![]()

Construction can be seen as an industry concerned with the production of the built environment. As an industry, its inputs cover a large variety of skills and materials. Its output covers many different types of products and services. As a sector of the economy, it includes the assembly of buildings and structures on site, the production of materials and building components and, indeed, the whole supply chain. This includes architects, surveyors, civil and structural engineers, plant and tool hire, construction product manufacturers and distribution. The construction sector is treated as one sector but, in fact, it covers a wide variety of work across many different areas. Construction output covers everything from the building of housing, commercial and industrial properties, education and health facilities to the building of vital infrastructure for water, energy, roads, rail, telecommunications and ports.

Whatever an individual or collection of individuals may wish or need to do in the economy or society, they will require construction to have taken place first to be able to do it. People need houses to live in, schools and universities to undertake learning, clinics and hospitals to make or keep us physically fit and comfortable, and offices to work in and shops to buy goods in. Even if we work from home and shop online then we still need the internet infrastructure to have been built. In addition, we need roads to drive on, rail infrastructure for trains to travel on, clean water for drinking and bathing, electricity and gas to power heating and lighting. As the built environment has grown over many years, the current buildings and infrastructure have developed over time, and, as a consequence, the repair, maintenance and improvement of existing buildings and infrastructure is also vital.

To measure the scale of investment in construction as part of the whole economy, the United Kingdom National Accounts, also known as The Blue Book (see Office for National Statistics 2017), contains a chapter entitled “Gross Fixed Capital Formation” (GFCF), which presents the total invested by the economy in plant and equipment and buildings and structures. This investment is essential if the country is to survive and remain competitive, in much the same way as companies need to invest in machinery in order to survive.

Fixed capital is the value of assets that usually last longer than one year and are usually used to aid production. The concept of capital formation describes the production of the means of production. The term “gross fixed capital” is used to indicate that the plant and machinery and buildings are measured at brand new values before any depreciation has been deducted.

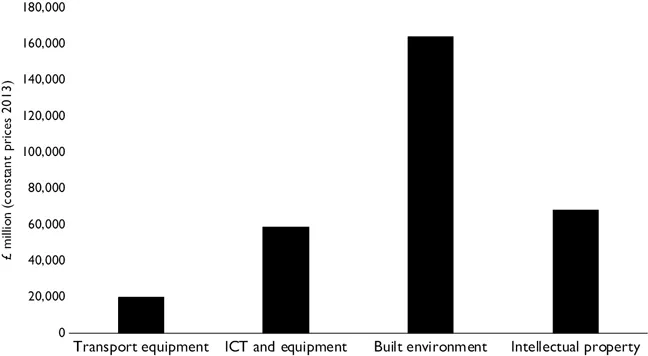

In terms of the whole economy, investment in the built environment, which includes buildings and structures, such as infrastructure, is a vital component of the United Kingdom’s fixed investment. Fixed investment is defined as long-term investment in plant and machinery, transport equipment, information technology, buildings and structures as well as major improvements to existing buildings and structures. The built environment accounts for over a half of all GFCF each year. Figure 1.1 shows that, in 2016, 52.8 per cent of all UK GFCF was in the built environment. The importance of this is that fixed investment enables increases in the productive capacity and productivity of the whole economy, by facilitating the production and movement of goods, capital, services and people.

Data covering construction

To understand a sector of the economy, you need to be able to measure it. The construction sector is certainly no exception to this. No one set of data fully explains the construction industry. However, there are three key types of official data that cover the construction sector, and each set provides a piece of the puzzle.

The first set of data is provided by the UK government’s Department for Business, Energy and Industrial Strategy (BEIS) and includes all firms registered to pay value added tax (VAT), combined with an estimate of very small firms that are below the VAT threshold and so do not have to pay VAT.

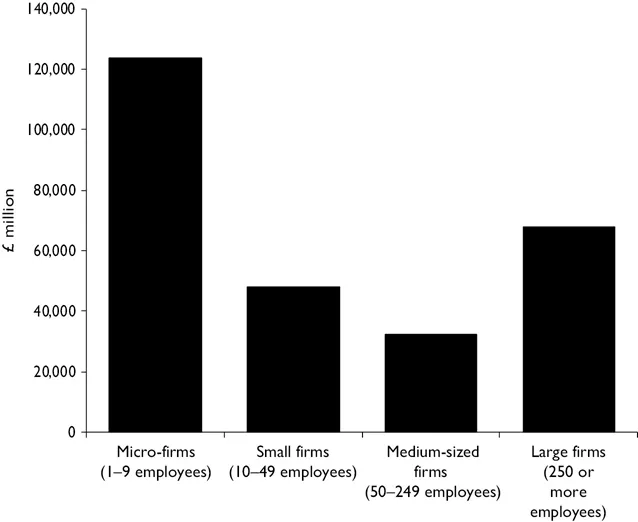

The benefit of this data is that it allows us to look at the basic structure of the industry. The majority of the focus tends to be on the largest firms within the construction sector. Clearly, though, the sector is dominated by small and medium-sized enterprises (SMEs), defined as firms employing fewer than 250 employees. According to the BEIS, in Figure 1.2, as much as 75 per cent of the £272 billion turnover in the construction sector in 2016 occurred within the SMEs, with 25 per cent of turnover in construction accounted for by the largest firms, which are defined as those employing 250 employees or more.

