- 48 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

This publication provides an update on developments in Pacific economies, explores topical policy issues in the region over the years, and presents global forecasts for 2019. It includes an outline of the economic setting, as well as country economic issues and specific policy briefs for 14 Pacific economies. This includes analysis of critical development challenges including connectivity, climate change and disaster resilience, tourism, fisheries, and public sector management. The December 2018 issue also focuses on debt sustainability amid clear financing needs to help address remaining infrastructure and services gaps in the Pacific.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Pacific Economic Monitor December 2018 by in PDF and/or ePUB format, as well as other popular books in Économie & Économie du développement. We have over one million books available in our catalogue for you to explore.

Information

POLICY BRIEFS

Strengthening public debt management in the Pacific through policy-based operations

The remoteness and dispersion of most Pacific island nations result in elevated costs for the provision of infrastructure. Indeed, the 14 Pacific developing member countries (DMCs) of the Asian Development Bank (ADB) all rank in the top 15 globally, based on a gross domestic product (GDP)-weighted measure of distance from all potential trade partners, adjusting for each partner’s market size. Distance drives up transport costs to import inputs that are mostly not available locally (e.g., food and fuel) and mobilize large capital equipment in isolated islands. Further, the Pacific’s vulnerability to disasters and climate-related shocks add to infrastructure costs through higher initial investment for climate-proofed designs and greater maintenance and repair requirements due to more frequent damage.

In the context of small and narrow economic bases, the high unit costs of infrastructure investment become even more pronounced. In 2017, the GDP of 8 of the 14 Pacific DMCs was under $500 million. With revenue sources and financing options both limited by their size, Pacific economies have relatively low carrying capacities to take on any substantial debt. Therefore, infrastructure planning and investment prioritization are even more paramount to ensure continued expansion in access to basic services without risking debt distress.

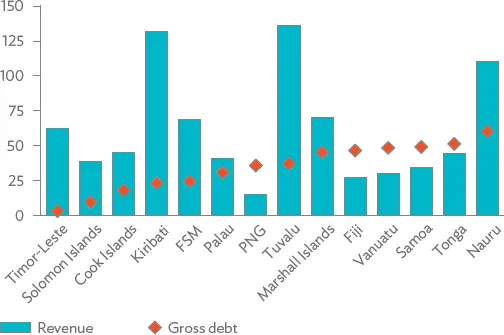

Caution is required in assessing debt sustainability in the Pacific. The debt-to-GDP ratio, a commonly used benchmark measure in assessing debt, may look relatively high because of the small size of the economy. In 9 of the 14 Pacific DMCs, total revenues for 2017 were higher than the debt stock for that year. For the smallest economies (Kiribati, Tuvalu, and Nauru), revenue-to-GDP ratios exceed 100%. However, this should not be interpreted as a license for Pacific DMCs to incur more debt. Total revenues include those that are unsustainable or volatile, such as fishing license royalties, grants, or royalties from natural resource extraction. Small populations scattered over wide areas also make government operations expensive, leaving fiscal balance in deficit or with small surpluses despite the high revenues.

On top of economic and financial due diligence to ensure sustainability of projects, as well as technical assistance work to help build systems and capacities in broader public sector management, development partners in the Pacific are also increasingly using policy-based operations to support sustained reforms. Policy-based operations provide grant or loan resources that help bridge DMCs’ more immediate financing needs, while supporting policy reforms that promote longer-term growth and poverty reduction. Financial resources may be directed through general budget support for broad fiscal and economic reforms, or sector budget support targeting policy improvements in specific areas such as health, education, or utility services.

Figure 1: Revenues and Gross Debt (2017, % of GDP)

FSM = Federated States of Micronesia, GDP = gross domestic product, PNG = Papua New Guinea.

Sources: Asian Development Outlook Database and World Economic Outlook Database October 2018.

