![]() Part One

Part One![]()

1.1 THE UK ECONOMY AND INVESTMENT ENVIRONMENT

Jonathan Reuvid

Legend Business

The robust deficit reduction policy that the Chancellor introduced shortly after the coalition took office in May 2010 remains in place, and the UK retains its triple A credit rating. August 2012 output numbers suggest that 3rd quarter GDP may signal relief from the second quarter double-dip recession while unemployment has stabilisd. However, while the US and other European economies remain depressed and the requirements of weaker Eurozone members for substantial financial support from the ECB increase, a return to more buoyant conditions in the UK’s prime export markets is delayed.

THE 2012-2013 INVESTMENT CLIMATE

There is consensus among economists, the government and Parliament that strong investment programmes by the public and private sectors are essential to recovery in the medium-term. The Government has pledged to stimulate infrastructure investment as an essential tool in generating growth and employment. As the Prime Minister stated in his speech at The Institution of Civil Engineers on 19th March 2012, “We’re encouraging the appetite of investors, both at home and abroad, for investment in British infrastructure; taking advantage of our stability and our open markets”.

The impact of necessary austerity on public services and disposable incomes is painful. However, there is nothing in the Coalition Government’s programmes to deter foreign investors. Indeed, as the UNCTAD international investment statistics for 2011 (reported below) show foreign investors already active in the UK are extending their commitments, and new incoming investors continue to develop a business base in this leading global economy.

More generally the lowering of the corporation tax rate by 1 per cent progressively each year up to 2014 is a major incentive to inward investors. The UK is very much open to inward investment.

BASICS OF THE UK ECONOMY

Population

The population of the UK stands at an estimated 62.3 million (Source:ONS, 2012), with 29.28 million in work, comprising 21.23 million in full-time work and 7.97 million in part-time work. The employment level (the proportion of working age people in work) in the UK is high at 70.6% compared with the European Union (EU) average of 64.3% Applying the international “standardised” measurement, the UK’s rate of unemployment is 8.2% which also compares favourably with the EU average of 10.3% (source: Eurostat, 2012). 83.6% of the population are English, 5.6% Scottish, 4.9% Welsh and 2.9 % Northern Irish.

Macro-Economic Indicators

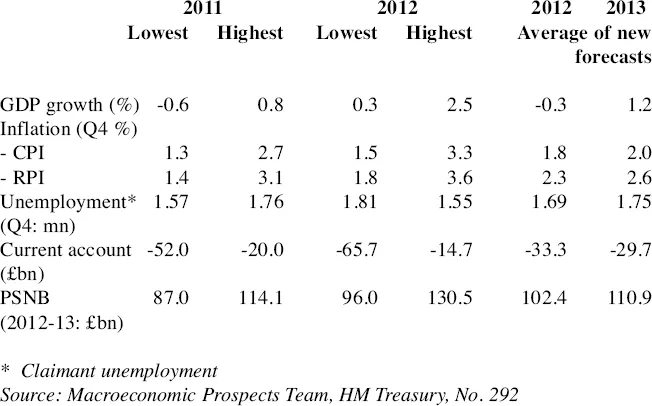

Forecasts for 2012/2013

Table 1.1.1 highlights 2012 and 2013 forecasts for the basics of the UK economy. Independent averages, and the range of forecasts, are based on forecasts made in the last three months (August: 23 institutions; July: 10 institutions; June: 3 institutions). Averages of new forecasts are calculated from forecasts for the comparison received in August.

Table 1.1.1 Macro-economic indicators August 2012

The 22 most recent forecasters include 11 banks and investment firms, 10 research institutions and the Confederation of British Industry (CBI).

UK INWARD INVESTMENT

In the World Investment Report 2012 by the UN Conference on Trade and Development (UNCTAD), the UK stock of inward foreign investment is quantified at US$1,198 billion, an increase of 3% over the previous year. UNCTAD also reports a 7% growth in the UK’s FDI inflows in 2011 to US$53.9 billion, with the UK ranked as second in the world behind the US and as the largest recipient of FDI stock in Europe. In world rankings the UK remains ahead of Hong Kong and France. In the Ernst & Young European Attractiveness Survey 2012 the UK was rated as the most attractive location for most foreign direct investment (FDI) projects (19%) in Europe, then rated the most attractive regional location for investors globally after China. More recently, the Financial Times fDi Intelligence Report 2012, confirms the UK as the primary FDI location in Europe.

