![]()

CHAPTER 1

A Jazz Age Real Estate Crisis

The Great Depression

From the distance of more than eighty years and in the cold light of economic analysis, it is easy to forget the death and despair of the Great Depression. Historian Adam Hochschild describes a country that “simmered in misery,” with thirty-four million Americans living in households without a breadwinner. He writes of unemployed steelworkers living inside idled coke ovens with their families and rummaging through the garbage bins for food, of riots, and of men in cloth caps waiting outside churches and charities for quickly depleted food supplies.1

The Great Depression brought a level of misery rarely seen in American history. Oceans of ink have been spilled to explain why the bust phase of the Great Depression, with the collapse of GDP, was so protracted, painful, and deep. For economists, explaining its cause has sometimes been referred to as the holy grail of macroeconomics. But largely absent from the most widely read books on the Depression is its one central cause: runaway private debt.

Those who do mention private lending, such as Milton Friedman and Anna Jacobson Schwartz in their iconic Monetary History, misrepresent the phenomenon. Though Friedman and Schwartz had a number of pivotal insights about the collapse in the 1930s, they said little about the overlending of the 1920s. “If there was any deterioration at all in the [pre-Depression] quality of loans . . . it must have been minor,” they wrote, and “any [pre-Depression] deterioration in the quality of loans . . . was a minor factor in subsequent bank failures.”2 By dismissing private debt, Friedman and Schwartz didn’t just miss its contribution. More fundamentally, they missed the human factors involved in a crisis: the competitive intensity, the drive for wealth, the pervasive hubris, and the self-delusion.

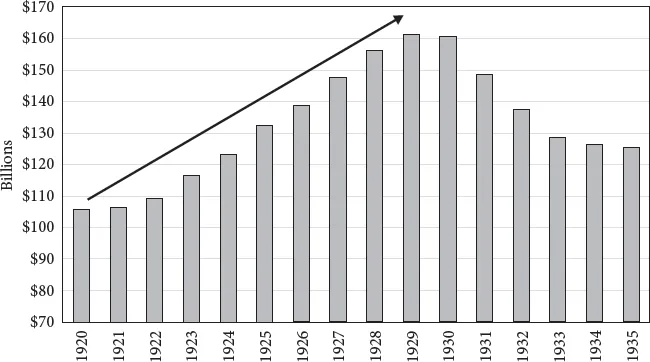

Figure 1.1. United States: Private Debt, 1920–1935

In the United States, private debt increased 52.7 percent from 1920 to 1929.

John Kenneth Galbraith’s Great Crash of 1929 glossed over the national real estate boom beyond Florida. In his final chapter on “causes,” he only briefly mentioned lending, noting mostly that in the late 1920s “money was tight,” even though loans were then growing at a robust 6 percent per year.3

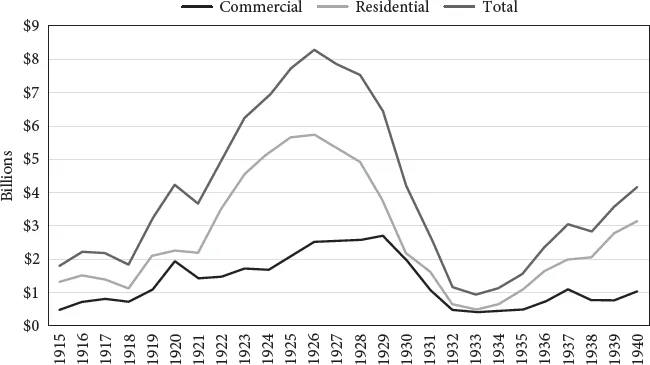

The misery that unfolded from 1929 to 1933 was a story of rampant and unsound lending followed by widespread loan contraction that contributed the lion’s share of the cataclysmic GDP contraction. The Great Depression was a massive residential and commercial real estate crisis. The financial records of the 1920s, which have largely been overlooked, indelibly show this. During the 1920s, annual housing and commercial real estate construction almost tripled—and nearly all of it was financed by debt (Figure 1.2).

This explosion in residential and commercial construction lending, augmented by lending for utilities and stock purchases, created the euphoria of the Roaring Twenties, the jazz age of robust spending and celebration. Companies used the new money from loans to expand and employ more people.

The acceleration in construction resulted in such extensive overbuilding that by the final years of the decade, before the stock market crash, thousands of newly erected office buildings, houses, and apartments sat empty. Office vacancy rates rose, and residential mortgage foreclosures nearly doubled in the final years of the decade.4 As in other cases, this crisis was inevitable before it was obvious. The only question, and the only area where the president and the Federal Reserve could still have a discretionary impact, was the length and severity of that correction.

Figure 1.2. United States: Construction Spending, 1915–1940

The Great Depression, like most financial crises, can be thought of as occurring in three distinct phases. The first, from 1923 to 1928, was the runaway lending boom that led to the avalanche of terrible loans that brought so many banks to failure. The second—the great contraction—lasted from 1929 to 1933, when GDP fell by an astonishing $48 billion, or 46 percent, and brought 30 percent unemployment. The third phase began in 1934, when the economy ceased contracting and slowly struggled forward. (There was a notable new recession outside of the scope of this book that began in late 1937.)

