- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Activity Based Costing for Construction Companies

About this book

Activity Based Cotsting for Construction Companies provides guidelines on how overhead costs can be managed for using Activity Based Costing (ABC), providing gains in contractor competiveness. Illustrated with a range of case studies and examples it alsopresents a map that shows construction contractors how to implement ABC to calculate overhead costs accurately, identifying non or low-value added operations which can then be improved.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Activity Based Costing for Construction Companies by Yong-Woo Kim in PDF and/or ePUB format, as well as other popular books in Technology & Engineering & Construction & Architectural Engineering. We have over one million books available in our catalogue for you to explore.

Information

Edition

11

Introduction

Every business wants to reduce its costs so as to maximize its profits. Since construction is a type of business, it cannot be denied that every construction contractor is eager to reduce their costs. Construction contractors should also be able to accurately price each of their products and services (i.e., their projects), because accurate estimation of projects leads to the success of projects. Prior to addressing effectively managed costs, we need to have consensus on what comprises costs in a construction company.

1.1 What comprises costs in a construction company?

We usually define costs as a resource consumed to achieve a specific objective (Horngren et al., 1999; Raffish and Turney, 1991). Costs are usually measured as the monetary amount that must be paid to acquire resources, i.e., goods and services.

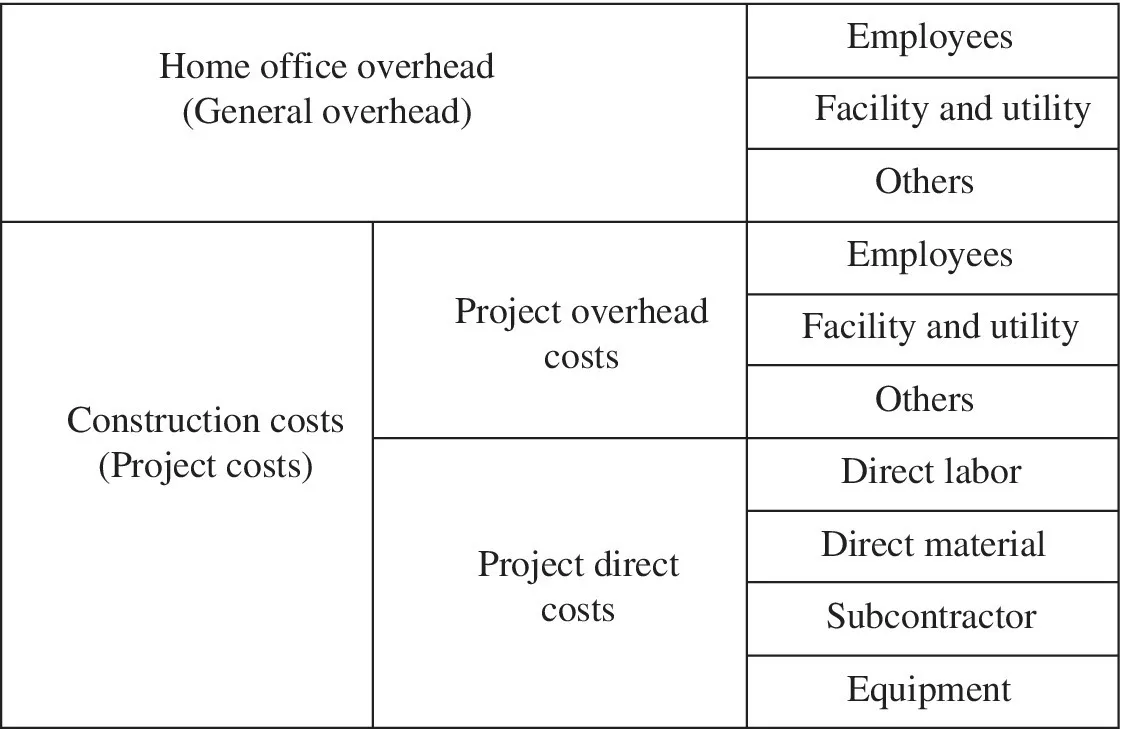

Let us investigate the cost structure of a construction company (i.e., a general contractor) to establish what comprises a construction company’s costs. The cost structure of a construction company is the framework by which its home offices and each of its projects are budgeted and controlled. Figure 1.1 shows the typical cost structure of a construction contractor whose revenue is the sum of the revenue of all projects.

Figure 1.1 Cost structure of a construction contractor.

As seen in Figure 1.1, a contractor’s total costs consist of total construction costs and its general overhead costs. Total construction costs are the sum total of the construction costs of each project, which includes project direct costs and project overhead costs. The terms “overhead” or “overhead costs” are used to represent indirect costs in the rest of this book.