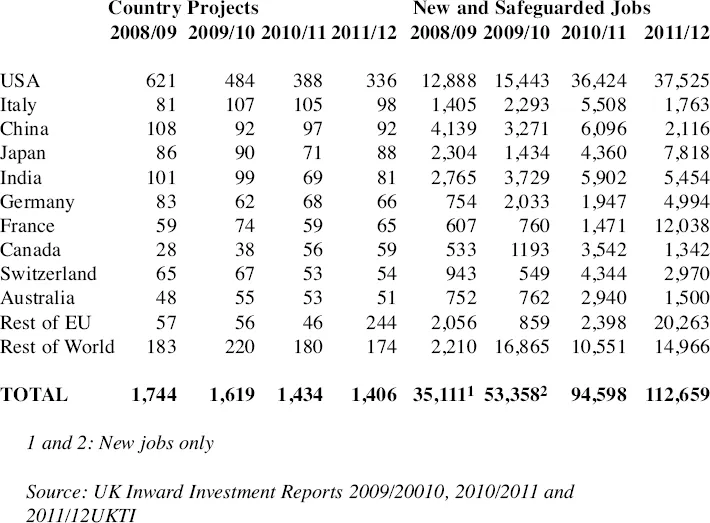

The sources of investment over the past four years are detailed in Table 1.1.2.

Table 1.1.2 Country sources of investment 2008/09 and 2011/12

The total number of inward investment projects in the year to March 2012 at 1,406 was marginally less than the 2010/2011 total of 1,434 projects. However, the number of new jobs generated by overseas investors was nearly 52,471, an increase of 26% on 2010/2011, and FDI activity also safeguarded a further 59,918 jobs, 14% more than in the previous year when a substantial increase over 2009/10 qas recorded. Together, the total of new and safeguarded jobs at 112,659 was 19% above the 2009/10 total and, as shown in Table 1.1.2, more than three times the total recorded for 2008/09. In the current recessionary climate, this is a satisfactory outcome.

As in the three previous years, among the 58 countries that invested in the UK in 2011/12 (54 in 2010/11), the US remains by far the biggest source of investment projects, accounting for 24% and one-third of created or safeguarded jobs (36% in 2010/11). Project numbers were down for Germany and France to their lowest in four years, but up from 53 to 98 in the case of Italy and with an increase for the rest of the EU from 144 to 244. However, while the rest of the EU generated 20,263 jobs in 2011/12, approaching 3 times the previous year total of 7,489 and new and safeguarded jobs from German and French FDI were together up from just over 10,000 to 17,000 in 20111/12, the greater number of Italian projects generated fewer jobs (1,763 in 2011/12 against 2,940 in 2010/11).

China ranked third in 2011/2012 after the USA and Italy and ahead of Japan and India as the source of 92 new investment projects, a significant increase of more than 55%, and generated 2,116 new and safeguarded jobs against 1,411 in 2010/2011. Although there were only 88 new investment projects from Japanese sources in the wake of the tsunami, compared to 105 in 2010/2011, the number of jobs generated increased from 5,508 to 7,818 as new models were introduced to its UK vehicle manufacturing plants, placing Japan third in the table. India was also the source of fewer new investment projects, 81 in 2011/2012 against 97 in 2010/2011 but the new and safeguarded jobs total was only marginally less at 5,454.

Within the employment figures, 52,741 new jobs were created by overseas investors, a more than satisfactory increase of 26% in the challenging economic circumstances. Likewise, 59,918 jobs were safeguarded in 2011/2012 as a result of FDI representing an increase of 14%.

Composition of investment projects

Inward investment by category

The 2011/2012 proportions of completely new investments, expansions of previous investments and mergers and acquisition (M&As) including joint ventures (JVs) are compared with the 2009/2010 and 2010/2011 proportions in Table 1.1.3.

Table 1.1.3 UK inward investment by category

| 2009/2010 | 2010/2011 | 2011/2012 |

New investments | 850 | 724 | 752 |

Expansions | 544 | 544 | 506 |

M & A (inc. JVs) | 225 | 166 | 148 |

TOTAL | 1,619 | 1,434 | 1,406 |

Source: UK Inward Investment Reports 2009/20010,2010/2011 and 2011/2012, UKTI

Although the total of investment projects was reduced marginally by 2% in 2011/2012, new investments in fact rose by 4% to 752 with the fall attributable to a decline of 7% in expansions and 11% in M&A and JVs.

Inward investment by sector

Although levels of investment activity were lower in 2011/2012 than the previous year for the first four sectors, all sectors continued to attract significant investment.

Table 1.1.4 UK inward investment projects by sector

| 2009/2010 | 2010/2011 | 2011/2012 |

Software | 257 | 229 | 233 |

Advanced engineering | 190 | 177 | 145 |

Life sciences | 173 | 139 | 137 |

Business services | 158 | 96 | 74 |

Finance | 110 | 99 | 123 |

ICT | 105 | 101 | 103 |

Environmental technology | 79 | 111 | 113 |

Creative & Media | 69 | 69 | 87 |

Other* | 478 | 413 | 391 |

TOTAL | 1,619 | 1,434 | 1,406 |

*“Other” includes the food & drink, power and chemicals sectors

Source: UK Inward Investment reports 2009/2010, 2010/2011 and 2011/2012, UKTI

As in the past two years, the software sector attracted the largest number of projects (more than 16 per cent of the total). Ranking second, the advanced engineering sector accounted for most jobs, an encouraging increase of 25% over 2010/2011 to 17,379. In spite of the continuing problems in the banking in...