The state of the nation’s housing had become a national issue in 1921, when Secretary of Commerce Herbert Hoover began to advocate for increased home ownership as “the foundation of a sound economy and social system.” In 1923 he wrote, “Maintaining a high percentage of individual home owners is one of the searching tests that now challenge the people of the United States.”5 This argument—that the homeowner was a more committed and responsible citizen—would recur in the 2000s. Hoover urged homebuilders to become more efficient and lenders to become more generous.

New tax incentives supported home construction. Historian Donald Miller writes that no legislation boosted New York City’s construction industry more than the 1921 exemption from real estate taxes for ten years of residential construction. “In the 1920s,” he writes, “New York City would account for fully 20 percent of all new residential construction in the country. Builders of large apartment houses were the pacesetters. In 1926, 77 percent of all new residential construction was given over to apartment dwellings.”6

Banks, building and loans, bond houses, and other lenders responded to Hoover’s call. As Robert M. Fogelson reports, Albert E. Kleinert, Brooklyn’s superintendent of buildings, reflected the frenzied pace of the era when he said, “They [the speculators] are now selling property between twelve and one o’clock and then at two o’clock they notify their tenants that the rent will be raised, and then when they show an income gain on paper, they sell again. More often than not, the new owners repeated the process.”7

In a financial crisis, it is typical for lenders other than conventional commercial banks (those that are less regulated or unregulated) to play a leading role in the preceding lending upturn, and so it was here. The number of building-and-loan associations—savings institutions whose primary purpose was home lending—grew from 8,000 to 13,000 during the 1920s.8 Builders and developers chartered many of them to finance their own projects in a brazen conflict of interest, especially by using low down-payment, long-maturity loans. As one example, to help fund their expanding real estate business, two Florida banker-developers succeeded through political connections in getting bank regulators to create sixty-one new national and state banks in which they took a stake. Others gained charters by extending loans to regulators.9

In addition to bank loans, real estate bonds were a major source of building finance. Many were sold to the general public, some in denominations as low as a hundred dollars. Billions of dollars in bond funding were raised—for apartments, hotels, office buildings, and more. Unlike bank loans, institutions that sold these bonds did not have risk of loss if the underlying real estate didn’t perform; they therefore embraced looser credit standards.

Much of this bond activity was unaffiliated with banks, but a number of banks sidestepped limitations on underwriting and trading in bonds by launching securities affiliates, which grew in number from 10 in 1922 to 114 by 1931.10 On a per-capita basis, the U.S. housing boom of the 1920s was every bit as large the housing boom of the 2000s.

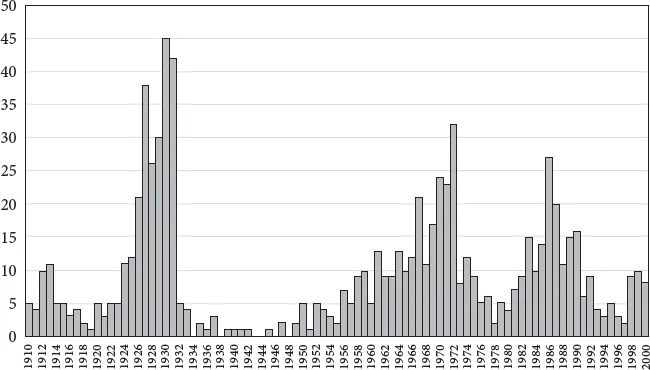

Overbuilding in commercial real estate, while smaller in dollars than housing, was still vast and more visible than overbuilding in houses. Between 1925 and 1931, office space increased by 92 percent in Manhattan, 96 percent in San Diego, 89 percent in Minneapolis, and 74 percent in Chicago.11 In New York alone, approximately 235 new buildings were constructed in this critical period, almost all debt financed. As Daniel Okrent maintains—and as our data indicate—more “buildings taller than 70 meters were constructed in New York between 1922 and 1931 than in any other ten-year period before or since.”12 Historian Robert Fitch estimates that between 1921 and 1929, “developers had added 30 million square feet of office space to the Manhattan inventory—an amount and a rate of increase that approaches the eighties office expansion. . . . They kept increasing the flood of overcapacity.”13

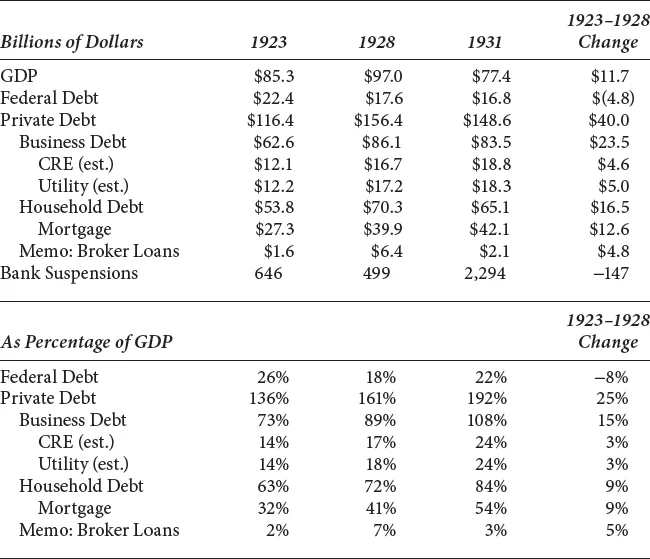

Table 1.1. U.S. Crisis Matrix: Portrait of the Great Depression

In the five years leading to 1928, private debt grew by $40 billion or 34 percent, far greater than the GDP growth of $12 billion. Sectors with the greatest concentration of overlending were household mortgages, commercial real estate, utility debt, and broker loans. Together they comprised 68 percent of the increase during this period. Government debt actually declined.

