- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

The comprehensive M&A guide, updated to reflect the latest changes in the M&A environment

M&A, Second Edition provides a practical primer on mergers and acquisitions for a broad base of individuals numbering in the hundreds of thousands:

- Investment bankers involved with mergers and acquisitions (M&A).

- Equity analysts at hedge funds, risk arbitrage funds, pension funds, and banks, who invest in firms engaged in M&A.

- Private equity professionals at buyout funds, venture capital funds, and hedge funds, who routinely buy and sell companies.

- Corporate executives and business development professionals.

- Institutional loan officers working with M&A and buyout transactions.

- Business students at colleges and graduate business schools.

- Investor relations professionals at corporations and public relations firms.

- Lawyers who work with corporate clients on M&A-related legal, financial, and tax matters.

- Independent public accounting firms that review M&A accounting.

- Government regulators

- Sophisticated individual investors

Its comprehensive approach covers each step in the process, from finding an opportunity, to analyzing the potential, to closing the deal, with new coverage of private equity funds and international transactions. This updated second edition also includes information on emerging markets, natural resource valuation, hostile takeovers, special deals, and more, plus new examples and anecdotes taken from more current events. Additional illustrations and charts help readers quickly grasp the complex information, providing a complete reference easily accessible by anyone involved in M&A.

The mergers and acquisitions environment has changed in the thirteen years since M&A was initially published, creating a tremendous need for authoritative M&A guidance from a banker's perspective. This M&A update fills that need by providing the characteristic expert guidance in clear, concise language, complete with the most up-to-date information.

- Discover where M&A fits into different corporate growth strategies, and the unique merits it confers

- Delineate clear metrics for determining risk, valuation, and optimal size of potential acquisitions

- Gain deeper insight into the fundamentals of negotiation, due diligence, and structuring

- Understand the best time to sell, the best way to sell, and the process of the sale itself

In the past decade, the dollar value of M&A deals has jumped ten-fold, and the number of individuals involved has expanded considerably. More and more executives, analysts, and bankers need to get up-to-date on the mechanics of M&A, without wading through volume after volume of dense, legalistic jargon. Finally, M&A is back – providing a complete reference to the current state of the M&A environment.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Part One

The Big Picture

CHAPTER 1

The Global M&A Market: Current Status and Evolution

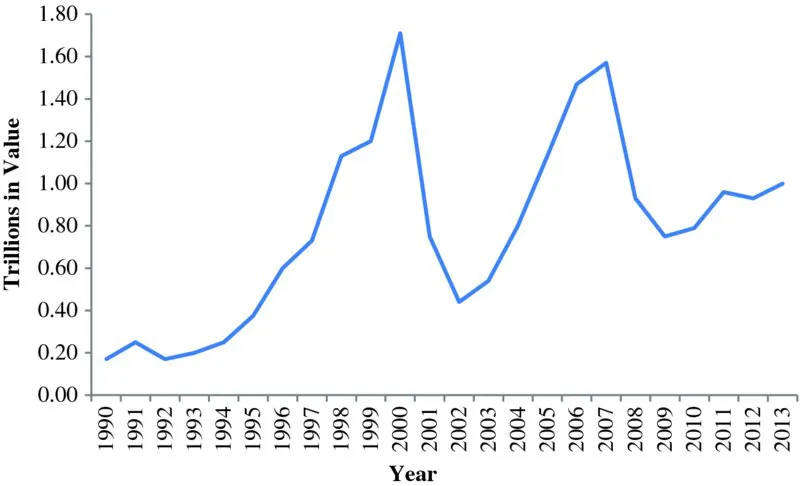

An Upward Trend, Interrupted by Booms and Busts

- Stock market valuations

- Availability of debt financing

- Optimistic views on the economy

M&A Activity by Geography

| Region | % |

| United States and Canada | 44 |

| Western Europe | 21 |

| Japan/Australia | 12 |

| Emerging Markets | 18 |

| 100 |

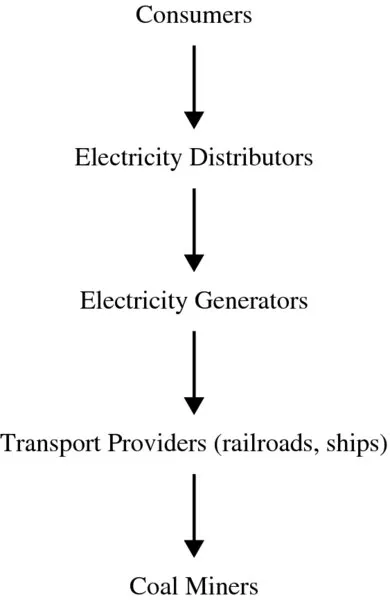

Deal Categories

- Horizontal

- Vertical

- Strategic/Diversification/Conglomerate

- Private Equity

Table of contents

- Cover

- Series

- Title Page

- Copyright

- Preface

- Part One: The Big Picture

- Part Two: Finding a Deal

- Part Three: Target Financial Analysis

- Part Four: Acquisition Valuation

- Part Five: Combination, the Sale Process, Structures, and Special Situations

- About the Author

- Index

- End User License Agreement

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app