- English

- ePUB (mobile friendly)

- Available on iOS & Android

Mergers, Acquisitions, and Corporate Restructurings

About this book

The essential M&A primer, updated with the latest research and statistics

Mergers, Acquisitions, and Corporate Restructurings provides a comprehensive look at the field's growth and development, and places M&As in realistic context amidst changing trends, legislation, and global perspectives. All-inclusive coverage merges expert discussion with extensive graphs, research, and case studies to show how M&As can be used successfully, how each form works, and how they are governed by the laws of major countries. Strategies and motives are carefully analyzed alongside legalities each step of the way, and specific techniques are dissected to provide deep insight into real-world operations. This new seventh edition has been revised to improve clarity and approachability, and features the latest research and data to provide the most accurate assessment of the current M&A landscape. Ancillary materials include PowerPoint slides, a sample syllabus, and a test bank to facilitate training and streamline comprehension.

As the global economy slows, merger and acquisition activity is expected to increase. This book provides an M&A primer for business executives and financial managers seeking a deeper understanding of how corporate restructuring can work for their companies.

- Understand the many forms of M&As, and the laws that govern them

- Learn the offensive and defensive techniques used during hostile acquisitions

- Delve into the strategies and motives that inspire M&As

- Access the latest data, research, and case studies on private equity, ethics, corporate governance, and more

From large megadeals to various forms of downsizing, a full range of restructuring practices are currently being used to revitalize and supercharge companies around the world. Mergers, Acquisitions, and Corporate Restructurings is an essential resource for executives needing to quickly get up to date to plan their own company's next moves.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

