- 336 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

This new publication in the series from Legend Business provides an authoritative and essential guide to the post-referendum business climate in the United Kingdom together with outlines of the laws, business regulations and practices that affect those looking to do business in the UK. The Guide also focuses on the impact of the 2016 decision to leave the European Union on both businesses in the UK and prospects for post-Brexit international trade.

Aimed at businesses of all sizes, from multinationals to SMEs, the Guide offers in-depth briefings on the technical aspects of investment, business start-ups and UK markets beyond the EU, such as:

- Grants and incentives

- Department for International Trade support services

- Company formation

- Financial reporting

- Business taxation

- Commercial law

- Intellectual property

- Immigration

- Employment law

- Pensions

- Mergers, acquisitions and joint ventures

- Infrastructure investment opportunities

- Key global markets for UK international trade

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Business Guide to the United Kingdom by Jonathan Reuvid in PDF and/or ePUB format, as well as other popular books in Business & Business Strategy. We have over one million books available in our catalogue for you to explore.

Information

Part One

Investment in the United Kingdom: The Current Outlook

1.1 THE UK ECONOMY AND INWARD INVESTMENT

Jonathan Reuvid, Legend Business

The outcome of the June 2016 Referendum on UK membership of the EU had little visible effect on the UK economy up to March 2017 when the Prime Minister invoked Section 50 of the Treaty of Rome confirming termination from March 2019. Following the intervention of the UK General Parliamentary Election called in April, negotiations on the terms of departure were delayed until 19th June when formal negotiations in Brussels opened. Understandably, uncertainties which surround the likely outcomes and which will persist until there is an outline agreement on the future relationship between the EU and the UK are now having a dampening effect on the economy.

However, the economy remains robust and there are encouraging signs of possible bilateral trade deals with some leading global economies beyond the EU when Brexit finally takes place. (Profiles of these economies and their foreign trade are included in Appendix I of this book.) The UK Department for International Trade is leading these initiatives.

MACRO-ECONOMIC INDICATORS

Forecasts for 2017/18

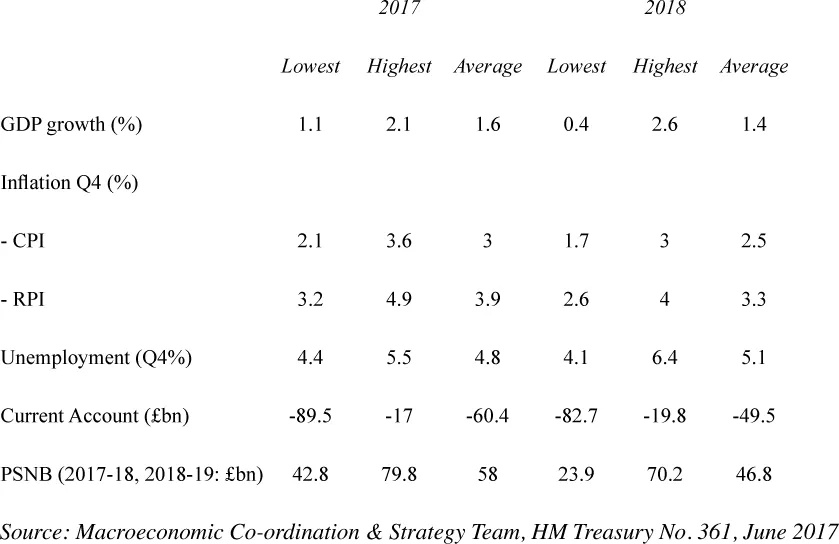

Composite forecasts for the basics of the UK economy published by HM Treasury are highlighted in Table 1.1.1.

Table 1.1.1 Macro-economic indicators June 2017

The highest and lowest forecasts are extracted and the averages calculated from the forecasts made by 20 City banks and accredited advisers and by 19 international institutes and professionals during the previous three months excluding May. The non-City institutions include the European Commission, OECD, IMF, the Economist Intelligence Unit (EIU), the Confederation of British Industry (CBI) and the British Chamber of Commerce (BCC).

Growth prospects for the UK are compared with those of other major advanced economies and the emerging and developing economies in Table 1.1.2 by reference to the most recent OECD forecasts of real GDP.

