![]()

Part Four

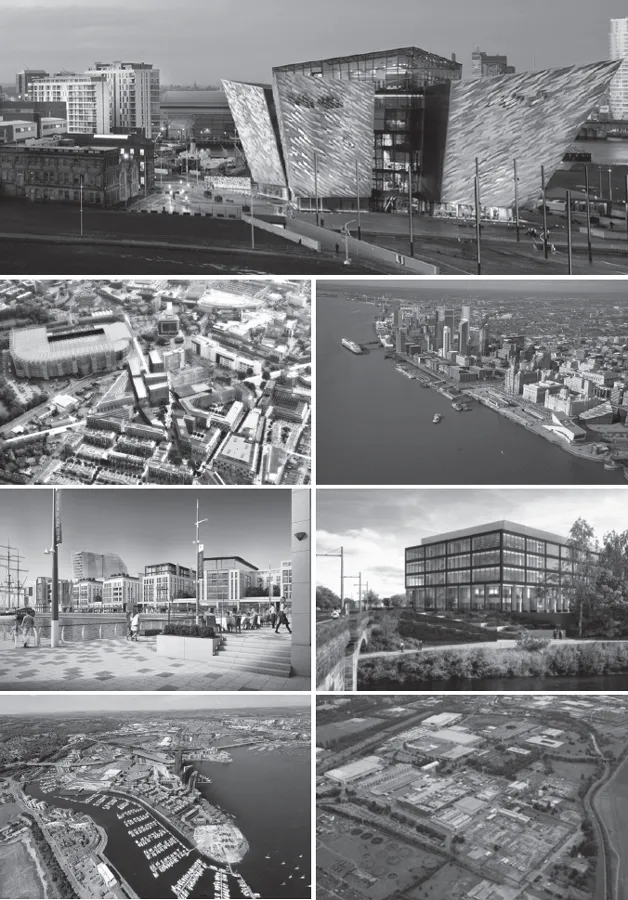

Investment in Energy and Regeneration

![]()

4.1 INVESTING IN UK REGENERATION PROJECTS

Jon Pickstone, UKTI’s Regeneration

Investment Organisation (RIO)

Why the UK is so attractive for property investment is a question that UKTI’s Regeneration Investment Organisation (RIO) never tires of. The answer includes a combination of attractive financial returns, a secure and low-risk business environment, strong government support, and a wide range of opportunities that meet a diverse range of investor interests.

THE RIO MODEL

RIO was launched by the Prime Minister in November 2013 with a remit to complement the work of commercial agents in helping international finance find and flow into the most suitable UK property development projects. These projects are located across the country and in a wide range of sectors, including commercial, industrial, residential, and leisure.

Such developments contribute to the regeneration and renewal of UK towns and cities, but are not necessarily on previously developed land. The continued prosperity of places also relies on growth and expansion, an ambition that is being met by increasing flows of international capital into UK property investment.

Sir Michael Bear - RIO Chairman and UK Special Envoy for Sustainable Urbanisation, China - explains RIO’s role: “the criteria for projects are straightforward - they must have planning consent and existing partners, and have a value of more than £100m, though sometimes a couple of smaller projects can be bundled together to meet this threshold.” From seasoned experience Sir Michael notes that “there may be one piece of the jigsaw to come, such as an anchor tenant, a construction partner or a crucial element of infrastructure. RIO helps overseas investors understand risks and returns and how long projects could take to come to fruition. We know the system and how it works. We have the ear of government.”

To help grow investor certainty, RIO can also introduce interested international parties to UK companies with a wealth of development expertise, or to one of several blue-chip domestic investors interested in co-funding models. Seeking to facilitate business-to-business partnerships is a key part of RIO being a one-stop-shop for regeneration investment. A recent example of this was when RIO helped bring together EcoWorld, a Malaysian investor, with Ballymore, a UK developer. The resulting joint venture is expected to bring forward a £2.2bn, primarily residential, London development portfolio.

Case Study: Peak Resort

Announced during the Prime Minister’s visit to the USA in January, RIO helped facilitate an investment commitment to create Peak Resort, a new £400m integrated year round leisure, health, sport and education destination. A partnership between UK development company Birchall Properties and US firm Grand Heritage Hotel Group, the US investor was identified by UKTI Denver who – along with other colleagues across North America – sourced potential investors for the scheme. The project will be developed near Chesterfield in Derbyshire, bringing to life a former open-cast mining site, and creating over 1,000 full time equivalent jobs and many more in the construction phase.

