The Socially Savvy Advisor

Compliant Social Media for the Financial Industry

- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

The social media marketing bible for the financial industry

The Socially Savvy Advisor: Compliant Social Media for the Financial Industry is the complete guide to creating an effective social media strategy without breaking the big rules. Written by an industry specialist Jennifer Openshaw, alongside Stuart Fross, Fidelity International's former general counsel, and Amy McIlwain, president of Financial Social Media, this book merges marketing basics with FINRA and SEC guidelines to help readers create an effective social media campaign specifically for the finance and investing world. Contributions from industry leaders at Charles Schwab, Citibank, and others provide inside perspective and experience so readers can tap into a new audience. With a focus on compliance, the book clears common hurdles while dispelling myths and outlining effective methods and techniques. Readers also gain access to a website featuring videos, Q & As, tutorials, Slideshare, and a social media policy template.

Social media is one of the hottest topics in finance. From solo practitioners to large asset managers, everyone's consumed by how, when, and where to use this new and powerful medium—but guidance is hard to find. The Socially Savvy Advisor covers the entire issue, from platform, to content, to what not to do.

- Best practices in using social media for advisors and compliance officers

- Planning for the regulators, vs. failing to plan

- Challenges with LinkedIn, Facebook, Twitter and other social platforms

- Elements of a good social media policy

- Managing the top issues related to marketing and business development, engagement, and compliance

With the right plan and the proper technique, social media marketing can dramatically improve client outreach and retention. The Socially Savvy Advisor provides the expert insight, tools, and guidance that shape a robust, effective strategy.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Part One

The New Business Environment

Chapter 1

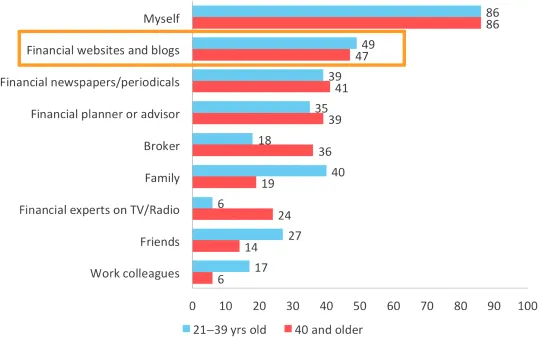

How Is Social Media Changing Investor Behavior?

How Investors Are Getting Social

- Convening—Connecting with others like them. You're familiar with online gatherings around a profession. Even the old-fashioned investment club is more active online, with greater access to tools and content for more efficient exchanges. Consumers are increasingly gathering with those like them, whether it's to engage in impact investing, to encourage more women to move into our industry, or to call for a greener world. Yes, the online world now makes niche convening with people truly “like me” more possible than ever before.

- Sharing—Thanks to the new federal Jumpstart Our Business Startups Act, firms and investors are increasingly sharing information and investment opportunities. They're doing it through online investment sites that allow them to discover Warren Buffett's latest investment. Soon, they'll be accessing prospectuses of investment opportunities that previously were available only to sophisticated investors.

- Reacting—You've wanted to react many times. To a bad product or service or a rude professional, or, on the flip side, a great experience. Now, imagine that reaction shared online, magnified by thousands if not millions. It's happening, especially through Facebook and Twitter, as we'll discuss in the coming pages.

- Opining—Perhaps the biggest surprise to some is the new ease with which overnight investment gurus can emerge. Many are springing up either with their own blogs, on sites like SeekingAlpha where professionals can share their investment insights, or on financial news sites and networks, from Dow Jones' MarketWatch to Motif, a consumer-oriented social investing platform.

- Protecting—One of the greatest empowerment moves is the ability to help consumers make better decisions—from choosing restaurants to hiring a handyman—and protect them from bad actors. I was once asked if online networks will pose a greater threat to investors who might be prey to the next Bernie Madoff. Interestingly, in Europe, a social network for investors called Unience (sister to Finect in the U.S.) discovered that members actually acted quickly to protect fellow members from bad investment products or people. Just as one can instantly flag a spammer on Yelp, so too can they instantly call out a disreputable professional.

Investors Are Demanding More with Transparency and Real-Time Access

- They're reallocating. According to a survey conducted by Cogent Research of 4,000 investors with more than $100,000 in investable assets, nearly 70 percent of wealthy investors have restructured their investments, started, or altered relationships with investment providers, based on content found through social media.

- They're researching electronically. Just in the last few years, consumers have had more access to real-time information, from scrolling through Twitter on their smartphones to pulling out their iPad while at the gym. In fact, a Fidelity Investments survey found that two-thirds of the millionaires surveyed said they would like to use electronic media with their advisors. And young millionaires—those ages 44 and younger—are three times more likely than millionaires of all ages to select a financial professional through a website providing detailed information on advisors, according to Spectrem Group.

- They're engaging online. Young millionaires are four times more likely to express interest in a blog or tweets from their advisor, and nearly six times more likely to say they'd like their advisor to be on Facebook. “The overall percentages of young investors wishing to connect with advisors via social media remain small, but the differences in attitudes between young millionaires and millionaires of all ages are striking,” Spectrem Group says.

What Investors Really Want: Find Their Advisors on Social Media

Table of contents

- Cover

- Related Titles

- Title Page

- Copyright

- Dedication

- Foreword

- Acknowledgments

- Introduction

- Part One: The New Business Environment

- Part Two: The Regulatory Environment

- Part Three: Key Playing Fields in Social Media

- Part Four: Marketing and Business Development

- Part Five: Client Servicing

- Part Six: Managing Social Media Compliantly

- Appendix Sample Social Media Policy

- About the Author

- About the Contributors

- About the Companion Website

- Index

- End User License Agreement