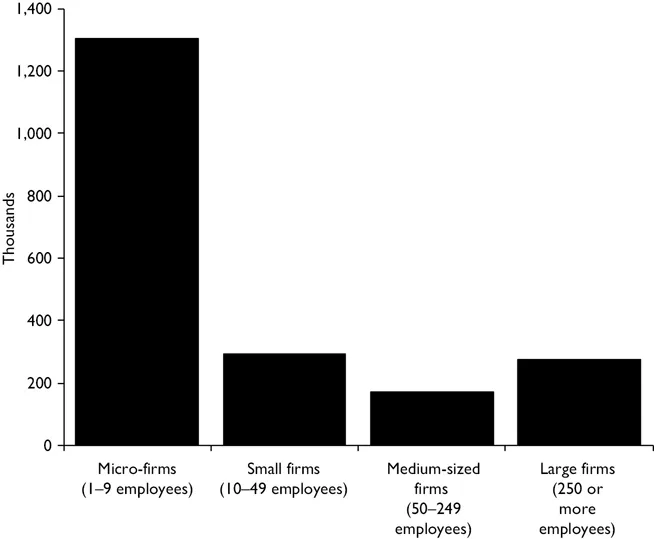

Figure 1.3 shows that the difference between large and small construction firms is even greater. Of the 2.3 million people employed in construction in 2016, 86.4 per cent were employed by SMEs, while large contractors employed only the remaining 13.6 per cent of the total construction workforce.

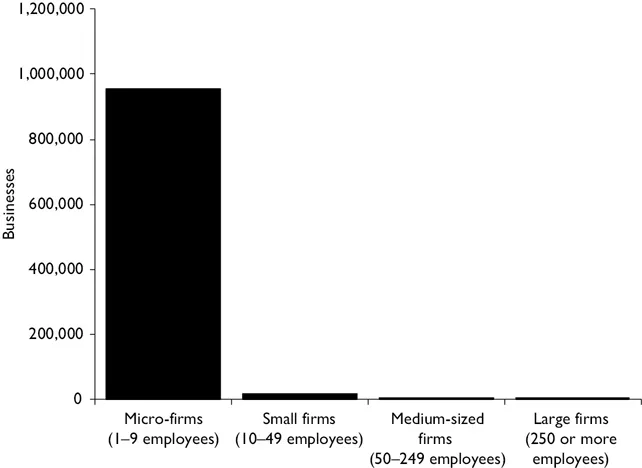

Furthermore, the percentage of SMEs within construction amounted to 99.9 per cent of all firms in Figure 1.4. However, a key point to note is that the largest 0.1 per cent of firms still account for 25 per cent of the total turnover of the construction industry.

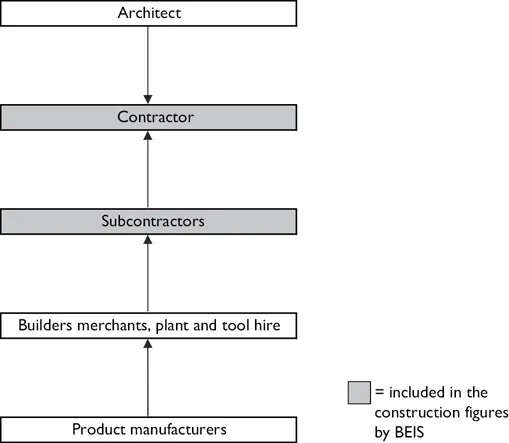

The BEIS business population estimates are useful at a general level. However, they suffer from two key issues. First, the definition of construction covers only the number of firms and employment of the contractors – those firms that operate on the construction site itself. Yet this is only one part of the whole construction supply chain, as construction is a very complex sector. Defining construction as only including contractors on site ignores the contribution of the supply chain of all the building components and materials and the design and civil and structural engineering inputs and other specialists.

Construction is a process involving architects and professionals, contractors, merchants and distributors, plant and tool hire, in addition to minerals and products manufacturers. All but the contracting element of this process is neglected in the BEIS statistics. As a result, the BEIS statistics are likely to underestimate the value of the construction sector to the UK economy.

The supply chains that supply the goods needed for on-site construction include the product manufacturers, builders’ merchants and distributors, plant and tool hire. Product manufacturers produce all the materials and products that go into the construction of a facility, and can be split into two broad categories: heavyside products and lightside products. Heavyside products include, but are not limited to, sand, bricks, concrete, asphalt, steel and glass, and tend to be used on the exterior of a building. Conversely, lightside products, which include lighting, heating and ventilation, air-conditioning and electrics, tend to be used in the interior of buildings. Builders’ merchants and distributors act as wholesalers and retailers of building materials and products. Tool and plant hire firms exist to provide additional capacity for heavy machinery or tools that are needed on site to complete the project but are not currently owned by the contractor or subcontractor, which may be vital given that the bespoke nature of construction, with every end product in each project being different, means that different sets of inputs may be needed across projects. Directly owning machinery and tools for activity across all areas of construction would mean considerable periods of unproductive inactivity whenever there is little work in certain sectors. It therefore makes economic sense to hire plant and machinery only when required.

In addition, even within the contracting side, there may be many layers or tiers of contractors depending upon the size of the project. For example, Figure 1.5 illustrates that, even on a small project, with only one SME contractor involved, parts of the supply chain may be hidden, including when the contractor purchases materials and products from builders’ merchants and distributors and hires additional machinery and tools when needed.