- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

The must-read summary of James Andrew and Harold Sirkin's book: `Payback: Reaping the Rewards of Innovation`.

This complete summary of the ideas from James Andrew and Harold Sirkin's book `Payback` asks an important question: `How can you generate a better return on any and all of your investments in innovation?`. In their book, the authors demonstrate that, rather than being a hit-and-miss affair, innovation can actually generate consistent and healthy returns. This summary explains how you can do this using a 3-step process for innovation.

Added-value of this summary:

• Save time

• Understand key concepts

• Expand your knowledge

To learn more, read `Payback` and gain a valuable insight into how to refine your innovation process.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Summary: Payback by BusinessNews Publishing in PDF and/or ePUB format, as well as other popular books in Personal Development & Personal Success. We have over one million books available in our catalogue for you to explore.

Information

Topic

Personal DevelopmentSubtopic

Personal SuccessSummary of Payback (James Andrew and Harold Sirkin)

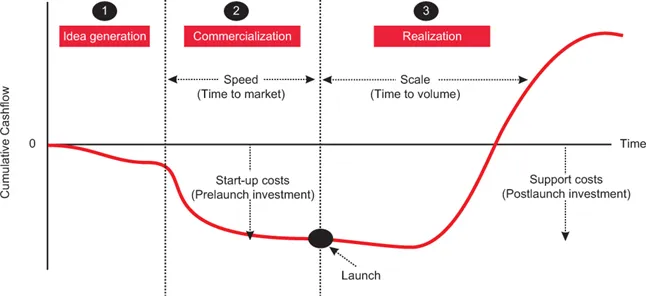

1. The four factors which affect payback

When it comes to successful innovation, cash is king. There are four factors which will ultimately influence just how much cash is generated by your innovations and which should be tracked:

- Start-up costs – your prelaunch investment

- Speed – your time to market

- Scale – time needed to achieve volume production

- Support costs – your postlaunch investments

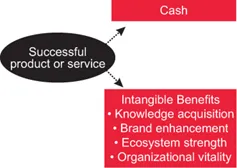

In addition to these cash returns, there will also be four indirect benefits which can be derived from innovation, and which may have the potential to lead to cash in the future:

- Knowledge acquisition – new intellectual property

- Brand enhancement – being seen as innovative

- Ecosystem – stronger relationships with other parties

- Organizational vitality – attracting good people

In order to manage the innovation process adroitly, it’s necessary to have a structured way to make good decisions. The most effective way to do this is to develop a “cash curve” which tracks overall cumulative cash flow over the length of the innovation project.

This cash curve is a good way to track the four factors which will affect the cash payback on any innovation:

- Start-up costs – the amount of money which must be invested up-front before a marketable offering can be made available. This capital is used in developing the assets and capabilities which will be required by the innovation. The larger the start-up investment, the greater the risk and the more marketplace success is needed.

- Speed – or time to market. This is the time and investment needed to go from a working prototype to a product which can be mass produced and sold. Increasing speed will increase the cash payback of the innovation and decrease risk because it enables the company to capture a larger market share at a higher average price. Increases in speed, however, often increase start-up costs and impact on quality.

- Scale – or time to volume. This is the time required from launch to where the new product or service achieves its planned volume. The faster an innovation reaches full production volume matched to market demand, the quicker it can begin generating cash profits.

- Support costs – the cost of marketing and promotion, special pricing offers, product enhancements and even the cannibalization of other products. The lower the ongoing support costs, the greater the cash profits that can be harvested by the company.

The cash curve is a management tool which brings together all of the assumptions which have been made about how the innovation will perform in the marketplace. It also centralizes in one place the different perspectives which individual managers may have about what the company’s plan of attack should be. It provides a common point of reference so everyone can get on the same page. The cash curve is a reality test which is helpful because for new ideas, optimism tends to run rampant.

The cash curve also helps companies assess risk more accurately. For an innovation project, three types of risks are generally present:

- Executional risks – whether the company can actually develop, make and sell the new product as scheduled.

- Technical risks – whether or not the product or service will do what it’s supposed to do.

- Market acceptance risks – whether customers will actually buy in the numbers required.

The cash curve makes any of the trade-offs which are happening become obvious as well. There’s often an option to do things faster if you’re prepared to spend more money. The cash curve allows the company’s executives to discuss these choices and make them deliberately. Use of the cash curve will also identify innovation projects which end up being cash traps -development projects that end up absorbing more cash than they ever generate over their lifetimes. Sometimes most of the cash a new product develops has to be reinvested just to maintain a competitive position. Cash traps can destabilize companies so they need to be identified early on.

In addition to cash, there are also four intangible benefits which can be derived from innovation. These intangibles may not generate an immediate payback but at some point down the road they may lead to more cash for the innovation developer.

The four main intangible benefits are:

- Knowledge acquisition – learning new things which may be able to be applied in improving current products or services or in developing other new products or services in the future. There are actually four different types...

Table of contents

- Title Page

- Book Presentation

- Summary of Payback (James Andrew and Harold Sirkin)

- About the Summary Publisher

- Copyright