Fixed Income Markets

Management, Trading and Hedging

- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

A comprehensive, in-depth look at global debt capital markets in the post-crisis world

Fully updated with comprehensive coverage of the post-crisis debt markets and their impact on key industry issues, Fixed Income Markets: Management, Trading, and Hedging, Second Edition offers insights into derivative pricing, cross-currency hedging, and new liquidity legislation. Written by Choudhry, Moskovic, and Wong, Fixed Income Markets is an indispensable read for anyone working in bond markets, interest-rate markets, and credit derivatives markets looking to better understand today's debt markets.

This acclaimed book takes a unique look into the leading practices in bond markets as well as post-credit-crunch impacts on pricing that are rarely captured in textbooks. The new edition provides expanded coverage on a wide range of topics within hedging, derivatives, bonds, rebalancing, and global debt capital markets. New topics include:

- Dynamic hedging practices and cross-currency hedging

- Collateralized and uncollateralized derivatives, and their impact on valuation

- Callable bonds, pricing, trading, and regulatory aspects related to liquidity

- Rebalancing as a method for capturing contingencies and other complex imbedded risks

As a bonus, the book includes reference information for statistical concepts and fixed income pricing, as well as a full glossary and index. Written in Choudhry's usual accessible style, Fixed Income Markets is a comprehensive and in-depth account of the global debt capital markets in today's post-crisis world.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

PART One

Introduction to Bonds

CHAPTER 1

The Bond Instrument

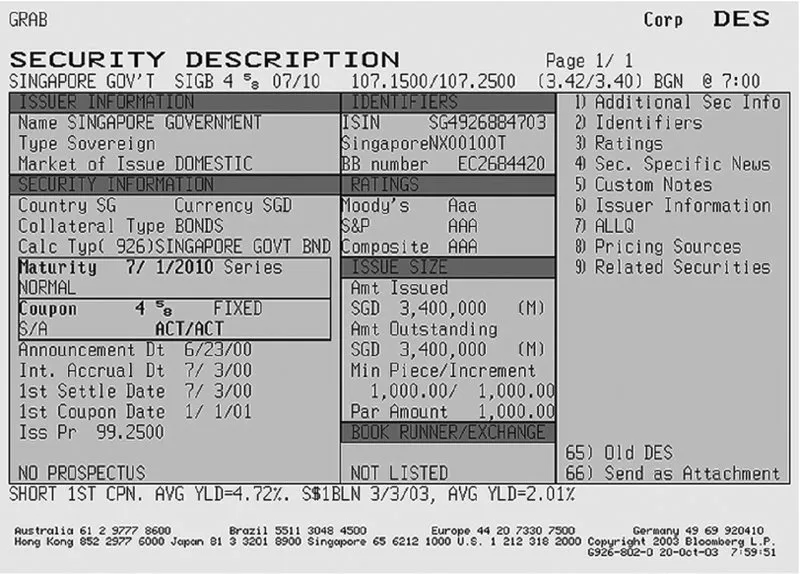

BOND-MARKET BASICS

| Issue date | July 2000 |

| Coupon | 4.625% |

| Maturity date | 1 July 2010 |

| Issue currency | Singapore dollars |

| Issue size | SGD 3.4 million |

| Credit rating | AAA/Aaa |

Table of contents

- Cover

- Series

- Titlepage

- Copyright

- Author Disclaimer

- Dedication

- Foreword

- Preface

- About the Authors

- PART ONE Introduction to Bonds

- PART TWO Selected Market Instruments

- PART THREE Derivative Instruments

- PART FOUR Bond Trading and Hedging

- APPENDIX A Statistical Concepts

- APPENDIX B Basic Tools

- APPENDIX C Introduction to the Mathematics of Fixed-Income Pricing

- APPENDIX D About the Companion Website

- Glossary

- Index

- End User License Agreement