eBook - ePub

Startup Syndicate Investment Playbook

Raising cross-border capital through an SPV and investing in early-stage U.S. startups

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Startup Syndicate Investment Playbook

Raising cross-border capital through an SPV and investing in early-stage U.S. startups

About this book

"A big applause to the authors for turning their comprehensive knowledge and practical experience in syndicate investing into such a well-organized, easy-to-read content. Syndicate investing in startups has been always complicated topic to me, but having finished the book, I feel pretty confident that I can lead a syndicate investment on my own. Well done!"

- Hon Lung Chu, Harvard Business School MBA -

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Startup Syndicate Investment Playbook by Gabriel Jung, Jed Ng, Yuki Shirato in PDF and/or ePUB format, as well as other popular books in Negocios y empresa & Inversiones y valores. We have over one million books available in our catalogue for you to explore.

Information

Publisher

PublishDriveeBook ISBN

9780463742976Topic

Negocios y empresaSubtopic

Inversiones y valores1. What Is an Investment Syndicate?

An investment syndicate is a privately-run, single-deal venture investment fund that allows individual investors (each a “backer”, and collectively the “backers” or the “syndicate backers”) to co-invest with an experienced lead investor (“lead” or “syndicate lead”) in a high-potential startup. This structure allows each backer to contribute a relatively small amount of capital—which may be below the minimum amount required for direct investment—thus giving the backers access to a deal they otherwise wouldn’t have had the opportunity to invest in. A syndicate lead organizes a special purpose vehicle which governs the parties’ rights and responsibilities for such an investment as described below:

- Syndicate Lead

A syndicate lead is an organizer of the syndicate who later becomes the syndicate’s “manager”. The manager sources an investment opportunity, fundraises from a number of individuals or entities that are not necessarily investment professionals, and makes a lump-sum investment in a target startup. The lead is responsible for forming a legal entity (e.g. LLC or General Corporation) and establishing a legally-binding investment vehicle that protects each backer’s rights for the life of the syndicate.

- Syndicate Backers

Backers are individuals or entities who join the syndicate as members by contributing small amounts of capital. Based on the strong trust they have for the syndicate lead, backers rely on the lead’s due diligence, negotiation, documentation, follow-ups, and exit strategy in regard to their investment. They own shares of the syndicate that is formed as a legal entity, and they are entitled to the distributed profits, dividends, and exit-related capital gains that the startup generates. Each backer is entitled to distributed profits and/or capital gains in proportion to his or her shares in the investment.

2. How an Investment Syndicate Can Benefit all Parties

The investment syndicate is a vehicle that makes a market by channeling capital to startups, and it can be organized and operated in a way that benefits all stakeholders.

Syndicate lead can expect the following benefits:

- Entitlement to carried interest that typically ranges from 12 - 30% (this is a percentage of the increase in a startup’s valuation that is paid upon an exit event such as an IPO or a straight sale).

- Ability to invest in deals larger than what the syndicate lead would ordinarily be able to come up with individually.

- Leverage and diversification: By grouping a larger pool of capital, the syndicate lead can invest in a larger number of deals and deploy larger sums of capital across portfolio startups, thus diversifying the risk associated with individual investments.

- Negotiating strength: The syndicate lead is able to negotiate more favorable investor rights and terms due to the larger investment amount.

Syndicate Backers enjoy the following benefits:

- Access to deal flow that they would not otherwise have due to network limitations, geography, or other reasons.

- Affordability: Access to deals with a higher risk threshold and minimum investment amounts than they could otherwise not have access to individually.

- Borrowed expertise: Due diligence and investment processes are executed and managed by a trusted and experienced syndicate lead.

- Reduced administration and paperwork.

For a Startup, the investment from a syndicate means:

- Access to a larger pool of capital and a more diversified group of investors.

- The single investor entity—as compared to a large number of small individual investors— makes it easier for a startup to manage, and it allows the startup to maintain a clean cap table.

- A large number of syndicate backers can become advocates/consultants for the startup, offering advice, customer introductions, social marketing, and other benefits.

3. Syndicate Investment Process Summary

For those who want to review the larger perspective for making a syndicate investment in a startup, here is a summary of the entire process. It is intended to give you a general idea about the steps that have to be taken from the initiation to the closure of a deal.

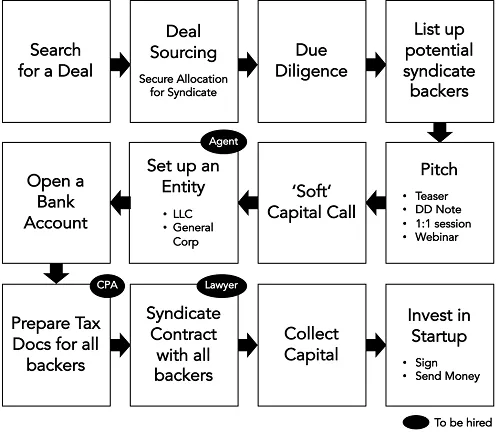

As figure 1 shows, you start from looking for and securing an excellent investment opportunity in the industry that you are interested in. You then conduct a thorough due diligence on the startup that enables you to pitch the business in detail to other people on behalf of the startup’s CEO. This is followed by pitching the startup to all the potential backers you’ve prelisted (call sessions, webinars, etc.) Next is the soft “capital call” in which you collect commitments from individuals seeking to join your syndicate for investing in the startup. Once you have sufficient backer commitments, you set up a legal entity (with the possible help of a lawyer or agent) and open a business bank account for the entity. Then, you typically use the services of a CPA to help you prepare all the legal and tax-related documents that are necessary for syndicate members. Once backers sign on to those documents, you collect the committed funds from each investor. Lastly, and with the capital in hand that you’ve promised the startup owners, you sign on the contract with the startup and transfer to them the lump-sum that was agreed upon in the investment contract.

