- English

- ePUB (mobile friendly)

- Available on iOS & Android

Basic Stochastic Processes

About this book

This book presents basic stochastic processes, stochastic calculus including Lévy processes on one hand, and Markov and Semi Markov models on the other. From the financial point of view, essential concepts such as the Black and Scholes model, VaR indicators, actuarial evaluation, market values, fair pricing play a central role and will be presented.

The authors also present basic concepts so that this series is relatively self-contained for the main audience formed by actuaries and particularly with ERM (enterprise risk management) certificates, insurance risk managers, students in Master in mathematics or economics and people involved in Solvency II for insurance companies and in Basel II and III for banks.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1

Basic Probabilistic Tools for Stochastic Modeling

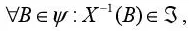

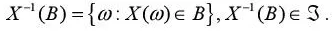

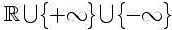

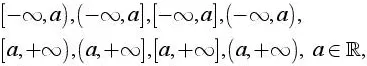

1.1. Probability space and random variables

Table of contents

- Cover

- Table of Contents

- Title

- Copyright

- Introduction

- 1: Basic Probabilistic Tools for Stochastic Modeling

- 2: Homogeneous and Non-homogeneous Renewal Models

- 3: Markov Chains

- 4: Homogeneous and Non-homogeneous Semi-Markov Models

- 5: Stochastic Calculus

- 6: Lévy Processes

- 7: Actuarial Evaluation, VaR and Stochastic Interest Rate Models

- Bibliography

- Index

- End User License Agreement

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app