eBook - ePub

Wired for Wealth

Change the Money Mindsets That Keep You Trapped and Unleash Your Wealth Potential

- 260 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Wired for Wealth

Change the Money Mindsets That Keep You Trapped and Unleash Your Wealth Potential

About this book

Neuroscience and money are being bandied about from Wall Street to Main Street, with people realizing that what goes on in their brain directly impacts their bank account. As financial stress mounts and an economic crash looms, the Wired for Wealth authors show that the biggest threat to your financial health is not a recession, it's your mindset. Markets fluctuate but one fact holds true: People's money scripts—the unconscious core beliefs they hold about money—will determine whether they win or lose. With Wired for Wealth, three respected experts explain their proven Money Makeover Program that has helped clients break through excessive debt, financial stress, self-sabotage, money avoidance, and more.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Wired for Wealth by Brad Klontz, Ted Klontz, Rick Kahler in PDF and/or ePUB format, as well as other popular books in Personal Development & Personal Finance. We have over one million books available in our catalogue for you to explore.

Information

THE SCIENCE AND PSYCHOLOGY

OF MONEY SCRIPTS

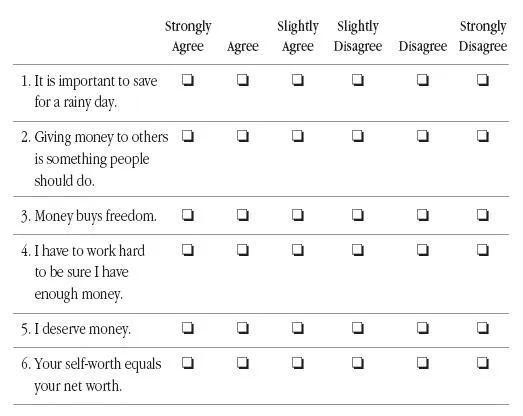

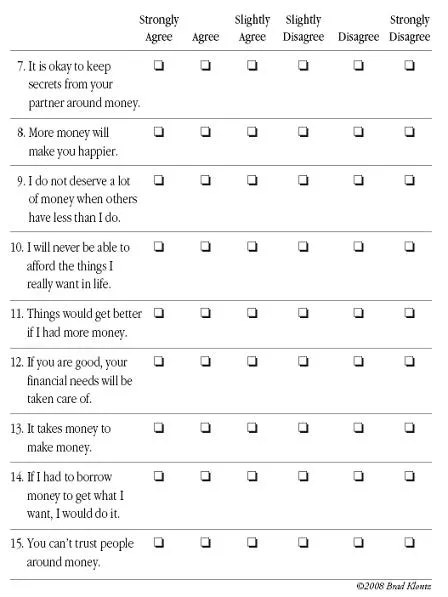

Please take a few minutes to complete the questionnaire that follows, which is taken from the survey we used in our research. Each item listed is a “money script,” or a belief about money. Later in the book, you’ll have the opportunity to compare your answers to our research findings. Your answers can reveal a great deal about your wealth potential.

Place an X in the box that best describes the extent to which you agree or disagree with each of the following statements. Please answer all the items.

MONEY SCRIPTS QUESTIONNAIRE

Now that you have a sense of some of your own beliefs about money, let’s explore the concept of money scripts.

MONEY SCRIPTS

Natalie would be the first to tell you, “I’m just not good with money.” She manages to pay her rent, utilities, and car payment every month, but the payments are frequently late. She uses her debit card for everything else, running up overdraft charges nearly every month because she has no idea how much money is in her account. One of her dresser drawers is full of unopened bank statements.

As a licensed practical nurse, Natalie earns enough money to live comfortably, yet she always seems to find herself in the middle of another financial crisis. Her car was recently impounded—the consequence of ignoring a year’s worth of parking tickets. It made her sick to have to ask her parents to pay the tickets, the impoundment fees, and the hefty fine to get her car back. The total cost was nearly as much as her car was worth. Her parents sent her a check, along with a four-page letter scolding her for being so stupid. She was further humiliated by having to make a court appearance and listen to a lecture from the judge. As soon as it was over, she went to the mall and bought two new pairs of shoes. Shopping always seems to make Natalie feel better.

Like Natalie, many of us aren’t managing money well. Americans have record-high debt and record-low savings rates—we are among the worst of all the developed countries. This isn’t because we lack the income. On a global basis, we have one of the highest earnings per capita. Nevertheless, with an average savings rate in 2005 of minus 0.5 percent—the lowest since the Great Depression—the average American spends more money than he or she makes. According to a report by the Department of Labor, a 2005 study done by Sharon DeVaney and Sophia Chiremba of Perdue University found that 19 percent of the respondents had spent more than their income, and 56 percent of the baby boomers usually spend all of—or more than—what they earn.

Clearly, many Americans are in bad financial shape. However, the basics of financial health are actually quite simple: spend less than you make and invest the difference for the future. Few of us can honestly say that we don’t know we should live within our means, save for a rainy day, and fund a retirement plan. Someone like Natalie would be quick to acknowledge that she should have a budget, pay more attention to her finances, spend less, and save more.