1.1.1 Construction costs (project costs)

Construction costs include both direct construction costs and the overhead (indirect) costs of each project. Direct project costs are the cost of materials, labor, and equipment, and subcontract costs. They are consumed and incorporated into the construction costs of a specific project. Project overhead costs include the consumption of resources used to support the activities of direct construction costs (e.g., field jobs), such as the salaries of project engineers.

All construction costs should be charged to a specific construction project. In addition, some of the home office resources used by a specific project are considered to be part of construction costs (i.e., project overhead costs). Suppose that 50% of an LEED (Leadership in Energy and Environmental Design) engineer’s time in charge of green construction consulting at your home office is spent on three construction projects. Then, 50% of his or her salary needs to be allocated to these three projects according to the actual percentage of time spent on each project. In other words, 50% of the LEED engineer’s salary is considered to be project overhead costs.

1.1.2 Overhead costs in a construction company

Although we used several terms in relation to cost structure (Figure 1.1), in general, costs can be grouped into direct costs and overhead costs. There are multiple definitions for direct and overhead costs in construction. One definition of direct costs is the costs expended in the realization of a physical sub-element of the project (Halpin, 1985). Although some practitioners use this definition based on the realization of a physical element on site, the definition is not widely accepted in the domain of cost accounting.

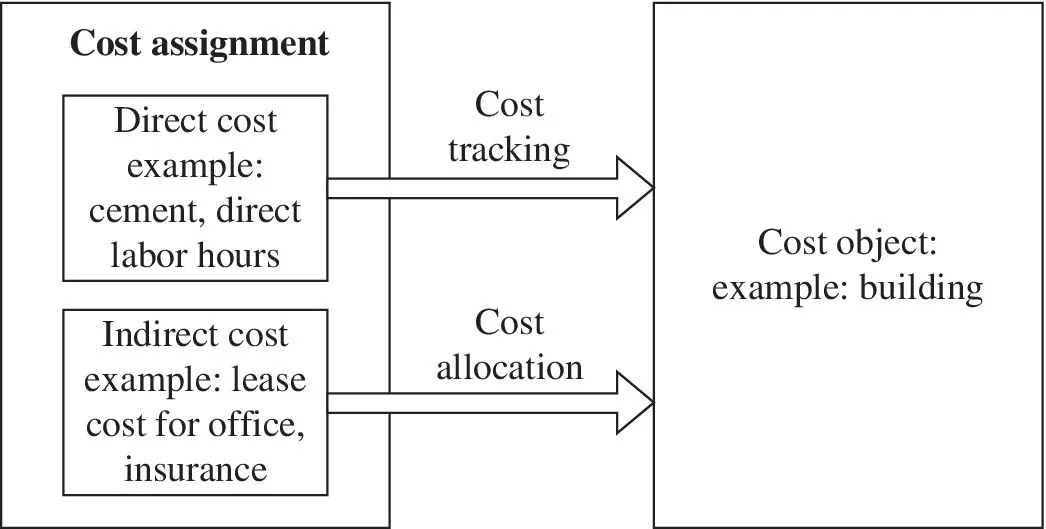

A generally accepted definition of direct costs uses the ability to track a cost to a cost object.1 Direct costs of a cost object are related to a particular cost object and can be traced to it in an economically feasible (cost-effective) way (Horngren et al., 1999). The term “direct costs,” when applied to construction accounting means costs which can be specifically identified with a construction job or with a unit of production within a job (Coombs and Palmer, 1989). This definition is consistent with the general definition of direct costs.

Overhead costs of a cost object, on the other hand, are related to a particular cost object but cannot be traced to it in an economically feasible way. Figure 1.2 illustrates cost categorization according to cost assignments. The term “cost allocation” is used to describe the assignment of overhead costs to a particular cost object (Raffish and Turney, 1991). The other important term is “cost object.” According to the definition of overhead costs, two criteria for discerning overhead costs are (1) cost object and (2) traceability.

Figure 1.2 Cost assignment and classification.

The term “overhead costs” is still used in a vague manner in the construction industry, because our industry has more than one type of overhead cost. In other words, the same cost can be both an overhead c...

Table of contents

- Cover

- Title Page

- Table of Contents

- Preface

- 1 Introduction

- 2 What Is Activity-Based Costing?

- 3 Managing Overhead Costs in Construction Projects

- 4 Managing Your General Overhead Costs

- 5 Managing Overhead Costs in a Fabrication Shop

- 6 Activity-Based Costing in Your Organization

- Index

- End User License Agreement