IPSAS Explained

A Summary of International Public Sector Accounting Standards

- English

- ePUB (mobile friendly)

- Available on iOS & Android

IPSAS Explained

A Summary of International Public Sector Accounting Standards

About this book

A succinct, yet highly informative guide to IPSAS and their application

IPSAS Explained provides a concise summary of the International Public Sector Accounting Standards for practitioners needing to maintain compliance with ever-changing practices. Comprehensively updated to align with newly-accepted standards in key subject areas and including the latest iteration of the framework and improvement projects, this guide distills each standard into a useful and accessible format. Coverage of each IPSAS includes a brief overview of the basic principles behind it, as well as charts, graphs and tables that provide information at a glance.

Updated material includes discussion of the new IPSASB governance structure, including the Public Interest Committee and Consultative Advisory Group, as well as information on the current Exposure Drafts and the changes forthcoming from the Improvements Project. New sections on First-Time Adoption of Accrual Basis IPSAS, new consolidation standards and Service Performance Reporting bring practitioners completely up to date to help ensure full compliance.

- Locate relevant IPSAS quickly and easily

- Get up to date on newly adopted standards

- Deepen conceptual understanding with graphical representations

- Understand the operations of the IPSASB, as well as new and ongoing projects

The International Public Sector Accounting Standards Board is engaged in the ongoing process of bringing public sector accounting in line with the IPSAS, which largely align with the IFRS model: where an IFRS exists, it is either adopted directly or adjusted to be suitable for the public sector; where no relevant IFRS exists, the IPSASB issues an IPSAS. IPSAS Explained condenses and clarifies each IPSAS, providing context, background and practical guidance to help practitioners find the answers they need to comply.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

IV. Overview of accrual basis IPSASs

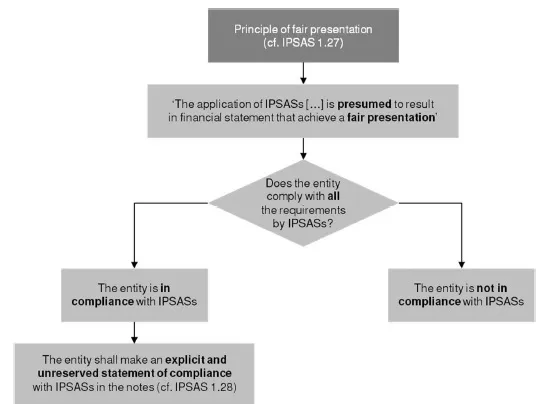

IPSAS 1: Presentation of Financial Statements

Objective

The IFRS on which the IPSAS is based

Content

Principal definitions

Scope

Purpose of financial statements

Components of financial statements

- A statement of financial position

- A statement of financial performance

- A statement of changes in net assets/equity

- A cash flow statement

- When the entity makes publicly available its approved budget, a comparison of budget and actual amounts either as separate additional financial statements or as a budget column in the financial statements

- Notes, comprising a summary of significant accounting policies and other explanatory notes

- Comparative information in respect of the preceding period as specified in IPSAS 1.53 and 1.53A

- Compliance with the conceptual framework for general purpose financial reporting by public sector entities (the conceptual framework)

Table of contents

- Cover

- Title Page

- Copyright

- About the Auther

- Disclaimer

- Foreword

- Contents

- Abbreviations

- I. Introduction: General information about IPSASs and the IPSASB

- II. Costs versus benefits of implementing accrual accounting in the public sector

- III. International developments in public sector accounting

- IV. Overview of accrual basis IPSASs

- V. Recommended Practice Guidelines (RPGs)

- VI. Exposure Drafts and Consultation Papers

- Further reading

- WILEY END USER LICENSE AGREEMENT

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app