Recognizing the delicate balance between financing clear investment needs and minimizing the risk of debt distress, ADB’s policy-based operations in the Pacific have emphasized reforms supporting debt management and broader fiscal sustainability. Over the past decade from 2008 to 2017, ADB has implemented 23 policy-based operations supporting debt management actions and reforms across eight Pacific DMCs (Table 1). This policy brief surveys recent progress in debt management policies and practices in the Pacific and outlines further considerations toward continued expansion of infrastructure investment, while steering clear of debt difficulties moving forward.

Table 1: Policy-Based Operations i n ADB’s Pacific Developing Member Countries, 2008–2017

| Country | Policy-based operations approved | of which with debt management actions |

| Cook Islands | 3 | 2 |

| Fiji | 0 | 0 |

| Kiribati | 2 | 2 |

| Marshall Islands | 2 | 2 |

| Micronesia, Federated States of | 0 | 0 |

| Nauru | 3 | 2 |

| Palau | 2 | 0 |

| Papua New Guinea | 0 | 0 |

| Samoa | 6 | 5 |

| Solomon Islands | 4 | 3 |

| Timor-Leste | 0 | 0 |

| Tonga | 6 | 5 |

| Tuvalu | 4 | 3 |

| Vanuatu | 0 | 0 |

| Total | 32 | 24 |

Source: Asian Development Bank.

Preparation of debt management strategies

A debt management strategy provides policy actions which promote fiscal sustainability through achieving fiscal discipline and improving transparency, accountability, efficiency, and equity in the use of public funds. Given potential debt concerns faced by many Pacific DMCs, ADB, together with other development partners, has provided financial support and technical expertise in the preparation and implementation of debt management strategies in the following DMCs:

Tuvalu. ADB extended a grant to the Government of Tuvalu in 2008 to improve government fiscal planning and management capacity. The request for ADB assistance came in response to the government’s widening budget deficit, with the 2007 deficit close to 10% of its GDP. The grant facilitated the development and implementation of a debt risk management and mitigation policy and strategy, which was approved by its Cabinet in 2009. The new policy required an impact analysis of any new guarantee or debt on job creation, poverty reduction on the outer islands, gender equity impacts, and impacts on health and education expenditure.

Tonga. The global financial and economic crisis adversely affected Tonga’s economy—an economic contraction and a 17.0% decline in overseas remittances in fiscal year (FY) 2009 (ended 30 June 2009) placed significant pressure on the government’s expenditure programs and on informal social safety nets. To help stabilize the economy and cushion vulnerable groups from the impact of the crisis, ADB approved a grant which helped the government operationalize a debt risk management and mitigation strategy. The policy, formulated in conjunction with the World Bank, set out the processes relating to new guarantees and debt, debt repayments, and preparation of government debt portfolio reports.

Samoa. In 2010, through the second subprogram loan of the Economic Recovery Support Program, ADB helped Samoa complete a medium-term debt strategy to achieve fiscal discipline, which was part of the government’s Public Financial Management Reform Plan. In 2013, ADB extended a grant to assist in the enhancement of the country’s debt strategy. It allowed Samoa to provide procedures for contracting new loans and issuing government guarantees. While there was a breach of the debt ceiling (50.0% of GDP) due to a disaster, the country’s debt strategy has helped keep debt manageable (see Figure 11 on page 13). Meanwhile debt servicing is seen to peak this fiscal year and gradually decline in the succeeding periods.

Marshall Islands. The Public Sector Program loan extended by ADB to the Marshall Islands, between 2010 and 2013 aimed to improve the country’s long-term fiscal sustainability. As part of the program, the Cabinet endorsed public sector debt management guidelines, which regulates borrowing and lending activities of the government and requires Cabinet approval on concessional borrowings that state-owned enterprises will avail of. This guidelines were eventually adopted into the government’s debt management strategy effective FY2013 (ended 30 September 2013).

Kiribati. In 2014, ADB provided a grant to support Kiribati’s Economic Reform Plan. ADB helped the government operationalize the country’s Debt Policy as approved by its Cabinet in 2013. The Debt Policy is designed to ensure sound loan and guarantee decisions, avoid recourse to expensive commercial loans, prevent re-accumulation of overdraft balances, and remove inappropriate loan guarantees to state-owned enterprises and joint ventures.

