- 162 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Trade Credit and Risk Management

About this book

This book offers managers a complete analysis of the various issues of credit risk management for trade credit financing instruments supported by applications to various types of markets and presents an analysis on risks associated with trade credit in supply chains.

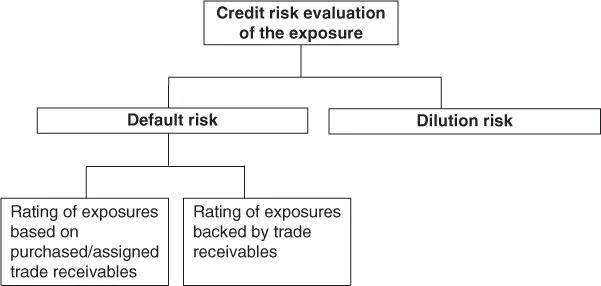

Trade credit finance is characterized by strong attractiveness deriving from risk mitigation, but the plurality of sources of credit risk (default and dilution risk) requires the implementation of a credit risk management system that exploits the broad knowledge developed by financing supply relationships. Consequently, financiers could be hindered from developing a full understanding of the underwritten risks and are thus unable or only partially able to evaluate their full potential to expand financial relationships over the credit capability of a single counterparty with respect to the supplier–debtor pair.

The richness of the information available in trade credit financing is not an obstacle for the development of a modern risk management framework, but it must be calibrated to avoid distortions in the implementation. In addition, risk analysis in the supply chain is not limited to the crises of individual members but must assess the effects of such crisis on the entire supply chain and assess the specific risks of contagion and the favorable conditions for the propagation. This book offers managers a complete analysis of the various issues of credit risk management for trade credit financing instruments supported by applications to various types of markets and presents an analysis on risks associated with trade credit in supply chains.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

With on-balance sheet exposure | Without on-balance sheet exposure | |

With recourse | Credit risk determined by the advance/purchasing price | No credit risk |

Without recourse | Credit risk determined by the commitment to guarantee for trade debtors default | Credit risk determined by the commitment to guarantee for trade debtors default |

- •Default risk

- •Dilution risk

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Dedication

- Contents

- Introduction

- Chapter 1 Risk Management for Trade Credit Financing Instruments

- Chapter 2 Application of Credit Risk Measures to Internal Processes

- Chapter 3 Trade Credit Instruments in Capital Adequacy Regulation

- Chapter 4 Risk Mitigation of Trade Credit and Distress along the Supply Chain

- Conclusions

- References

- Annex

- About the Author

- Index