- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

The new, fully-updated edition of the respected guide to understanding financial extremes, evaluating investment opportunities, and identifying future bubbles

Now in its second edition, Boombustology is an authoritative, up-to-date guide on the history of booms, busts, and financial cycles. Engaging and accessible, this popular book helps investors, policymakers, and analysts navigate the radical uncertainty that plagues today's uncertain investing and economic environment. Author Vikram Mansharamani, an experienced global equity investor and prominent Harvard University lecturer, presents his multi-disciplinary framework for identifying financial bubbles before they burst. Moving beyond the typical view of booms and busts as primarily economic occurrences, this innovative book offers a multidisciplinary approach that utilizes microeconomic, macroeconomic, psychological, political, and biological lenses to spot unsustainable dynamics. It gives the reader insights into the dynamics that cause soaring financial markets to crash. Cases studies range from the 17 th Century Dutch tulip mania to the more recent US housing collapse.

The numerous cross-currents driving today's markets—trade wars, inverted yield curves, currency wars, economic slowdowns, dangerous debt dynamics, populism, nationalism, as well as the general uncertainties in the global economy—demand that investors, policymakers, and analysts be on the lookout for a forthcoming recession, market correction, or worse.

An essential resource for anyone interested in financial markets, the second edition of Boombustology:

- Adopts multiple lenses to understand the dynamics of booms, busts, bubbles, manias, crashes

- Utilizes the common characteristics of past bubbles to assist in identifying future financial extremes

- Presents a set of practical indicators that point to a financial bubble, enabling readers to gauge the likelihood of an unsustainable boom

- Offers two new chapters that analyze the long-term prospects for Indian markets and the distortions being caused by the passive investing boom

- Includes a new foreword by James Grant, legendary editor of Grant's Interest Rate Observer

A comprehensive exploration of how bubbles form and why they burst, Boombustology, 2 nd Edition is packed with a wealth of new and updated information for individual and institutional investors, academics, students, policymakers, risk-managers, and corporate managers alike.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

PART I

Five Lenses

CHAPTER 1

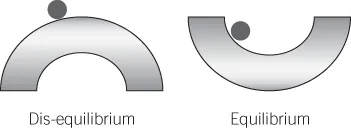

Microeconomic Perspectives: TO EQUILIBRIUM OR NOT?

The most interesting, and profitable, times to be involved in investment management are when Mr. Smith's invisible hand is visibly broken.—Paul A. McCulley

“Random Walks” and Accurate Prices: The Efficient Market Hypothesis

Table of contents

- Cover

- Table of Contents

- Foreword

- PREFACE: Is There A Bubble In Boom-Bust Books?

- Acknowledgments

- INTRODUCTION: The Study of Financial Extremes

- PART I: Five Lenses

- PART II: Historical Case Studies

- PART III: Looking Ahead

- CONCLUSION: Hedgehogs, Foxes, and the Dangers of Making Predictions

- ADDENDUMA: Passive Investing Bubble?

- About the Author

- Index

- End User License Agreement