The WEALTHTECH Book

The FinTech Handbook for Investors, Entrepreneurs and Finance Visionaries

- English

- ePUB (mobile friendly)

- Available on iOS & Android

The WEALTHTECH Book

The FinTech Handbook for Investors, Entrepreneurs and Finance Visionaries

About this book

Get a handle on disruption, innovation and opportunity in investment technology

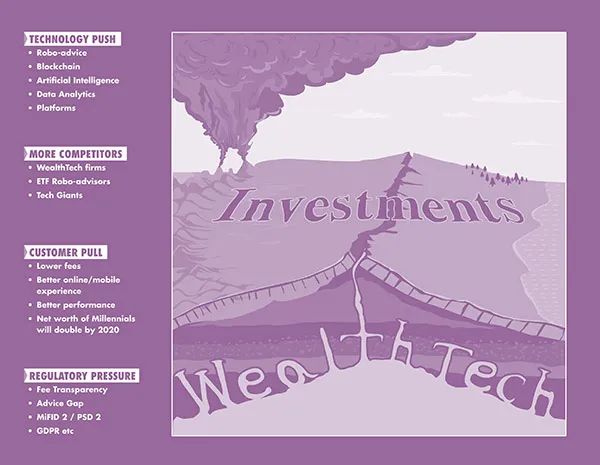

The digital evolution is enabling the creation of sophisticated software solutions that make money management more accessible, affordable and eponymous. Full automation is attractive to investors at an early stage of wealth accumulation, but hybrid models are of interest to investors who control larger amounts of wealth, particularly those who have enough wealth to be able to efficiently diversify their holdings. Investors can now outperform their benchmarks more easily using the latest tech tools.

The WEALTHTECH Book is the only comprehensive guide of its kind to the disruption, innovation and opportunity in technology in the investment management sector. It is an invaluable source of information for entrepreneurs, innovators, investors, insurers, analysts and consultants working in or interested in investing in this space.

• Explains how the wealth management sector is being affected by competition from low-cost robo-advisors

• Explores technology and start-up company disruption and how to delight customers while managing their assets

• Explains how to achieve better returns using the latest fintech innovation

• Includes inspirational success stories and new business models

• Details overall market dynamics

The WealthTech Book is essential reading for investment and fund managers, asset allocators, family offices, hedge, venture capital and private equity funds and entrepreneurs and start-ups.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

1

Introduction

Executive Summary

Notes

The Augmented Investment Management Industry

Clients are Changing

Table of contents

- Cover

- Epigraph

- Title Page

- Copyright

- Contents

- Preface

- About the Editors

- Acknowledgements

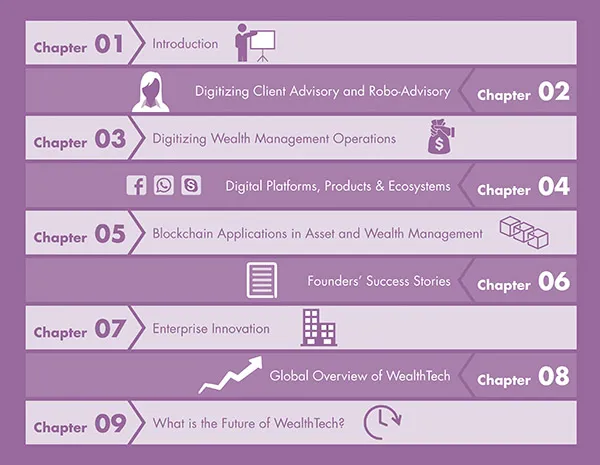

- 1: Introduction

- 2: Digitizing Client Advisory and Robo-Advisors

- 3: Digitizing Wealth Management Operations

- 4: Digital Platforms, Products and Ecosystems

- 5: Blockchain Applications in Asset and Wealth Management

- 6: Founders’ Success Stories

- 7: Enterprise Innovation

- 8: Global Overview of WealthTech

- 9: What is the Future of WealthTech?

- List of Contributors

- Index

- EULA