- 592 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

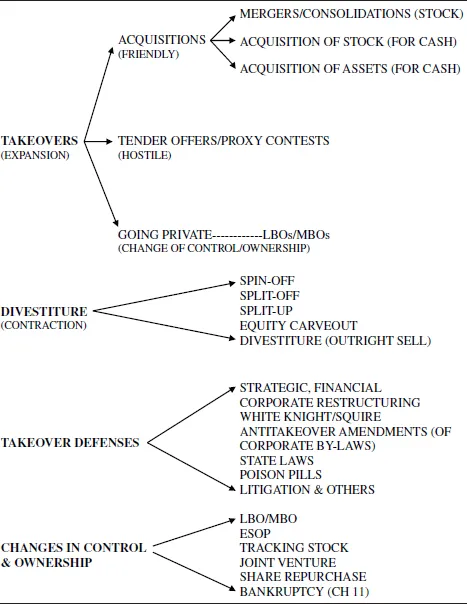

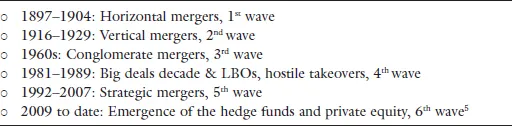

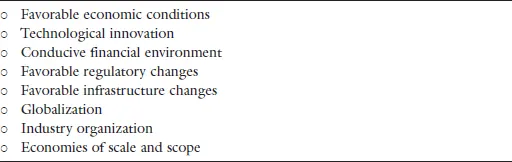

The survival and prosperity of any corporation over the long term depend on the company's ability to grow and develop through a process of investment, restructuring, and redeployment. Since the late 19th century, mergers and acquisitions (M&As) have become an essential vehicle for corporate change, fuelled by synergies that could arise from expansion of sales and earnings, reduction in cost, and lower taxes and cost of capital.

M&A transactions, however, are complex and risky and are affected by the state business cycle, financial conditions, regulations, and technology. Approximately two-thirds of all M&A deals fail. This book seeks to provide an effective and comprehensive framework, predominantly embedded in corporate finance, for achieving greater success. Written by academics and practitioners, it integrates business strategies with formal analysis relating to M&A deal making, providing a coherent statement on M&A by utilizing scholarly work with best practices by industry.

The authors provide extensive analytical review and applications of the following critical M&A issues: valuation, leveraged buyouts, payment methods and their implications, tax issues, corporate governance, and the regulatory environment, including antitrust in M&A. The book globalizes the M&A model by extending it to cross-border business, risk and select hedging methods, and addresses postmerger integration.

This book is intended as a reading text for a course in M&A for undergraduates and MBA programs, and for practitioners as a handbook.

Contents:

- Introduction to Mergers and Acquisitions (Harvey Poniachek)

- Doing the Deal: The Framework (Harvey Poniachek)

- The Due Diligence Process in M&A Transactions (Jerry Schwartzman)

- The Legal and Regulatory Framework of the M&A Market (Harvey Poniachek)

- Corporate Governance and Control: The Board's Role in M&A (Andrew J Sherman and Nick Rosenberg)

- Antitakeover Measures (Dovrat Bashan)

- Valuation Methods and Practices for M&As (Harvey Poniachek)

- Valuation of Privately Held Firms: Methodologies and Applications for M&As (Alina Niculita)

- Accounting for M&As (Harvey Poniachek)

- Tax Aspects of M&A (Peter F De Nicola and Robert M Gordon)

- Leveraged Buyouts (LBOs): The Financial Engineering of Transactions and Evolution of LBOs (Chris Droussiotis)

- Restructuring & Divestitures: (Christophe van Gampelaere)

- Cross-Border M&As (Harvey Poniachek)

- M&As in Bankruptcy and Reorganization: The Implications on M&A (Frank A Oswald, Kyle J Ortiz, and Katherine A Crispi)

- Bankruptcy Reorganization and its Implications on M&As in the European Union (Heike Luecke)

- Postmerger Integration: Lessons from Experience and Research in Successful Corporations (Stefan Hofmeyer)

Readership: Graduate students and lecturers of mergers and acquisitions, MBA students and lecturers, and practitioners.M&A;Mergers & Acquisitions;Guide to M&A;Merger;Acquisition;Company;Deal Structuring;Due Diligence;Anti Takeover;Valuation;Tax;LBO;Restructure;Bankruptcy;Postmerger0 Key Features:

- An M&A book authored by academics and practitioners is more authoritative on the subject than existing books

- Serves as textbook as well as handbook for practitioners

- Extensive analytical review and applications of critical M&A issues

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Chapter 1

Introduction to Mergers and Acquisitions

Introduction

Growth Through Mergers

Merger Trends and Main Influences

M&A Data

Table of contents

- Cover

- Halftitle

- Title

- Copyright

- Contents

- Preface

- About the Editor

- About the Contributors

- Chapter 1 Introduction to Mergers and Acquisitions

- Chapter 2 Doing the Deal: The Framework

- Chapter 3 The Due Diligence Process in M&A Transactions

- Chapter 4 The Legal and Regulatory Framework of the M&A Market

- Chapter 5 Corporate Governance and Control: The Board’s Role in M&A

- Chapter 6 Antitakeover Measures

- Chapter 7 Valuation Methods and Practices for M&As

- Chapter 8 Valuation of Privately Held Firms: Methodologies and Applications for M&As

- Chapter 9 Accounting for M&As

- Chapter 10 Tax Aspects of M&A

- Chapter 11 Leveraged Buyouts (LBOs): The Financial Engineering of Transactions and Evolution of LBOs

- Chapter 12 Restructuring & Divestitures

- Chapter 13 Cross-Border M&As

- Chapter 14 M&As in Bankruptcy and Reorganization: The Implications on M&A

- Chapter 15 Bankruptcy Reorganization and its Implications on M&As in the European Union

- Chapter 16 Postmerger Integration: Lessons from Experience and Research in Successful Corporations

- Index