eBook - ePub

Audit Analytics in the Financial Industry

- 387 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Audit Analytics in the Financial Industry

About this book

In Audit Analytics in the Financial Industry, editors Jun Dai, Miklos A. Vasarhelyi and Ann F. Medinets bring together a cast of expert contributors to explore ways to integrate Audit Analytics techniques into existing audit programs for the financial industry.

Separated into six parts, the contributors take a variety of approaches to this exploration. In Part One, the contributors present two articles illustrating the process of applying Audit Analytics to solving audit problems. Part Two contains four studies that use various Audit Analytics techniques to discover fraud risks and potential frauds in the credit card sector. In Part Three, the chapter focus on the insurance sector and show the application of clustering techniques in auditing. Part Four includes two chapters on how to employ Audit Analytics in the transitory system for fraud/anomaly detection. Finally, Parts Five and Six illustrate the use of Audit Analytics to assess risk in the lawsuit and payment processes.

For students, researchers, and professionals in the accounting sector, this is an unmissable read exploring the latest research in Audit Analytics.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Audit Analytics in the Financial Industry by Jun Dai, Miklos A. Vasarhelyi, Ann Medinets, Jun Dai,Miklos A. Vasarhelyi,Ann Medinets,Ann F. Medinets, Jun Dai, Miklos A. Vasarhelyi, Ann F. Medinets in PDF and/or ePUB format, as well as other popular books in Business & Accounting. We have over one million books available in our catalogue for you to explore.

Information

Part I

Audit Analytics Procedures

Chapter 1

An Application of Exploratory Data Analysis in Auditing – Credit Card Retention Case*

1. Introduction

Over the last several decades, operational risks in banking systems has attracted both regulatory and academic attention due to the devastating losses experienced by some banks. For example, Allied Irish Banks lost $750 million due to rogue trading,1 and Prudential Insurance entered into a $4 billion class action settlement with regard to fraudulent sales practices over 13 years2 (Muermann & Oktem, 2002).

An operational audit focuses on evaluating the efficiency, effectiveness, and economy of organizational activities to reduce operational risks and improve future performance (Lane, 1983). It plays an important role in ensuring that organizations achieve their strategies and objectives. This chapter demonstrates an application of exploratory data analysis (EDA) (Tukey, 1977) in a real operational audit setting and illustrates how internal auditors can benefit from this approach.

This case study in this chapter analyzes a data set of credit card annual fee discounts from an international bank in Brazil. In this case study, the EDA process is mainly applied to test three pre-defined audit objectives. The results of the EDA process are compared with the results of conventional audit procedures. The outcomes of this comparison demonstrate that EDA permits the auditor to obtain comprehensive findings easily with simple statistics and visualization techniques.

The chapter begins with a description of the audit problems facing this bank and then discusses the data and specific methods used in this case. The results of both conventional audit procedures and the EDA process are then presented. Finally, implications and limitations of this case study are discussed.

2. The Audit Problem

2.1. Scenario

This study investigates the credit card division of a large international bank in Brazil. Most of the credit cards issued by this bank have annual fees. Clients who do not want to pay these fees may call the bank and ask for a fee cancelation or a fee reduction. In these circumstances, bank representatives negotiate with the clients about the fees. Based on clients’ backgrounds, representatives can then offer appropriate discounts. During the discount negotiation process, bank representatives should follow the bank’s policy; they cannot offer discounts higher than they are authorized to give, and they should give top priority to the benefit of the bank. In other words, they should offer the lowest discounts acceptable to the clients.

2.2. Audit Objectives

The bank suggested that the initial audit scope for this study is to identify the bank representatives whose behavior, in the course of the annual fee negotiations, may cause the loss of bank revenue. Risky behaviors include (1) offering higher discounts than allowed; (2) offering high discounts without making an effort to negotiate lower discounts; and (3) offering discounts without any client negotiation. Based on these behaviors, three audit objectives are developed:

(1) All bank representatives obeyed bank policy when offering discounts.

(2) Bank representatives offered the lowest possible discounts to retain clients.

(3) Bank representatives negotiated with clients for lower discounts before offering final discounts.

In addition to these issues, the audit scope is extended to discovering potential operational risks in the annual fee-offering process. Non-behavioral factors, such as lack of effective internal controls, can also lead to loss of revenue. Even though some cases are not directly related to current revenue losses, business process risks may cause future revenue loss.

To achieve these audit objectives, all related fields need to be thoroughly explored for irregularities, making this topic a suitable scenario for EDA. As in a traditional audit, the auditors must gain an understanding of the process and then identify the risks and problems related to this process and its associated internal control system before testing to determine whether any policies have been violated.

3. Methodology

3.1. Data

Two data sets are used in this case: the retention data and the account master data. The retention data includes information on customer phone calls made in January 2012. The data set consists of 195,694 records in total. Each record represents a customer’s phone call and contains 162 fields.

