eBook - ePub

From Value Pricing to Pricing Value

Using Science, Psychology, and Systems to Attract Higher Paying Clients to Your Accounting Firm

- 210 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

From Value Pricing to Pricing Value

Using Science, Psychology, and Systems to Attract Higher Paying Clients to Your Accounting Firm

About this book

This book will reveal how to understand, implement and master the pricing value methodology.

Understanding and applying the concept of "pricing value" is critical for today's accountants-especially for self-employed accountants, CPAs, and small firms who primarily work with small business clients.

This book will reveal how to understand, implement and master the pricing value methodology. It will explain the solid academic research behind this approach, discuss how to avoid common pitfalls, and demonstrate step-by-step how to implement the methodology in a practical and persuasive way.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access From Value Pricing to Pricing Value by Rhondalynn Korolak in PDF and/or ePUB format, as well as other popular books in Business & Accounting. We have over one million books available in our catalogue for you to explore.

Information

CHAPTER 1

What Is Value?

The question “what is value” has been debated for hundreds of years in the realm of philosophy. One perspective is that value is intrinsic or objective—meaning the value is imposed by some higher power or created by the labor that goes into making a product/service. The other diametrically opposed view is that it is entirely subjective—meaning it’s whatever the person wants it to be.

But in truth, you cannot solve the puzzle “what is value” without first answering the questions to whom and for what. And this is where economics comes in.

The objective theory of value morphed into a labor theory of value as explained at length by Karl Marx in his work, Das Kapital.1 However, this line of thinking led to a classic value paradox, often referred to as the diamond-water paradox, and a lot of unanswered questions.

Here is a quick example of why the diamond-water paradox seriously challenged this old way of thinking. If the amount of labor that went into a good is the sole determinant of its value, a man out on a hike could just as easily stumble upon a diamond or a river and both would therefore, have the same objective value. In this example, both discoveries would require the same amount of labor, yet the diamond would still in most instances be valued much more than the water.

As a result of this paradox, the subjective theory of value was effectively born. Carl Menger was one of the first economists to apply the approach that value is subjectively determined by the individual. As such, value begins in the mind, not with the labor needed to produce a good or service. What this means is your clients have choice—they exercise that choice (whether consciously or unconsciously) to determine which service/solution by which accountant (or other provider) will satisfy their highest ranked need or desired outcome.

So now that you know it is your client who determines value, let’s examine what and whom they value.

Is What You Offer Valued by Your Client?

As accounting professionals most of you like to think that you help your clients improve their businesses and cure cash flow problems. The problem is, the vast majority of owners think more customers and sales will cure their cash flow problems and fix their business.

Now, as financial experts, you know that this is not technically correct. More customers does not necessarily lead to improved cash flow. But let’s look at another aspect of the problem…

If your clients perceive they need assistance to attract more leads and convert them to fix or grow their business, chances are most will not turn to you first for advice because they currently view you as unqualified in the realm of sales, marketing, pricing, and so on. And to be fair, that observation is technically astute. You need only take a look at your website (or any one of your marketing brochures) to discover that 99 percent of what you say relates to your brand, your experience and credentials, and a laundry list of the services that you provide. Very little time has been invested by you to address what is of value to your ideal client.

Right now clients come to you for a number of reasons—because they need help with bookkeeping, they need a tax return or set of year end accounts completed, or they have questions about payroll and sales tax obligations. And as a professional you have done very well to establish credibility and trust in the realm of “financial expert.” But as you’ve discovered, these tasks are highly price sensitive, limited in scope, and impossible to leverage to create influence with your client.

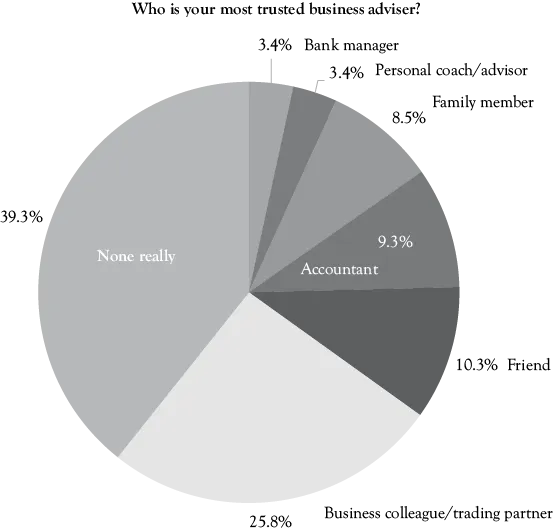

You’ve pigeonholed yourself in the box of “financial expert” and now you are stuck there unless you deliberately take action to bust out. And this dilemma is corroborated by a recent study by East & Partners published in the Financial Review.2 According to that research, only 9.3 percent of small businesses regard their accountant as their most trusted advisor (see Figure 1.1). Yes, you read that correctly, 9.3 percent.