Table 1.1.2 Forecast GDP growth for 2017 and 2018 vs 2016

2016 | 2017 | 2018 | |

% | % | % | |

Advanced economies | |||

UK | 1.8 | 1.6 | 1.0 |

US | 1.6 | 2.1 | 2.4 |

Australia | 2.4 | 2.5 | 2.9 |

Canada | 1.4 | 2.8 | 2.3 |

France | 1.1 | 1.3 | 1.5 |

Germany | 1.8 | 2.0 | 2.0 |

Italy | 1.0 | 1.0 | 0.8 |

Japan | 1.0 | 1.4 | 1.0 |

Spain | 3.2 | 2.8 | 2.4 |

Euro Area | 1.7 | 1.8 | 1.8 |

Emerging and developing Asian economies | |||

China | 6.7 | 6.6 | 6.4 |

India | 7.1 | 7.3 | 7.7 |

Korea | 2.8 | 2.6 | 2.8 |

Total OECD | 1.8 | 2.1 | 2.1 |

Source: OECD statistical Table 1, June 2017

The lower rate of growth projections by the OECD for the UK in 2018 compared to HM Treasury’s current forecasts reflects a more pessimistic view of the progress of Brexit negotiations. Nevertheless, it is clear that the short-term outlook for the UK economy is significantly weaker than for North America and for the larger EU countries other than Italy. All of these are overshadowed by the continuing high growth rates of Asia’s two biggest economies.

The UK Population

At mid-year 2016 the population total stood at 65.6 million having increased by 538,100 over the previous year. Of this increase net immigration accounted for 336,000, representing 62.4%.(Source: Office of National Statistics, June 2017).

As of May 2017, 32.1 million were in work, 324,000 more than a year earlier. As of July the jobless rate stands at 4.5% (www.tradingconomics.com). Applying the international measurement standard, the UK’s unemployment rate compares favourably with the EU average of 9.3% (source: Eurostat, 2017) although higher than the US (4.4%) and Germany (3.9%).

The last UK census of population was taken in 2011, when 83.9% of the population were resident in England, 8.4% in Scotland, 4.9% in Wales and 2.8% in Northern Ireland. Of those living in the UK at that time 8.4 million (13%) were born abroad.

UK INWARD INVESTMENT

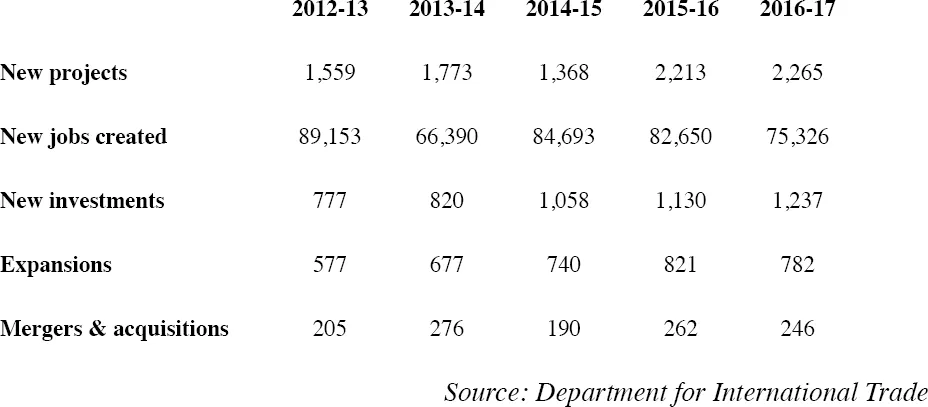

The UK enjoyed a successful year in 2016-17 with the number of projects rising by 2% compared with the previous year to 2,265, creating 75,226 new jobs and protecting a further 32,672 jobs. However, the total of jobs related to inward investment projects declined from 115,974 in 2015-16 to 107,986. Of the new projects registered 1,053 were funded by investors new to the UK and 1,212 by existing investors extending their UK engagements. Over the past five years, the number of new FDI projects in the UK has increased steadily each year as illustrated in Table 1.1.3.

