Getting the Measure of Money

A Critical Assessment of UK Monetary Indicators

- 206 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

How much money is circulating in the United Kingdom? The question sounds simple. In fact, it is notoriously difficult to answer, because what counts as money is not a straightforward matter. A variety of measures have been advanced, and they tell different stories about the changing supply of money in an economy. These differences are of more than merely academic interest, because measures of the money supply are inputs to the decisions of central banks. Wrong answers can lead to wrong actions, with potentially devastating economic effects. This book examines the measure of money and, in that light, the actions of the Bank of England in in the lead up to the 2008 financial crisis and its aftermath. It is essential reading for anyone interested in money, measures of its quantity, and the relationship between the money supply and the economic cycle.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

- For some time academic economists have neglected the role of money, and monetary policy has been conducted through interest rates rather than the money supply.

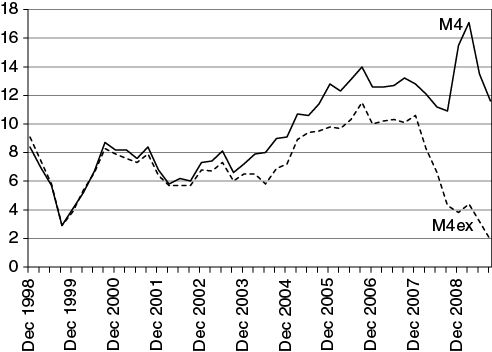

- The introduction of quantitative easing (QE) in 2009 has made the money supply relevant again, and made a discussion about alternative money supply measures of direct policy significance. Unfortunately, official Bank of England figures have proved misleading and subject to major alterations (such as the replacement of M4 with M4ex).

- This chapter argues in favour of measures such as MZM and Divisia money, which attempt to find a middle ground between narrow and broad, and introduces a new and publicly available measure, MA, based on an a priori approach to defining money as the generally accepted medium of exchange.

- Attention to MA would have provided an early warning that a major credit crunch was occurring in 2008, and explains the lethargic recovery.

Table of contents

- The author

- Preface

- Acknowledgements

- Summary

- 1Introduction

- 2M: The importance of alternative monetary aggregates

- 3V: Velocity shocks, regime uncertainty and the central bank

- 4P: The hidden inflation of the Great Moderation

- 5Y: GDP, GO and the structure of production

- 6Conclusion

- About the IEA