An Introduction to Derivative Securities, Financial Markets, and Risk Management

- 772 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

An Introduction to Derivative Securities, Financial Markets, and Risk Management

About this book

Written by two of the most distinguished finance scholars in the industry, this introductory textbook on derivatives and risk management is highly accessible in terms of the concepts as well as the mathematics.

With its economics perspective, this rewritten and streamlined second edition textbook, is closely connected to real markets, and:

Beginning at a level that is comfortable to lower division college students, the book gradually develops the content so that its lessons can be profitably used by business majors, arts, science, and engineering graduates as well as MBAs who would work in the finance industry.

Contents:

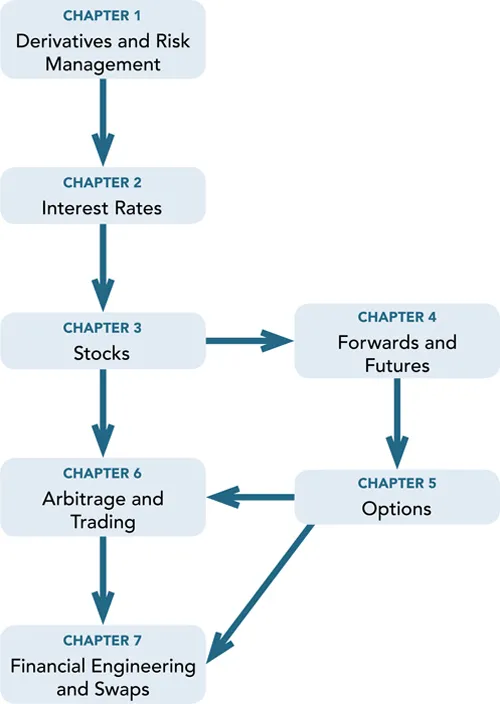

- Introduction:

- Derivatives and Risk Management

- Interest Rates

- Stocks

- Forwards and Futures

- Options

- Arbitrage and Trading

- Financial Engineering and Swaps

- Forwards and Futures:

- Forwards and Futures Markets

- Futures Trading

- Futures Regulations

- The Cost-of-Carry Model

- The Extended Cost-of-Carry Model

- Futures Hedging

- Options:

- Options Markets and Trading

- Option Trading Strategies

- Option Relations

- Single-Period Binomial Model

- Multiperiod Binomial Model

- The Black–Scholes–Merton Model

- Using the Black–Scholes–Merton Model

- Interest Rate Derivatives:

- Yields and Forward Rates

- Interest Rate Swaps

- Single-Period Binomial HJM Model

- Multiperiod Binomial HJM Model

- The HJM Libor Model

- Risk Management Models

Readership: Undergraduate and graduate students of economics, business, arts, science and engineering, and MBAs who would work in the finance industry.Derivatives;Financial Markets;Risk Management;Arbitrage;Financial Engineering;Forwards;Futures;Call Options;Put Options;European Options;American Options;Swaps;Currency Swaps;Interest Rate Swaps;Commodity Swaps;Equity Swaps;Credit Default Swaps;Commodity Derivatives;Equity Derivatives;Index Derivatives;Interest Rate Derivatives;Commodities;Margins and Daily Settlements;Binomial Model;Black-Scholes Model;Black-Scholes-Merton Model;Delta Hedging;Gamma Hedging;Heath-Jarrow-Morton Model;Libor Model,;Forward Rate Agreements;Interest Rate Futures;Interest Rate Options;Market Manipulation;Regulation;Derivatives Exchanges00

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

1.1 Introduction

1.2 Financial Innovation

Modern finance is, truly, as powerful and innovative as modern science. More people own homes—many of them still making their mortgage payments—because mortgages were turned into securities sold around the globe. More workers enjoy stable jobs because finance shields their employers from the ups and downs of commodity prices. More genius inventors see dreams realized because of venture capital. More consumers get better, cheaper insurance or fatter retirement checks because of Wall Street wizardry.

Table of contents

- Cover

- Halftitle page

- Title page

- Copyright page

- Dedication page

- About the Authors

- Brief Contents

- Contents

- Preface to Second Edition

- Preface to First Edition

- PART I: Introduction

- PART II: Forwards and Futures

- PART III: Options

- PART IV: Interest Rate Derivatives

- APPENDIX A Mathematics and Statistics

- Glossary

- References

- Notation

- Additional Sources and Websites

- Books on Derivatives and Risk Management

- Name-Index

- Subject-Index