The account master data is a large data set with 60,309,524 records and 504 fields. Each record represents a credit card account. All accounts opened in the bank from July 1980 to March 2012 are included in the data set. The fields in the account master data cover a wide variety of information relevant to the accounts and accounts holders: account information, such as account type and account status; demographic information, such as account holders’ age and gender; and financial information, such as credit limits and late pay amounts. Account master data is updated by the bank on a continuous basis.

This case study uses eight attributes: call length, bank representative ID, supervisor ID, customer service center location, original fee, actual fee, sequence number of the account, and number of cards. Most of these attributes, such as call length, annual fee, and output annual fee, are necessary to test the original audit objectives. Other attributes are newly added during the EDA process, such as supervisor number and number of cards. The names, source database, and descriptions of these attributes are listed in Table 1.

Table 1. Description of Attributes Included in This Study.

Attribute Name (Source Database) | Description |

Call length (retention) | The duration of each call in seconds |

Call location (retention) | The location of the customer service center |

Agent number (retention) | ID of the bank representative answering the call |

Supervisor number (retention) | ID of the representative’s supervisor |

Sequential number (retention and account master) | Sequence Number of an account |

Annual fee (retention) | Original annual fees of a credit card |

Output annual fee (retention) | Actual annual fees paid by each client |

Number of cards (account master) | Number of cards associated with each account |

Among these fields, call length, original fees, actual fees, and number of cards are continuous variables. Representative’s ID, supervisor’s ID, client’s ID, account sequential number, and customer service center location are nominal variables. To protect clients’ privacy, the account sequential numbers and clients IDs are encrypted in the data set. The encryption method preserves the integrity of the original data; each original value corresponds to a unique cipher text.

3.2. Data Preprocessing

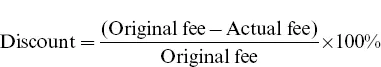

Discounts offered by bank representatives play an important role in the process of analyzing loss of revenue. However, there is no field that directly reflects discounts in the raw retention data. Two existing fields that relate to discounts are original fees before negotiation and actual fees after negotiation. The difference represents the discount, which is needed to conduct EDA. Specifically, the discount is the difference between original fees and actual fees divided by the original fees. The formula used to calculate discounts is:

EDA analyses may require account master data. Therefore, retention data and customer master data need to be joined so that related data elements can be matched. For example, while each client exists only once in the customer master data, each phone call to negotiate discounts creates another item in the retention data set. These many-to-one data sets can be joined based on this relationship. The joining process uses the account sequential number field as it exists in both data sets and is the unique identifier in the Visual Basic for Applications (VBA) data.

3.3. Applied EDA Techniques

In this case study, traditional EDA techniques, such as descriptive statistics, data transformation, and data visualization techniques are mainly used to explore the data. Descriptive statistics used in this study include frequency distribution, summary statistics (mean and standard deviation), and categorical summarization. Data transformation is achieved by the logarithm function. Applied data visualization techniques involve pie charts, bar charts, linear charts, and scatter plots.

4. Results and Discussion

4.1. Policy-violating Bank Representatives and Negative Discounts

4.1.1. Conventional Audit Procedures. To determine whether bank representatives are violating bank policy, the maximum discount that each bank representative is allowed to offer according to bank policy must be determined. The bank policy allows bank representatives to offer discounts up to 100% of the annuity to retain the customer, so the conventional audit procedure to test this audit objective is to check whether any bank representatives offered more than 100% discounts. Internal auditors can perform this test simply by applying a filter to select all of the records with discounts greater than 100%. In this case, this filter returned no records, indicating that no bank representative violated bank policy. Thus, this audit objective is confirmed by a conventional audit procedure. Auditors can check this box on their checklist and move to the next one.

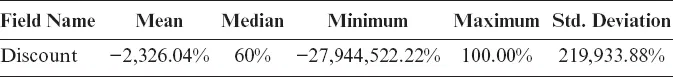

Table 2. Descriptive Statistics of Discounts.

4.1.2. EDA Process. The first step of EDA is to display the distribution of related fields. As bank representatives’ discount-offering behaviors are the main concern of the bank, the analysis begins with some descriptive statistics: mean, median, minimum value, maximum value, and standard deviation of the discounts offered by the representatives. The results are shown in Table 2.

According to these results, the maximum discount offered by the bank representatives is 100% of the annual fee. Using this number, the same conclusion can be drawn: No bank representatives offered more than 100% discount. Thus, no bank representative violated bank policy.

This table also shows that th...

Table of contents

- Cover

- Title

- Part I. Audit Analytics Procedures

- Part II. Analytics in Credit Card Audits

- Part III. Analytics in Insurance Audits

- Part IV. Audit Analytics in Transitory Systems

- Part V. Audit Analytics for Lawsuit Risk Detection

- Part VI. Audit Analytics in the Payment Process