Figure 1.1 Who Small Business Owners Turn To For Advice

It’s an indictment on where our profession stands in the eyes of our clients.

The overwhelming majority (75.4 percent) trust no one, a business colleague, or a friend. And since roughly 85 percent of small business owners are financially illiterate, you can safely conclude that their colleague or friend knows about as much as they do about financials and business improvement, which isn’t a hell of a lot. Now the good news is that this proves there is enormous potential for you to step up and redefine your role and impact with your small business clients. The only tricky bit is for you to figure out what your client actually values (i.e., what are they willing to pay you for) and how to arm yourself with the right skills, tools, and mindset to deliver that value and impact.

Most of your colleagues are not going to successfully make the transition because they are content (and it feels safe) to stay where they feel comfortable…in the numbers. Thankfully, you already have the edge over those who still have their heads in the sand because you are here with an open mind and ready to learn.

Where to from Here?

Unfortunately, there are two major problems in the accounting industry: a massive skills deficit (in terms of adding real value) and an image problem.

Despite all the talk about moving to advisory and value-based pricing, the truth is most of you have not yet done it. A recent survey3 highlighted that even in 2016/17, 90 percent of accountants have not yet begun to shift toward advisory services in any meaningful way. In addition, revenue from business advisory services is not growing rapidly and you are being asked to deliver more value each year in compliance with revenue remaining flat or decreasing.

As most of you have discovered, it’s not as easy as adding to your website and proposal documents “I’m now providing business advisory” or “I’ve got some value-priced packages.” And the reason for that is simple yet profound—your clients are only willing to pay the big bucks for solutions that are of value to them. And value has been somewhat elusive because until now, you’ve been looking for it in all the wrong places.

Where Do You Find Value?

The natural inclination for most who embark on the journey is to dedicate 90 percent of their time and attention on the semantics of pricing. After all, you are an accountant, so it seems logical to focus on the price because the price is expressed as a number, and you are very good with numbers. The point you have missed is eloquently summed up by Ron Baker, the author of seven best-selling books, several of which focus on pricing—“Pricing is not a number, it’s a feeling.”

Unfortunately, this preoccupation with pricing semantics has caused you to waste time on factors that only matter to you and the esoteric exercise of determining “the price you need to get” in order to earn a decent living. And that mistake is not entirely your fault because it was driven by factors that are below the level of consciousness and therefore, have gone unnoticed by you until now.

As explained earlier, the phrase “value pricing” is a red herring—value is seen as a mere qualifier to the word “pricing.” You’ve been predisposed from the outset to focus almost all of your attention on the pricing component, and if you think about it, many books, articles, and training programs on the topic follow this pattern. They are marketed with attention grabbing titles such as:

- How to Get the Price You Deserve.

- How to Double Your Price and Avoid Resistance.

- Seven Pricing Strategies of the Most Profitable Firms.

- Eight Steps to Getting a Better Price.

- Using Psychology to Boost Your Prices.

But here’s the problem…

The most important word in the phrase Pricing Value is of course “value.” And value, while determined by your client, must be masterfully uncovered and drawn out by you, the practitioner. Value may not be something your client can easily articulate or quantify without your expert assistance. In fact, some of the most valuable information and insights may be pain points, experiences or transformations, and feelings that even your clients themselves are not yet fully aware of.

One of the reasons why it is so vital to completely turn the co...

Table of contents

- Cover

- halftitle

- title

- Copyright

- dedi

- Abstract

- Contents

- Testimonials

- Intro

- Part_1

- 01_Chapter 1

- 02_Chapter 2

- 03_Chapter 3

- 04_Chapter 4

- 05_Chapter 5

- 06_Chapter 6

- 07_Chapter 7

- 08_Chapter 8

- 09_Chapter 9

- Part_11

- 10_Chapter 10

- 11_Chapter 11

- 12_Chapter 12

- 13_Chapter 13

- 14_Chapter 14

- 15_Bios

- 16_Index

- Adpage

- backcover