- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

A deeper examination of Basel III for more effective capital enhancement

The Handbook of Basel III Capital – Enhancing Bank Capital in Practice delves deep into the principles underpinning the capital dimension of Basel III to provide a more advanced understanding of real-world implementation. Going beyond the simple overview or model, this book merges theory with practice to help practitioners work more effectively within the regulatory framework, and utilise the complex rules to more effectively allocate and enhance capital. A European perspective covers the CRD IV directive and associated guidance, but practitioners across all jurisdictions will find value in the strategic approach to decisions surrounding business lines and assets; an emphasis on analysis urges banks to shed unattractive positions and channel capital toward opportunities that actually fit their risk and return profile. Real-world cases demonstrate successful capital initiatives as models for implementation, and in-depth guidance on Basel III rules equips practitioners to more effectively utilise this complex regulatory treatment.

The specifics of Basel III implementation vary, but the underlying principles are effective around the world. This book expands upon existing guidance to provide a deeper working knowledge of Basel III utility, and the insight to use it effectively.

- Improve asset quality and risk and return profiles

- Adopt a strategic approach to capital allocation

- Compare Basel III implementation varies across jurisdictions

- Examine successful capital enhancement initiatives from around the world

There is a popular misconception about Basel III being extremely conservative and a deterrent to investors seeking attractive returns. In reality, Basel III presents both the opportunity and a framework for banks to improve their assets and enhance overall capital – the key factor is a true, comprehensive understanding of the regulatory mechanisms. The Handbook of Basel III Capital – Enhancing Bank Capital in Practice provides advanced guidance for advanced practitioners, and real-world implementation insight.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Information

Chapter 1

Overview of Basel III

1.1 INTRODUCTION TO BASEL III

1.1.1 Basel III, CRR, CRD IV

- Capital Requirements Directive 2013/36/EU of the European Parliament and of the Council of 26 June 2013 (hereinafter the “CRD IV”), on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC. CRD IV entered into force in the EU on 1 January 2014; and

- Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012 (hereinafter the “CRR”).

- In Germany, the banking regulator is the Bundesanstalt für Finanzdienstleistungsaufsicht (“BaFin”).

- In Switzerland, the banking regulator is the Swiss National Bank (“SNB”).

- In the United Kingdom, the banking regulator is the Prudential Regulation Authority (“PRA”).

- In the United States, bank holding companies are regulated by the Board of Governors of the Federal Reserve System (the “Federal Reserve Board” or “FSB”).

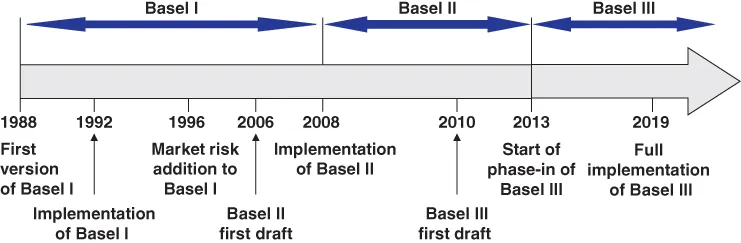

1.1.2 A Brief History of the Basel Accords

1.1.3 Accounting vs. Regulatory Objectives

1.2 EXPECTED AND UNEXPECTED CREDIT LOSSES AND BANK CAPITAL

Table of contents

- Cover

- Title Page

- Copyright

- Dedication

- Table of Contents

- Preface

- About the Author

- Chapter 1: Overview of Basel III

- Chapter 2: Minimum Capital Requirements

- Chapter 3: Common Equity 1 (CET1) Capital

- Chapter 4: Additional Tier 1 (AT1) Capital

- Chapter 5: Tier 2 Capital

- Chapter 6: Contingent Convertibles (CoCos)

- Chapter 7: Additional Valuation Adjustments (AVAs)

- Chapter 8: Accounting vs. Regulatory Consolidation

- Chapter 9: Treatment of Minority Interests in Consolidated Regulatory Capital

- Chapter 10: Investments in Capital Instruments of Financial Institutions

- Chapter 11: Investments in Capital Instruments of Insurance Entities

- Chapter 12: Equity Investments in Non‐financial Entities

- Chapter 13: Deferred Tax Assets (DTAs)

- Chapter 14: Asset Protection Schemes and Bad Banks

- Chapter 15: Approaching Capital Enhancement Initiatives

- Glossary

- Bibliography

- Index

- End User License Agreement