- 58 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

This report measures the skills gap among tourism industry workers and the resulting opportunity costs along the Almaty–Bishkek Economic Corridor in Central Asia. The skills gap analysis identifies an annual lack of about 8,500 trained professionals in the tourism industry along the region which is causing opportunity costs of more than $30 million per year. The Almaty–Bishkek Economic Corridor has an exceptional heritage and wealth of culture and nature. This combination results in a high potential for tourism development that is largely untapped.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Improving Education, Skills, and Employment in Tourism by in PDF and/or ePUB format, as well as other popular books in Business & Hospitality, Travel & Tourism Industry. We have over one million books available in our catalogue for you to explore.

Information

1

Skills for Tourism Sector Overview

“We are looking for potential rather than skills.”

- General manager of five-star hotel in the Almaty–Bishkek Economic Corridor

The Almaty–Bishkek Economic Corridor (ABEC) has an exceptional heritage and wealth of culture and nature. This combination results in a high potential for tourism development, which is largely untapped. Only the historically developed mainstream beach and health tourism at Lake Issyk-Kul may to some degree be considered as a more intensive form of developed tourism in ABEC.

Limitations and delimitations of this report—additional sector overview with focus on skills for tourism (S4T). Even though tourism data and methodology are patchy in Kazakhstan and the Kyrgyz Republic, various reports and publications, mostly by bilateral and multilateral development partners, exist and are listed in the references section of this report. The focus of this research is on skills and, to some extent, jobs. Therefore, those components, data, and reports of the tourism sector will be primarily highlighted insofar as they are relevant for skills development and employment. In addition, new employment and skills data, and data on the tourism industry in general, will be offered if respective data were not available in existing reports.

On the importance of skills for sector development. Skills development is an important binding constraint for almost any sector development. The more labor-intensive and complex a given sector, the more important skills of the respective workforce become. Put into context, for tourism sector development in ABEC, a greater in quantity and better skilled workforce is paramount. Tourism products in ABEC are presently suffering from a low quality-of-service reputation while perceived as relatively expensive. Improved skills will be essential to develop the sector, improve client satisfaction, develop niche markets, and attract more regional and international tourists. Marketing communication and branding is another key activity for sector development, especially for regional tourism. However, if the quality of the tourism products is not improving, it would be difficult to build up and sustain the sector’s image.

1.1 Structure of Tourism Market in Almaty–Bishkek Economic Corridor

Generally, the tourism industry has had a robust 4% long-term growth over the last decades. In recent years, the industry grew worldwide at about 6% (ITB 2016). According to the World Economic Forum (WEF), the Kyrgyz Republic recorded 3,051,000 international tourist arrivals, which accounted for the tourism industry’s about $100 million gross domestic product (GDP). On the other hand, Kazakhstan received reportedly 4,559,500 international tourist arrivals, leading to the tourism industry’s $3,077 million GDP. For the Kyrgyz Republic, the data suggest only about $33 spent per tourist arrival, while in Kazakhstan, each tourist spent about $667, about 20 times as much. Given economic disparities, this difference still appears to be very high indeed. It seems more realistic to assume that the Kyrgyz Republic’s tourism GDP is about $1 billion, when comparing the arrivals of both countries.

For ABEC, but also for both countries individually, by far, the biggest existing tourism markets are the domestic ones. Domestic tourists in Kazakhstan account in 2015 for 83% of tourist arrivals. In the Kyrgyz Republic, this figure is estimated at 73% (Choi 2016; and UNWTO 2017a, 2017b, 2017c, 2018). Another high concentration is revealed when unpacking the international tourist arrivals. The following regional breakdown applies according to United Nations World Tourism Organization (UNWTO) data (UNWTO 2017a, 2017b, 2017c, 2018) and is illustrated in Tables 1 and 2. International leisure tourists account only for about 50,000 tourists a year in Kazakhstan. The vast majority of international arrivals are business tourists who also consume leisure tourist offers to some extent.

Table 1: Overview of Incoming Tourists to Kazakhstan by Country

Kazakhstan incoming International Tourists 2016: 6,509,390 | ||

Top 3 | % | |

1 Uzbekistan | 37.79 | |

2 Russian Federation | 24.39 | |

3 Kyrgyz Republic | 21.72 | |

Total | Central and Eastern European countries (CEE non-EU) and Commonwealth of Independent States | 91.44 |

Top 3 EU | ||

1 Germany | 1.39 | |

2 United Kingdom | 0.31 | |

3 Italy | 0.24 | |

Total | EU | 2.94 |

Other | ||

Turkey | 1.38 | |

People’s Republic of China | 1.80 | |

India | 0.21 | |

Rest of the world | 0.61 | |

EU = European Union.