[Figure 1: Syndicate Investment Process Summary]

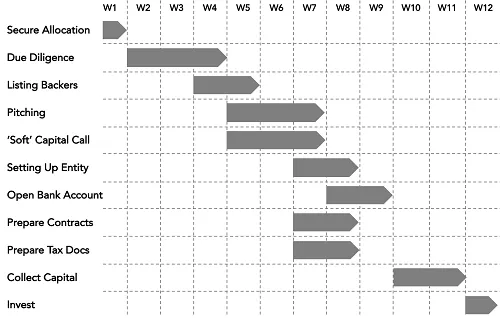

[Figure 2: Usual Timeline]

4. Deal Sourcing

Now that you’ve determined that you want to become a syndicate lead:

The first thing to do is to define your investment criteria. Investment criteria are the ‘filters’ through which you analyze various startups to find a deal that is good enough to invest your own capital in (of at least $10,000). There are no universal standards for how to select a great startup, so you rely on your own filters. Those filters may include a particular sector or industry, company developmental stage, founder type, management capability, technology maturity, target market and segment, geography, target value chain, competition level, product type, value proposition, business model, growth rate, risk, macro-level threat, and the list goes on. Such filters will make your deal-sourcing process more efficient and give you a higher level of confidence for pitching to your client backers.

When your filters are ready, you need to search for opportunities to run through the filters.

However, unless you are a full-time investment professional, the deal propositions that you have an opportunity to investigate may prove limited.

That’s when you could leverage your professional and personal networks to find an appropriate, early-stage startup seeking investors. You can also cold-call/email companies, review industry regulatory filings and published reports, and attend industry networking conferences or startup events where entrepreneurs interact with each other and pitch to potential investors—and also attend accelerator demo days or industry conferences to scout for potential targets. These days, many of these avenues are plentiful and relatively easy to find. Keep in mind that startups that are fundraising usually have a pitch deck that they share with investors. This would be an important first glimpse into the company’s business, executive team, and other basic information.

Once you latch on to a possible target, you need to introduce yourself as an angel investor with special expertise and experience in your industry, and establish your standing as a competent, helpful, and trustworthy person. Developing a good relationship with a target startup is an essential first step and a common challenge that those who are new to the business struggle with.

Competency: Listen to many interesting ideas from those CEOs and try to understand precisely what they do and where they’re going. Be careful not to be a harsh critic, for you are not there to judge them. Instead, respect them, ask questions that you think the CEOs should be able to answer, acknowledge their accomplishments, and encourage them onwards.

Helpfulness: Communicate your authority and the value you can bring to the startup as an investor. Facilitate meaningful business connections, particularly executive-level industry experts who can themselves become investors or who can introduce potential investors or partner companies to the startup. Leverage your entire network in pursuit of this step and the next one.

Trustworthiness: When it comes to a syndicate investment, the trust level between the CEO and the syndicate lead plays a critical role, and it helps to become transparent, both at the professional and personal levels. The trust doesn’t build up instantly, and it doesn’t always develop through talking, but instead through actions as well. For that reason, offer to the CEO any help you can while making sure you execute on what you promise in a timely manner.

Now that you’ve identified a great target startup and developed the best possible relations with their top team, we’re ready to move on to a practical discussion about an investment.

5. Getting an Allocation for Your Syndicate

Again, well done for getting to where you now find yourself. The real issue though is whether the startup really needs your syndicate investment. In some cases, startups prefer institutional investors (venture capitalists, private equity firms, investment banks, and the like) to a syndicate investment, primarily because having those institutional type of investors benefits them in terms of boosting their reputation, leveraging those institutional investors’ expertise, knowledge, and networks, and the potential availability of these investors as participants in further deals.

By the same token, other startups prefer syndicate investments because of the access to larger sums of capital (with a diminished level of oversight), because of the one person to deal with (i.e. the syndicate lead), the fact that the syndicate becomes the single investor in the startup’s cap table, and because of having the backers as ambassadors and supporters of theirs.

Let’s now check to see if the CEO understands and is open to a syndicate investment. Most CEOs are not familiar with the concept of syndicate investment. That means that you may have to explain what it is, how it works, and the benefits that accrue to the startup. Even if they prefer venture capital investments, there is no need for disappointment, for you already know what that is about. So, all ...

Table of contents

- 1. What is an Investment Syndicate?

- 2. How an Investment Syndicate Can Benefit all Parties

- 3. Syndicate Investment Process Summary

- 4. Deal Sourcing

- 5. Getting an Allocation for Your Syndicate

- 6. Term Negotiation with a Startup

- 7. Due Diligence (DD)

- 8. Target Valuation

- 9. Terms to be Communicated to Syndicate Backers

- 10. Contacting Potential Syndicate Backers

- 11. Pitching a Startup

- 12. Soft “Capital Call”

- 13. Setting Up an Investment Entity - Special Purpose Vehicle (SPV)

- 14. Opening a Business Checking Account

- 15. Preparing Tax-Related Documents for Syndicate Backers

- 16. Contract with Syndicate Backers

- 17. Capital Collection

- 18. Investing as a Syndicate

- 19. Follow-Up

- 20. Templates / Application Forms

- 21. Contract Draft (Lawyer-Prepared LLC Agreement)

- 22. Syndicate Leads & Backers Network

- 23. Advisory

- 24. About the Authors