Fat-Tailed Distributions

Data, Diagnostics and Dependence

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Fat-Tailed Distributions

Data, Diagnostics and Dependence

About this book

This title is written for the numerate nonspecialist, and hopes to serve three purposes. First it gathers mathematical material from diverse but related fields of order statistics, records, extreme value theory, majorization, regular variation and subexponentiality. All of these are relevant for understanding fat tails, but they are not, to our knowledge, brought together in a single source for the target readership. Proofs that give insight are included, but for most fussy calculations the reader is referred to the excellent sources referenced in the text. Multivariate extremes are not treated. This allows us to present material spread over hundreds of pages in specialist texts in twenty pages. Chapter 5 develops new material on heavy tail diagnostics and gives more mathematical detail. Since variances and covariances may not exist for heavy tailed joint distributions, Chapter 6 reviews dependence concepts for certain classes of heavy tailed joint distributions, with a view to regressing heavy tailed variables.

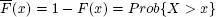

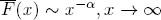

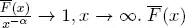

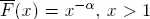

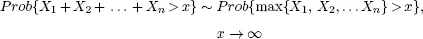

Second, it presents a new measure of obesity. The most popular definitions in terms of regular variation and subexponentiality invoke putative properties that hold at infinity, and this complicates any empirical estimate. Each definition captures some but not all of the intuitions associated with tail heaviness. Chapter 5 studies two candidate indices of tail heaviness based on the tendency of the mean excess plot to collapse as data are aggregated. The probability that the largest value is more than twice the second largest has intuitive appeal but its estimator has very poor accuracy. The Obesity index is defined for a positive random variable X as:

Ob(X) = P (X1 +X4 > X2 +X3|X1 ? X2 ? X3 ? X4), Xi independent copies of X.

For empirical distributions, obesity is defined by bootstrapping. This index reasonably captures intuitions of tail heaviness. Among its properties, if ? > 1 then Ob(X) < Ob(X?). However, it does not completely mimic the tail index of regularly varying distributions, or the extreme value index. A Weibull distribution with shape 1/4 is more obese than a Pareto distribution with tail index 1, even though this Pareto has infinite mean and the Weibull's moments are all finite. Chapter 5 explores properties of the Obesity index.

Third and most important, we hope to convince the reader that fat tail phenomena pose real problems; they are really out there and they seriously challenge our usual ways of thinking about historical averages, outliers, trends, regression coefficients and confidence bounds among many other things. Data on flood insurance claims, crop loss claims, hospital discharge bills, precipitation and damages and fatalities from natural catastrophes drive this point home. While most fat tailed distributions are "bad", research in fat tails is one distribution whose tail will hopefully get fatter.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1

Fatness of Tail

1.1. Fat tail heuristics

1.2. History and data

1.2.1. US flood insurance claims

1.2.2. US crop loss

1.2.3. US damages and fatalities from natural disasters

1.2.4. US hospital discharge bills

1.2.5. G-Econ data

Table of contents

- Cover

- Contents

- Title Page

- Copyright

- Introduction

- 1 Fatness Of Tail

- 2 Fundamental Parameters of Antennas

- 3 Records

- 4 Regularly Varying and Subexponential Distributions

- 5 Indices and Diagnostics Of Tail Heaviness

- 6 Dependence

- Conclusions and Perspectives

- Bibliography

- Index

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app