Since we know what we should do to manage money more wisely, why are so few of us doing it? If our behavior with money causes us so much stress, why don’t we just do what we know we should do? Natalie is a smart woman. Why can’t she learn from her expensive mistakes and humiliation and behave more responsibly with her money? It doesn’t make sense to keep making the same destructive financial choices over and over when we know we should stop.

In reality, however, our self-defeating actions do make sense. Even the most self-destructive financial behaviors make perfect sense when we understand what drives those behaviors. All our decisions and actions or inaction concerning money, including those that do not serve us well, are based, with perfect logic, on our beliefs about money. These beliefs are called money scripts.

Money scripts are the thoughts, beliefs, and attitudes that we hold about money. Many of our associations with money are hidden deeply in the unconscious mind. The new field of neuroeconomics combines the sciences of psychology and economics to identify how these patterns of thinking and emotions affect financial decisions.

For example, research conducted by Hersh Shefrin and Meir Statman of the University of Santa Clara and published in the Journal of Finance (1985) showed that people do not trade stocks in a rational manner. They found that people have a natural disposition to sell winning stocks too early and hold onto losing stocks too long. In this study, only a minority of stock trades occurred in accordance with rational principles, because people tried to avoid feeling regret by not selling losing stocks, sought feelings of pride by selling stocks that were winning, and had difficulty with self-control.

Similar studies show that the average human being suffers from thinking errors and emotions that affect investing decisions. Psychologists and financial coaches know that each of our brains is individually wired to think certain ways about money based on our personal experiences with money.

Our money scripts affect every decision we make that directly or indirectly involves money. These scripts are formed during childhood and are further developed and shaped through our life experiences. We don’t even realize that we believe these “truths” about money—what it is, what it can do, and how it works. We are taught that it is not polite to talk about money. Thus, we keep our beliefs to ourselves and do not open our thinking to new awareness or understanding. Conscious or not, money scripts define our relationship with money and lie at the foundation of all our financial behaviors.

WHERE DO MONEY SCRIPTS COME FROM?

As children, we internalize the messages we receive from our surroundings and integrate that information to help us make sense of the world. We receive messages, both overtly and covertly, from our parents, other significant people in our lives, our life circumstances, and society as a whole. Just as children depend on their parents to provide nourishing food, they also depend on the adults in their lives to provide nourishing, accurate information and messages about the world. Many of those messages are about money.

Many money scripts come from beliefs that are spoken or otherwise directly communicated to us by some authority figure. For example, parents might pay children for chores or require them to save part of their allowances. They might directly tell children such things as “Money can’t buy happiness,” “It’s just as easy to fall in love with a rich man as a poor one,” “Money doesn’t grow on trees,” or “Spend your money on education; nobody can ever take that away from you.” Children may also simply over hear Mom and Dad say those things to others.

Other money scripts are indirect; they come from beliefs that we internalize from listening to other people or watching their behavior, from seeing the way that rich and poor people are regarded and portrayed in the media, and from absorbing thoughts, feelings, and behaviors concerning money from our parents.

Children whose parents worry about money, for example, may grow up to be insecure and fearful about finances. Those whose parents are envious of wealthy people and resentful about their own circumstances may develop money scripts such as “Being rich is the most important thing in life,” “Rich people are shallow,” or “If you’re poor, it’s somebody else’s fault.” If these beliefs are not identified, explored, and modified, the children who are exposed to them will grow up to unconsciously communicate the same messages to their own children.

Because children take in and process messages about money in individual ways, the money scripts they learn from their situations can vary. Two children from the same family can grow up with different worldviews about money and totally different adaptations.

The deepest and most stubborn money scripts come from circumstances or events that are associated with strong emotional or traumatic experiences. The actual role that money plays in the event is less important than its association. The more primitive part of our brain, whose primary purpose is to help us survive, often misinterprets the significance that money has played in a particularly traumatic situation. To protect us from further emotional harm, the primitive brain’s association between money and pain can lead us to unconscious actions that end up hurting our financial health but have no survival value.

For example, a child growing up in a wealthy family in which there is a significant amount of emotional pain might associate money with family dysfunction. In reality, money does not cause dysfunction, but its misuse can be a symptom of an underlying dysfunction (for example, divorce, abuse, alcoholism). However, an unconsciously held negative association involving money can lead to deeply held money scripts and can lead a person to “choosing” a life of avoiding wealth. Conversely, a child who grows up in a poor family in which there is substantial emotional pain might erroneously associate the pain with a lack of money. This child may then engage in a workaholic life of pursuing money at the expense of relationships, health, or spiritual development, believing that money will bring love, connection, and joy.

Sometimes the significance of money-related traumatic associations and events is readily apparent: the parents losing a business or going through bankruptcy, being evicted from the family home, intense family conflict about money, or a parent being incarcerated for embezzlement. At other times, events might seem unimportant but can still result in deeply embedded money scripts because children attach such strong emotion to them. For example, a child may want something that the family can’t afford. The parents’ saying no may be done in a way that the child interprets as deeply shaming. To avoid experiencing such shame in the future, the child might develop a money script of “It’s wrong to want anything.” This could result in a life of unnecessarily denying comforts and pleasures to oneself and perhaps one’s family.

