in Pérez-López, Moreno-Romero, & Barkemeyer, 2015). Freedman and Stagliano (2010) point out that organizational sustainability performance can be a holistic concept, including not only environmental performance, but also the quality of systems of corporate governance, efficient use of resources, or the way an organization treats its employees (p. 73). Although sustainability and CSR are often used synonymously, Van Marrewijk (2003) suggests that there is a difference between the two concepts:

[one should link] CSR with the communion aspect of people and organizations and CS [corporate sustainability] with the agency principle. Therefore, CSR relates to phenomena such as transparency, stakeholder dialogue and sustainability reporting, while CS focuses on value creation, environment management, environmental friendly production systems, human capital management and so forth. (p. 102)

For the purposes of Huang and Watson’s (2015) extensive review of 10 years of CSR research in the top 13 accounting journals, CSR was defined as a

firm’s efforts to surpass compliance by voluntarily engaging in actions that appear to further some social good, beyond the interests of the firm and that which is required by law […] incorporating economic, legal, ethical and philanthropic responsibilities into decision-making. (p. 2)

Huang and Watson acknowledged the close relation between “corporate social responsibility” and “corporate sustainability,” remarking that a 2013 KPMG report revealed different usage among the world’s largest 100 firms: “corporate responsibility” (14%), “corporate social responsibility” (25%), and “sustainability” (43%). The articles they had included in their review, however, predominantly used “corporate social sustainability,” so that was the term they adopted for their own study of those articles.

Huang and Watson’s (2015) review encompassed four main themes (determinants of CSR, the relation between CSR and financial performance, consequences of CSR, and CSR disclosure/assurance). A broad spectrum of areas of activity (with the attendant measurement difficulties) was considered, involving multiple elements of CSR: environment, corporate governance, community relations, employee relations, diversity, human rights, and product or industry-related characteristics or controversies. Huang and Watson pointed out the important role that accountants play in CSR, and highlighted that integrating CSR measures into management control systems (MCS) can significantly improve a company’s control over CSR objectives and positively influence its CSR performance. Moreover, their review indicated that integrating CSR elements into an MCS may increase both environmental performance and financial performance, while acknowledging the potential tension between CSR objectives and traditional performance objectives, and stressing this as an important point for future research.

Shabana and Ravlin (2016) recommend the consideration of organizational issues such as compensation and performance management for a better understanding of substantive and symbolic CSR reporting. While the individual measures used to evaluate sustainability performance have CSR characteristics, in this study we focus on strategic internal sustainability reporting for performance assessment. The current G4 guidelines and the GRI Sustainability Reporting Standards, announced in Fall 2016 (scheduled to go in effect in July 2018), emphasize that sustainability measures and standards “create a common language for organizations and stakeholders … [allowing] internal and external stakeholders to make informed decisions” (Global Reporting Initiative, 2016).

The institutionalization of sustainability measures plays an important role in successfully understanding and reporting corporate sustainability performance. The noticeable trend to...

Table of contents

- Cover

- Title

- 1 Do Sustainability Measures Matter in Managerial Appraisal and Rewards?

- 2 An Examination of the Perceptions of Auditors and Chief Financial Officers of the Proposed Statement of Financial Accounting Concept Definition of Materiality

- 3 An Evaluation of the Effectiveness of Sec Oversight of Climate Change Disclosures: An Analysis of Comment Letters

- 4 The Banks and Market Manipulation: A Financial Strain Analysis of the Libor Fraud

- 5 Environmental Efficiency, Firm Efficiency, and Managerial Ability

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Beyond Perceptions, Crafting Meaning by Cheryl R. Lehman in PDF and/or ePUB format, as well as other popular books in Commerce & Comptabilité. We have over one million books available in our catalogue for you to explore.