Portfolio Management

Theory and Practice

- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

A career's worth of portfolio management knowledge in one thorough, efficient guide

Portfolio Management is an authoritative guide for those who wish to manage money professionally. This invaluable resource presents effective portfolio management practices supported by their underlying theory, providing the tools and instruction required to meet investor objectives and deliver superior performance. Highlighting a practitioner's view of portfolio management, this guide offers real-world perspective on investment processes, portfolio decision making, and the business of managing money for real clients. Real world examples and detailed test cases—supported by sophisticated Excel templates and true client situations—illustrate real investment scenarios and provide insight into the factors separating success from failure. The book is an ideal textbook for courses in advanced investments, portfolio management or applied capital markets finance. It is also a useful tool for practitioners who seek hands-on learning of advanced portfolio techniques.

Managing other people's money is a challenging and ever-evolving business. Investment professionals must keep pace with the current market environment to effectively manage their client's assets while students require a foundation built on the most relevant, up-to-date information and techniques. This invaluable resource allows readers to:

- Learn and apply advanced multi-period portfolio methods to all major asset classes.

- Design, test, and implement investment processes.

- Win and keep client mandates.

- Grasp the theoretical foundations of major investment tools

Teaching and learning aids include:

- Easy-to-use Excel templates with immediately accessible tools.

- Accessible PowerPoint slides, sample exam and quiz questions and sample syllabi

- Video lectures

Proliferation of mathematics in economics, growing sophistication of investors, and rising competition in the industry requires advanced training of investment professionals. Portfolio Management provides expert guidance to this increasingly complex field, covering the important advancements in theory and intricacies of practice.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

CHAPTER 1

Introduction

Chapter Outline

- 1.1 Introduction to the Investment Industry

- 1.2 What Is a Portfolio Manager?

- 1.3 What Investment Problems Do Portfolio Managers Seek to Solve?

- 1.4 Spectrum of Portfolio Managers

- 1.5 Layout of This Book

- Problems

- Endnotes

1.1 INTRODUCTION TO THE INVESTMENT INDUSTRY

- Advances in modern portfolio theory.

- More complex instruments.

- Increased demands for performance.

- Increased client sophistication.

- Rising retirement costs, and the growing trend toward individual responsibility for those costs.

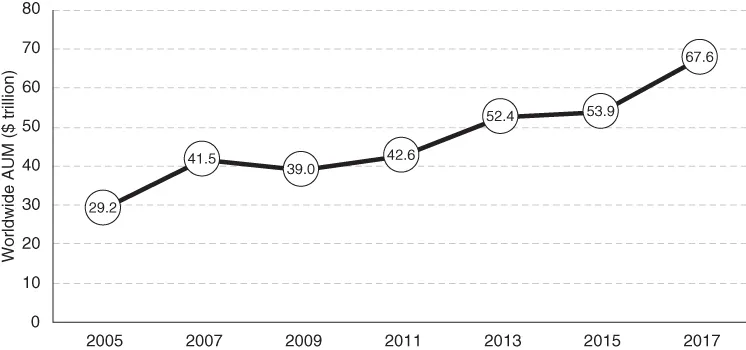

- Dramatic growth in assets under management.

THEORY IN PRACTICE: FAMOUS LAST WORDS—“IT'S DIFFERENT THIS TIME.”

- Creating and following an investment plan to help maintain discipline. Investors often appear driven by fear and greed. The aim should be to avoid panicking when markets sell off suddenly (1974, 1987) and risk missing the potential recovery, or overallocating to hot sectors (the dot-com bubble) or stocks (Enron) and being hurt when the market reverts.

- Focus on total return and not yield or cost.

- Establishing and following a proper risk management discipline. Diversification and rebalancing of positions help avoid outsized exposures to particular systematic or idiosyncratic risks. Performance measurement and attribution provide insight into the risks and the sources of return for an investment strategy.

- Not investing in what you do not understand. In addition to surprisingly good performance that could not be explained, there were additional red flags, such as lack of transparency, in the Enron and Madoff cases.

- Behave ethically and insist others do, too.

Table of contents

- Cover

- About the Authors

- Acknowledgments

- Preface

- CHAPTER 1: Introduction

- CHAPTER 2: Client Objectives for Diversified Portfolios

- CHAPTER 3: Asset Allocation: The Mean - Variance Framework

- CHAPTER 4: Asset Allocation Inputs

- CHAPTER 5: Advanced Topics in Asset Allocation

- CHAPTER 6: The Investment Management Process

- CHAPTER 7: Introduction to Equity Portfolio Investing: The Investor's View

- CHAPTER 8: Equity Portfolio Construction

- CHAPTER 9: Fixed-Income Management

- CHAPTER 10: Global Investing

- CHAPTER 11: Alternative Investment Classes

- CHAPTER 12: Portfolio Management Through Time: Taxes and Transaction Costs

- CHAPTER 13: Performance Measurement and Attribution

- CHAPTER 14: Incentives, Ethics, and Policy

- CHAPTER 15: Investor and Client Behavior

- CHAPTER 16: Managing Client Relations

- Sample Cases

- Jerry W.

- MSSI

- McClain Capital

- The Fairbanks Fund

- Glossary

- References

- Index

- End User License Agreement