PART ONE

Background

CHAPTER ONE

Introduction

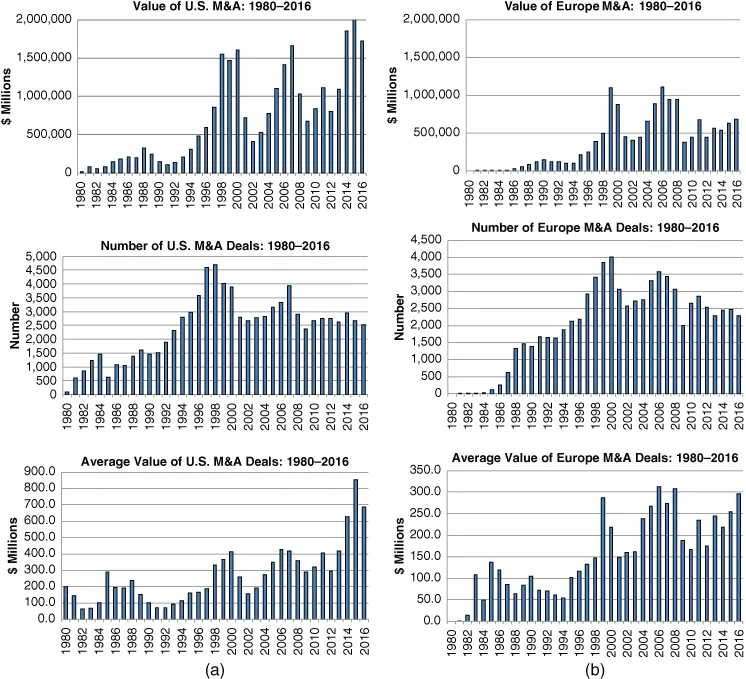

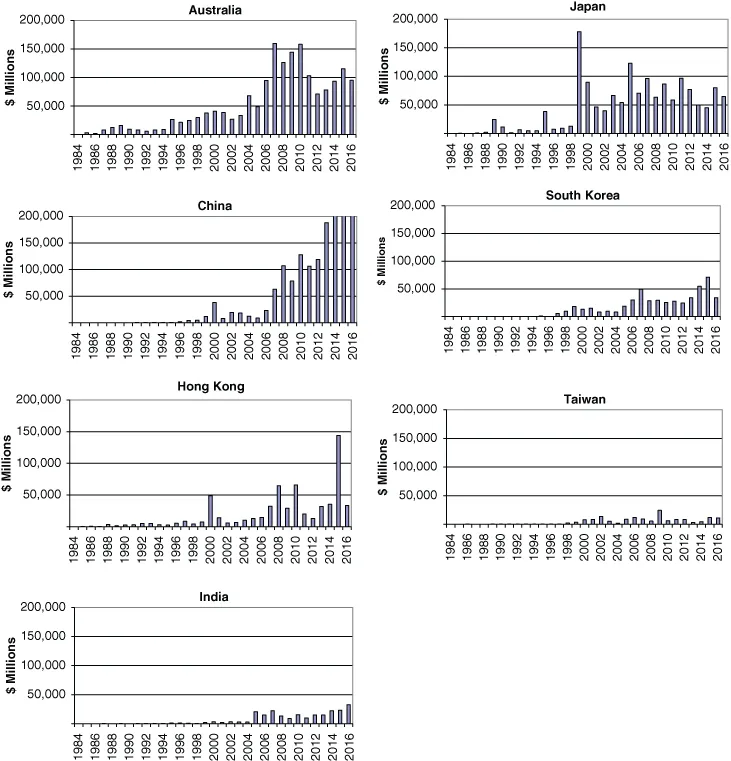

RECENT M&A TRENDS

| Date Announced | Date Effective | Value of Transaction ($ Millions) | Target Name | Target Nation | Acquirer Name | Acquirer Nation |

| 11/14/1999 | 4/12/2000 | 202,785.13 | Mannesmann AG | Germany | Vodafone AirTouch PLC | United Kingdom |

| 1/10/2000 | 1/12/2001 | 164,746.86 | Time Warner | United States | America Online Inc | United States |

| 6/26/2015 | 8/9/2015 | 145,709.25 | Altice SA | Luxembourg | Altice SA | Luxembourg |

| 9/2/2013 | 2/21/2014 | 130,298.32 | Verizon Wireless Inc | United States | Verizon Communications Inc | United States |

| 8/29/2007 | 3/28/2008 | 107,649.95 | Philip Morris Intl Inc | Switzerland | Shareholders | Switzerland |

| 9/16/2015 | 10/4/2016 | 101,100.89 | SABMiller PLC | United Kingdom | Anheuser-Busch Inbev SA/NV | Belgium |

| 4/25/2007 | 11/2/2007 | 98,189.19 | ABN-AMRO Holding NV | Netherlands | RFS Holdings BV | Netherlands |

| 11/4/1999 | 6/19/2000 | 89,167.72 | Warner-Lambert Co | United States | Pfizer Inc | United States |

| 12/1/1998 | 11/30/1999 | 78,945.79 | Mobil Corp | United States | Exxon Corp | United States |

| 1/17/2000 | 12/27/2000 | 75,960.85 | SmithKline Beecham PLC | United Kingdom | Glaxo Wellcome PLC | United Kingdom |

| Date Announced | Date Effective | Value of Transaction ($mil) | Target Name | Target Nation | Acquirer Name | Acquirer Nation |

| 11/14/99 | 06/19/00 | 202,785.13 | Mannesmann AG | Germany | Vodafone AirTouch PLC | United Kingdom |

| 6/26/2015 | 8/9/2015 | 145,709.25 | Altice SA | Luxembourg | Altice SA | Luxembourg |

| 08/29/07 | 03/28/08 | 107,649.95 | Philip Morris Intl Inc | Switzerland | Shareholders | Switzerland |

| 9/16/2015 | 10/4/2016 | 101,100.89 | SABMiller PLC | United Kingdom | Anheuser-Busch Inbev SA/NV | Belgium |

| 04/25/07 | 11/02/07 | 98,189.19 | ABN-AMRO Holding NV | Netherlands | RFS Holdings BV | Netherlands |

| 01/17/00 | 12/27/00 | 75,960.85 | SmithKline Beecham PLC | United Kingdom | Glaxo Wellcome PLC | United Kingdom |

| 10/28/04 | 07/20/08 | 74,558.58 | Shell Transport & Trading Co | United Kingdom | Royal Dutch Petroleum Co | Netherlands |

| 04/08/15 | 02/15/16 | 69,445.02 | BG Group PLC | United Kingdom | Royal Dutch Shell PLC | Netherlands |

| 09/29/14 | 09/01/15 | 65,891.51 | UBS AG | Switzerland | UBS AG | Switzerland |

| 02/25/06 | 07/22/08 | 60,856.45 | Suez SA | France | Gaz de France SA | France |

| Date Announced | Date Effective | Target Name | Target Nation | Acquirer Name | Acquirer Nation | Value of Transaction ($mil) |

| 03/26/14 | 08/25/14... |

Table of contents

- Cover

- Title Page

- Table of Contents

- Preface

- PART ONE: Background

- PART TWO: Hostile Takeovers

- PART THREE: Going‐Private Transactions and Leveraged Buyouts

- PART FOUR: Corporate Restructuring

- Glossary

- Index

- End User License Agreement