Our money scripts may be exact copies of our parents’ teachings and actions about money. Thus we may find ourselves, for better or worse, creating the same financial situation our parents created. For example, a boy raised in poverty may incorporate a money script of “No matter what I do, I will always be poor.” If left unchallenged, such a belief could lead him to a life of underachievement in which he ignores opportunities to create wealth and interprets financial defeat as a confirmation of his sorry lot in life. On the other hand, a boy raised in a wealthy family might have the money script “I am meant to be rich,” resulting in a dogged pursuit of wealth. When he experiences a setback, he might shake it off or chalk it up as a learning experience, being convinced that wealth is his birthright. In adulthood, both boys will unconsciously create the destiny they believe is theirs, and those around them will join them in those beliefs and respond to them in kind.

However, it is also common to form money scripts that are the opposite of what our parents do, often as a reaction against our parents’ way of doing things. When strong feelings are involved, we might adopt an opposite and equally unbalanced and destructive belief, even if it is not good for us. For example, Charlie, the son of a workaholic father who still hurts from his father’s absence in his life, decided that “the pursuit of money is bad—look what it cost me.” This money script resulted in an exaggerated desire to avoid work, leading to a life of unnecessary poverty and underachievement for Charlie and his family.

Shelly, the daughter of a single mother on welfare whose choices were limited, decided that “money is the most important thing” and organized her life to maximize her ability to earn. That money script essentially cost her own daughter and son their mother; Shelly was rarely around because she worked so much. History is full of such rags-to-riches stories, illustrating the ability of people like Shelly to step out of their natal family’s financial legacy by adopting money scripts that are more conducive to acquiring and increasing wealth. The family they create as adults often pays the price for such a single-minded pursuit.

Money scripts that result from traumatic or deeply emotional experiences are formed at a deep, primal level and become part of our worldview. These beliefs, developed for survival and protection in an unpredictable world, are often incredibly strong, resistant to change, and totally unconscious.

Natalie, whom we introduced at the beginning of this chapter, had a money script of “I’m not good with money” that was created when she was a little girl. Her mother was a nurse and her father was the bookkeeper for a large law firm. As the family’s “money expert,” he paid the bills and made the financial decisions. The only discussions Natalie ever heard about money consisted of her father lecturing her mother about not keeping to the budget.

When Natalie and her sister were old enough to receive allowances, they had to account to their father every week for what they spent. If he didn’t approve of their choices, he told them they wouldn’t get any money the next week. By the end of the week, he always relented and gave them the money, with an accompanying lecture. Natalie soon learned to avoid the lecture by lying about her spending. She also learned that in a pinch she could go to her mother, who would give her additional money without her father’s knowledge.

Some of the money scripts Natalie developed were “I’m too stupid to learn to manage money,” “Money matters are the man’s province,” “My parents will always lecture me, but they’ll always bail me out,” and “Money is used to manipulate others.” These beliefs were internalized, and Natalie organized her entire financial life around them, as if they were absolute truths. Natalie’s money scripts make perfect sense, given where she came from. As long as they go unrecognized and unchallenged, however, they will continue to limit her ability to achieve financial health.

MONEY SCRIPTS ARE PARTIAL TRUTHS

A money script is not necessarily wrong, but neither is it necessarily right. Our scripts are often skewed, exaggerated, or one-dimensional, consisting of incomplete or partial truths...

Table of contents

- COVER PAGE

- TITLE PAGE

- COPYRIGHT PAGE

- CONTENTS

- ACKNOWLEDGMENTS

- INTRODUCTION

- CHAPTER ONE: THE SCIENCE AND PSYCHOLOGY OF MONEY SCRIPTS

- CHAPTER TWO: THE TOP TEN MONEY SCRIPTS THAT MESS UP PEOPLE’S FINANCIAL LIVES

- CHAPTER THREE: YOUR FINANCIAL COMFORT ZONE: DO YOU NEED TO BREAK OUT?

- CHAPTER FOUR: WHEN MONEY SCRIPTS KEEP YOU POOR

- CHAPTER FIVE: WHEN MONEY SCRIPTS KEEP YOU POOR IN SPIRIT

- CHAPTER SIX: MONEY SCRIPTS THAT PROMOTE WEALTH

- CHAPTER SEVEN: MONEY SCRIPTS:WHAT’S YOUR FAMILY LEGACY?

- CHAPTER EIGHT: FINANCIAL REHAB: REWIRING YOUR MONEY SCRIPTS—THE FIVE-STEP PROCESS

- CHAPTER NINE: WHEN MONEY SCRIPTS COLLIDE: COUPLES IN CONFLICT

- CHAPTER TEN: RAISING FINANCIALLY HEALTHY CHILDREn

- CHAPTER ELEVEN: CHANGE YOUR MONEY MINDSETS AND CREATE THE LIFE YOU WANT