Table 1.1.3 FDI performance over five years

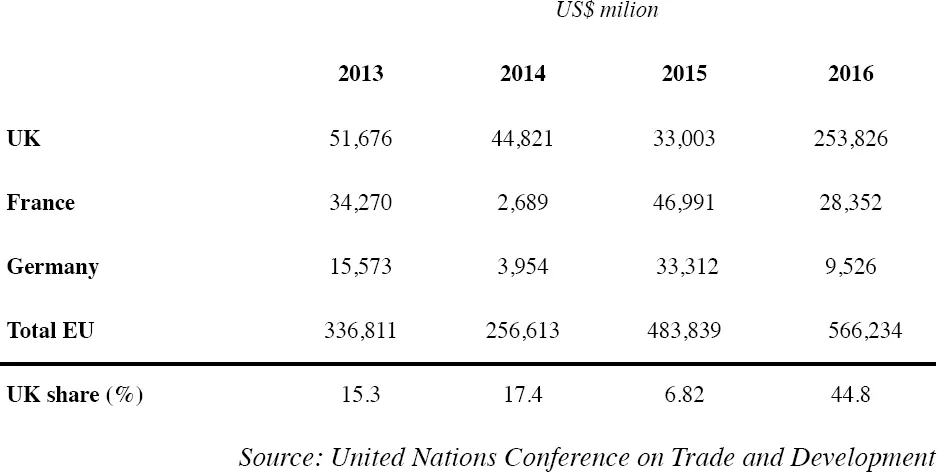

Inward investment flows to the UK over the past four years have been impressive by comparison with EU fellow members and the EU in total according to UNCTAD statistics (World Investment Report 2017).

Table 1.1.4 Value of FDI inflows

In terms of accumulated investment UK inward FDI in 2016 reached USD$1.2 trillion, representing 15.6% of the EU total and compared to US$771 billion for Germany and US$698 billion for France. UK outward FDI stocks, net of disposals, stood at US$1.4 trillion.

Sources of FDI

The top sources of UK FDI in 2016-17 in descending order are listed in Table 1.1.5 together with the new jobs created and safeguarded jobs.

Table 1.1.5 The UK’S major investment sources

Country | FDI projects | New jobs | Safeguarded jobs |

United States | 557 | 24,607 | 7,197 |

China and Hong Kong | 160 | 3,326 | 1,444 |

France | 131 | 5,831 | 2,182 |

India | 127 | 3,999 | 7,645 |

Australia and New Zealand | 127 | 2,197 | 1,803 |

Japan | 116 | 3,511 | 6,095 |

Germany | 100 | 5,802 | 426 |

Italy | 99 | 1,482 | 167 |

Canada | 72 | 1,788 | 122 |

Spain | 70 | 1,789 | 1,152 |

Ireland | 56 | 2,914 | 752 |

Netherlands | 53 | 2,292 | 546 |

Switzerland | 49 | 1,428 | 643 |

Other Europe, Middle East, Africa | 261 | 6,867 | 923 |

Other American countries | 59 | 1,080 | 206 |

Other Asian Pacific countries | 82 | 1,896 | 394 |

Source: Department for International Trade

Regional dispersion

FDI in 2016-17 was spread widely among the regions with the Greater London Area taking the lion’s share as Table 1.1.6 demonstrates:

Table 1.1.6 Regional dispersion of 2016-17 FDI

No. of projects | New jobs created | |

London | 891 | 20,753 |

South East | 217 | 5,432 |

North West | 147 | 6,501 |

West Midlands | 151 | 6,570 |

Yorkshire and the Humber | 132 | 3,872 |

East of England | 125 | 3,634 |

South West | 101 | 3,402 |

East Midlands | 74 | 1,796 |

North East | 69 | 4,609 |

England | 1,907 | 56.569 |

Scotland | 183 | 5,547 |

Wales | 85 | 2,581 |

Northern Ireland | 34 | 1,652 |

Source: Department for International Trade

Sectoral focus of 2016-17 FDI

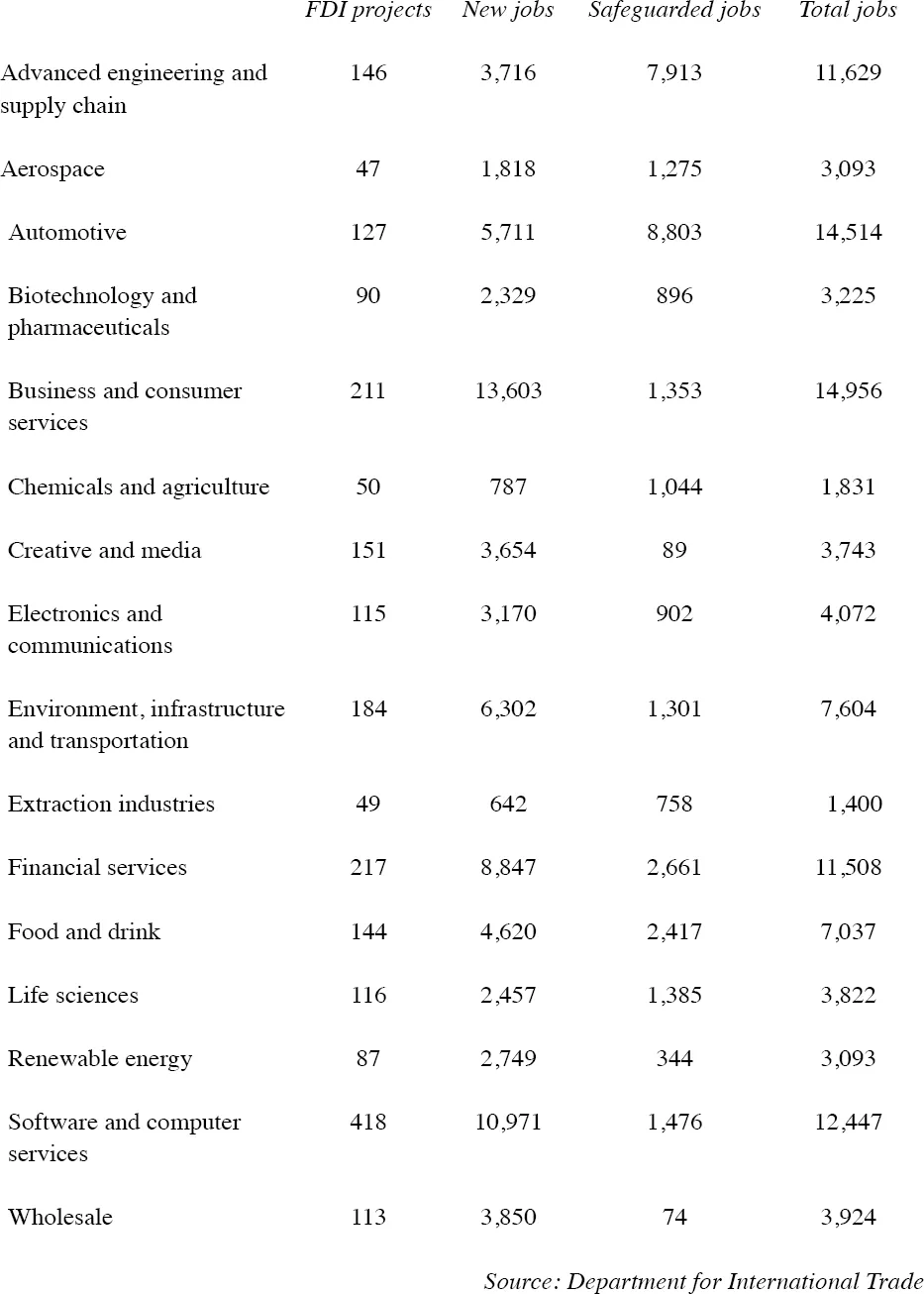

As the report issued by the Department for International Trade for 2016-17shows, the tech sector attracted the greatest number of new projects with the second highest number of new jobs after the business and consumer services sector. Many of these are located in the Greater London area and at the beginning of July London & Partners reported a record level of investments in UK tech companies in the first six months of 2017 accounting for £1.3 billion. The UK remains the leading destination for venture capital investments, attracting more than twice as much invested than in Berlin.

The sectoral dispersion of investment and job creation is illustrated in Table 1.1.7.

Table 1.1.7 Sector results 2016-17

Among the other sectors receiving the most new projects creating high numbers of jobs and protecting existing ...

Table of contents

- Cover

- Title

- Copyright

- Foreword: David Thomas, Chairman, The Council of British Chambers of Commerce in Europe(COBCOE)

- Contributors

- Introduction: Jonathan Reuvid, Editor

- Part One: Investment in the United Kingdom: The Current Outlook

- Part Two: The Business Environment

- Part Three: Operating a Business in the United Kingdom

- Part Four: Banking, Property and Financial Services

- Part Five: UK International Trade in a Wider World

- Appendix I Priority Trade Markets Beyond the EU

- Appendix II Contributors’ Contact Details