Developing fiscal ratios

Recognizing that public financial management (PFM) also greatly influences debt sustainability, policy-based operations have also pursued broad-based reforms to reduce the pressure on governments to borrow and build the capacity to repay existing debt. Some of these reforms involved fiscal ratios that, analogous to the financial ratios and industry averages used to measure the performance of firms, help monitor and define targets for PFM.

After the 2008–2009 global financial and economic crisis, ADB’s policy-based operations employed fiscal ratios to build fiscal sustainability in support of economic recovery. To access a loan in 2009, the Cook Islands refined and updated ratios under the 1998 Manila Agreement and set targets for tax collections, the public wage bill, and the overall fiscal deficit as well as for net borrowing and debt service. A related loan in 2012 required the government to meet the updated targets before funds could be disbursed (Figure 2). In the Solomon Islands, support for economic recovery over 2010–2011 required continued compliance with the 2005 Honiara Club Agreement that, among others, sets a threshold on government payroll spending.

Figure 2: Cook Islands Borrowing (% of GDP)

e = estimate, FY = fiscal year, GDP = gross domestic product.

Note: Fiscal year ends 30 June.

Sources: Cook Islands budget documents, various years; and Asian Development Bank estimates.

Box 1: The Case of the Solomon Islands’ Tina River Hydropower Development Project

From having one of the lowest debt-to-gross domestic product ratios in the Pacific, the debt-to-gross domestic product ratio of Solomon Islands is expected to double in the next 5 years as it invests in the Tina River Hydropower Development Project. The project, which is expected to exceed $200 million, will be financed through a mix of concessional loans, grants, and equity from the government and the private sector. It has four main components: a power-generating dam, an access road, transmission lines, and technical assistance. The number of lenders and donors not only reflects the magnitude of the project but also the extensive collaboration and support needed to put the project together. The donors include the Green Climate Fund, the Asian Development Bank (ADB), the World Bank, the Republic of Korea’s Economic Development Cooperation Fund, Australia, and the International Renewable Energy Agency/Abu Dhabi Fund for Development (IRENA/ADFD).

The hydropower plant, which is projected to become operational by 2022, is expected to increase access to electricity, lower costs of power, and improve air quality in Honiara. Cleaner energy from the project is expected to replace 65% of diesel-generated electricity. Electricity tariffs, which are among the highest in the Pacific, are expected to fall by more than 5.0%, reducing the cost of doing business and boosting economic development. The construction is expected to employ and provide training to more than 300 Solomon Islanders. The dam is also expected to reduce the risk of heavy flooding as experienced in 2014.

Aside from the mix of grants and concessional loan for the Tina River Project, ADB is also providing a policy-based grant to Solomon Islands under the Improved Fiscal Sustainability Reform Program. Reforms under the program seek to improve public financial and investment management, strengthen fiscal management and sustainability, and enhance private sector investment climate. The policy actions under the program are part of the government-led multipartner reform effort started in 2009 through the Core Economic Working Group (CEWG). The CEWG has supported a series of policy-based programs that helped in reducing public debt and restoring economic stability. The most recent policy-based program is also cofinanced with other members of the CEWG: the World Bank, the European Union, Australia, and New Zealand.

Source: Asian Development Bank.

Tonga likewise developed its own fiscal ratios and set medium-term PFM targets under the auspices of a 2009 grant for post-crisis economic recovery. Besides public debt, these ratios measured spending on capital investments and maintenance, government personnel, and other operating expenses. The government used the ratios to guide budget preparation starting in FY2011, and incorporated them into its medium-term budgeting framework.

Fiscal ratios can also monitor indicators of special interest to the government. A 2012 policy grant to strengthen PFM in Tuvalu required Cabinet approval of target fiscal ratios that, among others, limit spending on the country’s hea...

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Abbreviations

- Highlights

- International and regional developments

- Country economic issues

- Policy briefs:

- Economic indicators