Source: United Nations World Tourism Organization data, calculations by authors.

Table 2: Overview of Incoming Tourists to the Kyrgyz Republic by Country

Kyrgyz Republic incoming International Tourists 2016: 2,930,200 | ||

Top 3 | % | |

1 Kazakhstan | 56.49 | |

2 Russian Federation | 14.71 | |

3 Uzbekistan | 11.90 | |

Total | Central and Eastern European countries (CEE non-EU) and Commonwealth of Independent States | 91.65 |

Top 3 EU | ||

1 Germany | 0.37 | |

2 United Kingdom | 0.27 | |

3 France | 0.21 | |

Total | EU | 2.73 |

Other | ||

Turkey | 1.82 | |

People’s Republic of China | 1.27 | |

India | 0.35 | |

Rest of the world | 0.56 | |

EU = European Union.

Source: United Nations World Tourism Organization data, calculations by authors.

Table 1 illustrates the high regional concentration of incoming (business) tourists to Kazakhstan. When comparing the estimation above of 83% arrivals being domestic, 6.5 million international arrivals, on the other hand, result in a very high proportion of domestic travel—close to 40 million domestic arrivals. Relative to the population size of about

18 million, this accounts for more than two arrivals per capita, a high value in international comparison. However, Kazakh culture is traditionally mobile, and people travel frequently to attend extended family functions (baptisms, initiation festivities, marriages, funerals, commemoration ceremonies, etc.). Those functions may fall mostly under the internationally unified tourism category of visiting friends and relatives; however, in Kazakhstan, considerable spending in addition to travel cost is involved for presents, monetary contribution, clothes, and hospitality. Special venues exist also in the Kyrgyz Republic to representatively host such festivities.

For the Kyrgyz Republic, the situation is similar, but leisure travel is likely to be a major motivation for visitors. Arrivals from Central Asian countries, especially Kazakhstan, contribute to more than 90% of international arrivals. Incoming tourists from the European Union (EU) yet present a niche market, which can and should be considerably expanded. There are historical linkages with Turkey, and a market share of 1.82% has been established. The tourism market of the People’s Republic of China (PRC) is developing at a pace of around 10% per annum. However, it remains at less than 40,000 incoming tourists per year in 2016. Other markets, such as tourism from India, remain infant in terms of market share.

Other than for Kazakhstan, leisure tourism plays a significant role in the Kyrgyz Republic’s economy. The Kyrgyz Republic statistical committee’s staff estimates 1.1 million visiting tourists or about one-third of visitors being leisure tourists. This proportion of leisure tourists seems reasonable since the Kyrgyz Republic has about half (or more) the number of international tourist arrivals than Kazakhstan. However, the economy, population, and geography are multiple times smaller which, in turn, suggests a sizable quantity of incoming leisure tourism.

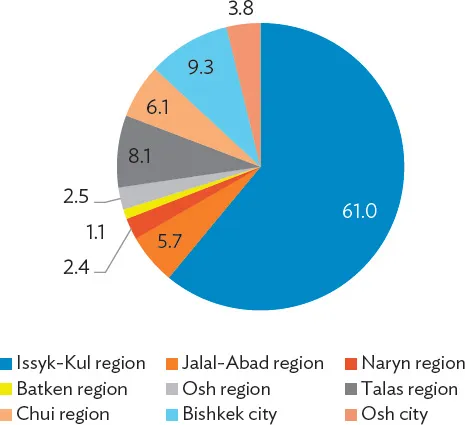

Figure 1: Tourism by Region in the Kyrgyz Republic, 2013

Source: National Statistical Committee.

A high concentration of tourism around Lake Issyk-Kul is observed (61%) compared with the large business tourism to Bishkek that is relatively l...

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Tables, Figures, and Boxes

- Acknowledgments

- Abbreviations

- Key Findings

- 1. Skills for Tourism Sector Overview

- 2. Skills Supply and Demand in the Tourism Industries of Almaty–Bishkek Economic Corridor

- 3. Key Issues for Improving Tourism Skills in Almaty–Bishkek Economic Corridor

- 4. Structures for Improving Skills for Tourism

- References

- Appendixes

- Footnotes

- Back Cover