Investing in Mortgage-Backed and Asset-Backed Securities

Financial Modeling with R and Open Source Analytics

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Investing in Mortgage-Backed and Asset-Backed Securities

Financial Modeling with R and Open Source Analytics

About this book

A complete guide to investing in and managing a portfolio of mortgage- and asset-backed securities

Mortgage- and asset-backed securities are not as complex as they might seem. In fact, all of the information, financial models, and software needed to successfully invest in and manage a portfolio of these securities are available to the investment professional through open source software. Investing in Mortgage and Asset-Backed Securities + Website shows you how to achieve this goal.

The book draws entirely on publicly available data and open source software to construct a complete analytic framework for investing in these securities. The analytic models used throughout the book either exist in the quantlib library, as an R package, or are programmed in R and incorporated into the analytic framework used.

- Examines the valuation of fixed-income securities—metrics, valuation framework, and return analysis

- Covers residential mortgage-backed securities—security cash flow, mortgage dollar roll, adjustable rate mortgages, and private label MBS

- Discusses prepayment modeling and the valuation of mortgage credit

- Presents mortgage-backed securities valuation techniques—pass-through valuation and interest rate models

Engaging and informative, this book skillfully shows you how to build, rather than buy, models and proprietary analytical platforms that will allow you to invest in mortgage- and asset-backed securities.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Part One

Valuation of Fixed-Income Securities

Chapter 1

The Time Value of Money

The chief value of money lies in the fact that one lives in a world in which it is overestimated.

- It allows the investor to measure the value of one asset or portfolio of cash flows relative to another.

- The investor, using the time value of money, can estimate expected holding period returns.

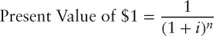

1.1 Present Value

where  | = | Interest rate |

| = | Number of periods |

Table of contents

- Cover

- Series Page

- Title Page

- Copyright

- Table of Contents

- Dedication

- Foreword

- Preface

- Acknowledgments

- Introduction

- Part One: Valuation of Fixed-Income Securities

- Part Two: Residential Mortgage-Backed Securities

- Part Three: Valuation of Mortgage-Backed Securities

- Part Four: Structuring Mortgage-Backed Securities

- Part Five: Mortgage Credit Analysis

- About the Website

- Bibliography

- Index

- End User License Agreement