- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

Although the interest around smart contracts is generally defined in a narrow way, centered in applications terms such as Bitcoin contracts, Ethereum contracts or Smart Contracts Bitcoin, or even just in technical trading aspects such as Ethereum price, in reality the field is more diverse. A number of companies and non profit organizations are serving governments, institutional and private clients implementing distributed ledger technology. In this accessible book, we present the detailed corporate profile of several smart contracts companies, their trading and social network volumes, and provide a gentle introduction to smart contracts examples. ECONOMY MONITOR Guide to SMART CONTRACTS offers a demonstrably effective way to diversify risk when investing in cryptocurrency securities by focusing on companies that are offering products with actual demand in the real economy. The book is also useful for managers seeking to learn about vendors of fintech, blockchain, and computable contracts technology.

Inside this book:

I Companies

(Corporate profile, Funding, Team, Clients, Leverage points, Regulatory compliance information)

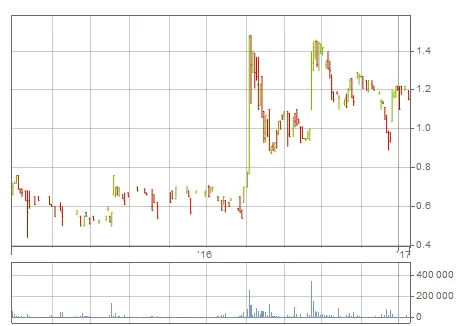

Interbit (BTL)

Symbiont

Counterparty

Lisk

BitShares

R3CEV

Ripple

Ethereum

Stellar

Chain

Clearmatics

II Social Signals

What is breakdown of followers and influence by twitter handle?

What is the trend of the number of Tweets over Day?

What is the trend of author favorite count over month?

What is the contribution of Retweet count over month by Sentiment?

What is the breakdown of sentiment negative signals?

What are the values of author friend count by country?

III Appendix

Examples (Programming smart contracts)

About Consensus

About the author

Percy Venegas is a former Intel engineer, co-founder of Economy Monitor, and member of the founding advisory board of the Social Venture Capital Conference, Latin America, Caribbean and South Florida.

He has published in journals such as International Advances in Economic Research and Financial Assets and Investing, and more recently he has been a speaker on the topic of Trust-less Crypto Markets at the Cambridge Centre for Risk Studies Seminars.

Percy holds an MBA in International Business from MIB School of Management in Trieste, Italy. He attended the MIT Sloan China Program, Lingnan University College at Sun Yat Sen University in Guangzhou, and earned an Executive Master in Sustainable Development and Corporate Responsibility from EOI Business School, Campus Universidad Complutense de Madrid. He's also lived in New York and is currently based in Costa Rica.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

I

Companies

1

Interbit (BTL)

Overview

Company information

Service/Product Offer

Key Features

Clients/Backers

Market validation

Funding

Team

Regulatory compliance

Leverage points

Website

2

Symbiont

Overview

Company information

Service/Product Offer

Key Features

Clients/Backers

Market validation

Funding

Team

Regulatory compliance

Leverage points

Table of contents

- About the author

- Introduction

- I. Companies

- II. Social Signals

- III. Appendix

- Disclaimer