Figure 1.3. New York Skyscrapers (Taller than 70 Meters) Built, 1910–2000

The iconic structures of American skylines form the silhouette of the Great Depression: New York’s Chrysler Building, Empire State Building, and RCA Building; Chicago’s Merchandise Mart, Wrigley Building, and Tribune Tower; Philadelphia’s PSFS Building; Los Angeles’s City Hall; Dallas’s Cotton Exchange Building; Detroit’s Fischer Building; and Houston’s Gulf Building. These are enduring architectural feats of the 1920s, vestiges of the real estate eruption that came before the fall. Many were speculative projects, unsupported by actual real estate demand; begun toward the end of the 1920s, when loans were still available; and finished after the crash, when lenders had little choice but to make funds available to complete construction or else see their entire loan go bad. None was financially successful for its original investors. They remained partly or largely empty for a decade or more after completion, as would hundreds of others.

Lenders were caught in the euphoria, too. Real estate was built when—and because—a loan was available to finance it, even in the absence of hard-nosed analysis of demand. The construction boom meant more job creation and employment, but since so much construction was based on the availability of financing rather than actual underlying need, more workers were hired than dictated by organic demand. Florida had a famous and fraud-riddled real estate surge that came to an ugly end in the hurricane of 1926, but its equivalent played out in any number of major U.S. cities, especially New York and Chicago.14

The lending boom of the 1920s also brought significant growth in business loans for the acquisition of utility companies by larger utility companies. These came to be known as “utility pyramids.”

Ever since 1882, when Thomas Edison first lit the homes of Manhattan customers through his Pearl Street Power Station, U.S. utility companies had been racing frantically to capture market share. Edison’s most important successor was his former personal secretary, Samuel Insull, who became one of the most powerful executives in the nation. Utilities were the hottest listed stocks—the era’s go-go stocks. At the 1929 peak, utilities were 18 percent of the New York Stock Exchange’s value, its largest single component. These stocks averaged prices fifty-seven times the earnings per share, with at least one more than ninety times the earnings per share, far above conventional levels, especially for such capital-intensive stocks.15

Insull became the powerful chairman of Chicago’s Commonwealth Edison utility and was a master at building and buying utilities. The companies he controlled were collectively the largest supplier of power in the country. He built Commonwealth Edison into a company with $500 million in sales, using only $27 million in equity. His companies acquired a network of gas, light, power, and transit companies over thirty-two states, serving ten million people. In the late 1920s, he sought to further consolidate control of these companies using more debt, with the stock of these subsidiaries as collateral.16

Across the industry, these highly leveraged utilities were ripe for investment speculation. “Holding company” ownership was increasingly popular: a shell company would buy operating utility companies, often with debt at both levels, sometimes referred to as “double leverage.” This was an ominous trend, given lofty stock valuations. Actually, there were holding companies that owned holding companies, creating a third layer of debt. In such a three-story house of cards, if 40 percent leverage were employed at each level, the ultimate owner could control a million-dollar company with only a $64,000 investment. This meant greater upside opportunity and greater downside risk. Acquisition debt was often more than 60 percent and, in some cases, more than 90 percent of the purchase price. This holding company activity was sufficiently widespread to attract a Federal Trade Commission investigation in 1928.17

Merger and acquisition activity across the entire private sector reached an all-time high in 1928 and 1929, largely financed with debt and surpassing the 1890s levels that had inspired early 1900s antitrust enforcement. Insull’s biographer says of the era’s lenders:

During the expansionist fever of the late twenties, [bankers] began throwing money at everyone who seemed prosperous; . . . At a party, the new president of the Continental Bank sidled up to [Insull’s son] and . . . said, “Say, I want you to know that if you fellows ever want to borrow more than the legal limit, all you have to do is organize a new corporation, and we’ll be happy to lend you another $21,000,000.” . . . Insull’s bookkeeper said, “The bankers would call us up . . . [and ask] isn’t there something you could use maybe $10,000,000 for?” . . . This situation had the impact of three stiff drinks on an empty stomach.18

This passage could just as easily have been applied to the era’s real estate lenders.

Hubris and a sense of invincibility among lenders typically run rampant in the years before a financial crisis. In the 1920s, the short-term boost to economic growth was so sweeping that then-presidential nominee Herbert Hoover boasted in 1928 that Americans were “nearer to the final triumph of poverty than ever before in the history of any” country; “the poor-house,” he claimed “is vanishing from among us.”1...