RIO has a pipeline of £115bn (Gross Development Value) of projects with over 50 of these currently in commercial dialogue (total value £32bn). Further details of these projects are available from RIO’s pages on the UK government’s website: www.gov.uk/government/organisations/regeneration-investment-organisation

RIO is supported by being part of UKTI, the UK government’s dedicated Department for Trade and Investment. UKTI encourage and support overseas companies to look at the UK as the best place to set-up or expand their business. RIO’s work is reinforced by UKTI’s professional advisers around the UK and staff across more than 100 countries. This global network provides broad and deep reach into international investment markets and also the ability to respond to multi-sectoral project ambitions, including where property forms a component.

A GREAT TIME TO INVEST

Although live data on the current value of property developments across the UK is limited, both temporal and geographical comparisons evidence this being a favourable time for investing in UK property markets. Figures reported by PwC and the Urban Land Institute show the UK to be the number one destination for property investment in Europe. In Q1-Q3 of 2014, 47bn Euro was invested in UK property, more than 50% more than the next European country, Germany. Deloitte note that US-based companies and funds have been highly active, aided in part by a favourable exchange rate, targeting portfolios and a wide range of property types at a time when UK institutional funds have also been increasing their exposure to real estate.

Deloitte report that “UK commercial property achieved a total return of 17.1% over 2014, according to IPD, which placed it ahead of the majority of countries covered by their data. Among the major investment locations, only Ireland outperformed the UK.”

Figures from CBRE show that flows of international capital into this sector have increased every year since the nadir of the 2008 global economic downturn. Inflows from Asia, Europe, and the Americas have all risen substantially.

So, why is the UK evidentially particularly attractive for property investors? Jon Neale, Head of Research at Jones Lang LaSalle, explains:

“The UK’s relatively positive economic prospects and high demographic growth, alongside a strong planning system, are probably the most obvious reasons why. However, there are other factors at work. Firstly, there is a long history of protecting the rights of property owners, alongside a well-developed legal, advisory and professional framework. Secondly, a city such as London offers a scale of proposition and a level of liquidity that only a handful of cities (Paris, New York) can match; there is sufficient depth and breadth of interest for a buyer to reassured that they will find a seller. Thirdly, the market is transparent and there is plentiful information on pricing and property ownership. Finally, soft factors are undoubtedly important – familiarity and the English language, to name just two.”

RIO is working across government to ensure that these advantages are harnessed effectively and that regeneration is well integrated with wider local economic growth programmes. An example of this was the successful Investment into Cities event that RIO helped organise at Number 10 Downing Street where representations from Birmingham, Bristol and Leeds impressed a range of key investors with development plans and the support of strong local government. Such events and the sectoral and geographical diversity of RIO’s pipeline evidence the range of competitive opportunities available across the UK.

OPPORTUNITIES ACROSS THE UK

RIO has seen growing interest in development sites outside London, and Deloitte point to pricing and availability being the key factors drawing property investors to locations outside the capital. Two-thirds of those canvassed for the PwC/Urban Land Institute 2015 Emerging Trends Europe report say “there’s a need to consider secondary markets or assets. Their willingness to take on more risk is reflected in this year’s ranking of city investment prospects: Birmingham in the UK has moved up to 6th place [in Europe], from 17th last year.”

CBRE data on flows of international capital into UK commercial property show that since 2011 higher growth rates have been experienced outside of London. Mat Oakley, Director of Commercial Research at Savills PLC tells a similar story: “Commercial property investors have clearly rediscovered the joys of the UK regions, with 58% of the total investment in the UK going to markets outside London in 2014. Furthermore, non-domestic investor demand is spilling out into the regions, with 2014 seeing the highest ever level of investment activity by non-domestic investors outside London.”

Momentum and direction of travel is similar in the residential sector where Jim Ward, also a Director at Savills, comments that:

“With regard to residential led regeneration, it’s all about the strength of our undersupplied residential market, with demand spilling out of the higher value markets of London and other centres of employment, into other well connected markets where this creates the market conditions for value uplift. Investment in new rail links is increasing the reach of this regeneration potential, as is the cyclical pattern of house price inflation which we now expect to shift from London to other parts of the UK.”

THE NORTHERN POWERHOUSE

Th...