The Director's Manual

A Framework for Board Governance

- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

Directors: Improve Board Performance

The Director's Manual: A Framework for Board Governance offers current and aspiring board members essential up-to-date governance guidance that blends rigorous research-based information with the wisdom found only through practical, direct experience. The book's flexible approach to solving governance issues reflects the authors' belief that no two boards and the cultural dynamics that drive them are the same. As such, the advice offered reflects recognizable leadership dynamics and real world, relevant organizational situations.

The book's two authors, Peter C. Browning, an experienced CEO and member of numerous boards and William L. Sparks, a respected organizational researcher, combine their individual experiences and talents to create a book that is both innovative and applicable to directors in any industry sector. Specific best practice guidance is designed to help board members and their directors understand the unique strengths and challenges of their own board while at the same time provide targeted information that drives needed improvements in board performance and efficiency. Specifically, this book will help board members:

- Explore practical advice on key issues, including selection, meeting schedules, and director succession

- Consider board performance from multiple perspectives, including cultural and group dynamics

- Discover how to effectively manage classic problems that arise when making decisions as a group

- Access a comprehensive set of assessment questions to test and reinforce your knowledge

The Director's Manual: A Framework for Board Governance offers practical advice to guide you as you lead your organization's board.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Chapter 1

The Changing World of Board Governance

How We Got Here

- How and Why Boards Have Changed

- A Barometer for CEO Compensation

- Why Pay Ratios Have Changed Radically

- A Board Governance Tipping Point

- Impact of the 2008 Financial Meltdown

- Chapter Summary and What's Next

How and Why Boards Have Changed

- A move away from a manufacturing economy to a service economy following decades of dominance in the post–Second World War global economy.

- Improvements in automation and the manufacturing process of the 1970s and 1980s. It was a trend that further undermined the manufacturing sector over the years as computer-driven machinery and tools (robotics, CAD-CAM design tools, etc.) replaced individual workers. Global competition also slowly eroded the U.S. manufacturing base as more and more manufacturing jobs moved to countries outside U.S. borders with lower labor costs.

- The diminishing influence and power of organized labor's ability to guarantee members a lifetime of a steady, living wage and a fully funded, secure pension upon retirement.

- The “creative destruction” of industries in the 1980s brought about by the world of leveraged buyouts and a ruthless cadre of “corporate raiders” who broke up many marquee old-line companies and sold off the divisions to score huge profits for themselves.

- The dot-com bubble that began its rise in the early 1990s and continued throughout the decade until it popped, to a devastating effect, in 2001. Investment strategy at the time was a race toward unrealistic valuation. Investors were willing to fund nearly any technological start-up venture even if it lacked a viable business plan. It is interesting to note that this investment setback did little to cloud the financial community's continued unrealistic economic outlook. In fact, this unsound enthusiasm in the marketplace was encouraged in large part by favorable economic policies of the federal government, supported by a period of low inflation due largely to lower cost of goods from China and a continuing worldwide technological revolution.

- The impact of blatant corporate malfeasance in 2001, exemplified by three highly visible corporations at the time: WorldCom, Enron, and Tyco. It was a revelation that rocked both the investment community and individual stockholders. Again, high-flying investors and shareholders lost millions of dollars when these companies declared bankruptcy (Enron Corporation declared bankruptcy in December of 2001), a singular action that further exposed an underbelly of lies and deceit that had pervaded these organizations at the very top and eventually put thousands of ordinary workers out on the street without jobs or their life savings.

- Finally, the 2008 huge financial meltdown and the economic panic that followed. It was a time of fear and shock as we watched once powerful brokerage houses as well as large banks and old-line industrial giants teeter on the brink of declaring bankruptcy. It took massive, last-minute, stopgap federal cash infusions to save the world's economy and to shore up institutions that were deemed “too big to fail.”

Why These Events are Important

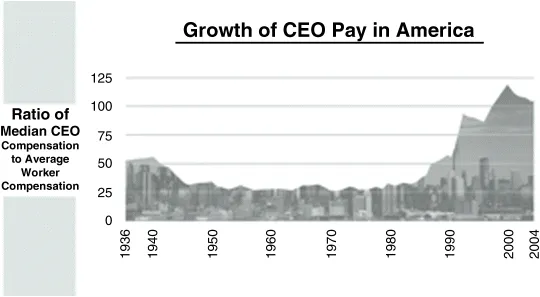

- Ever-increasing chief executive officer (CEO) compensation (see Figure 1.1).

- The impact of a 2002 change to the New York Stock Exchange (NYSE) Listed Company Manual that required “non-management directors to meet at regularly scheduled executive sessions without management.” While this change to the NYSE Listed Company Manual (303A.03) occurred during the same time period as the passage of the 2002 Sarbanes-Oxley Act (Congress's response to public outrage over Enron's corporate malfeasance and greed), the fact that the two actions occurred at the same time is a coincidence of timing. The fact is, as important as the Sarbanes-Oxley legislation has been to curbing illegal corporate activities, we would argue that the NYSE Listed Company Manual change has ultimately produced the most far-reaching impact on board governance, performance, and effectiveness.

A Barometer for CEO Compensation

Global Competition Brings Change

The Impact of Strategic Planning

Table of contents

- Cover

- Title Page

- Copyright

- Acknowledgments

- Preface

- Chapter 1: The Changing World of Board Governance: How We Got Here

- Chapter 2: Role of the Board

- Chapter 3: Key Board Leadership Roles

- Chapter 4: Board Culture

- Chapter 5: Group Dynamics and Board Decision Making

- Chapter 6: Board Structure and Schedule

- Chapter 7: Assessing Board Performance

- Chapter 8: The Challenge of The Disruptive Director

- Chapter 9: The Other Succession Challenge: The Board of Directors

- Chapter 10: What's Next in the Boardroom?

- Appendices: Board of Directors Assessment Forms

- About the Authors

- Index

- End User License Agreement