The Financial Controller and CFO's Toolkit

Lean Practices to Transform Your Finance Team

- English

- ePUB (mobile friendly)

- Available on iOS & Android

The Financial Controller and CFO's Toolkit

Lean Practices to Transform Your Finance Team

About this book

Simplify and streamline your way to a winning legacy

The Financial Controller and CFO's Toolkit is a hybrid handbook and toolkit with over 100 lean practice solutions and a wealth of practical tools for senior financial managers of small, midsized and large companies. This book outlines the mindset of paradigm shifters relevant to future-ready finance teams, and contains guidelines on how to become an effective change leader. Guidance from world leading expert David Parmenter provides the insight and tools you need to reach your true leadership potential and achieve more for your organization. Packed with templates and checklists, this book helps you adhere to the best practices in reporting, forecasting, KPIs, planning, strategy, and technology. The companion website—a complete toolbox for positive, entrenched change—gives you access to additional resources that reinforce The Financial Controller and CFO's Toolkit strategy.

This new second edition has been updated to reflect the latest practices and technology to streamline your workflow and get more done in less time—without sacrificing quality or accuracy. As an all-in-one resource for the CFO role, this book provides a clear, practical strategy for demonstrating your value to your organization.

- Selling and leading change effectively

- Get more accurate information from your KPIs

- Attracting, recruiting and retaining talented staff

- Invest in and implement new essential tools

- Investing wisely in 21 st century technologies

Report the month-end within three days, implement quarterly rolling forecasting, complete the annual plan in two weeks or less, and bring your firm into the 21 st century with key tools that get the job done. Be the CFO that your organization needs and the leader that your teams deserve. The Financial Controller and CFO's Toolkit gives you everything you need to achieve more by doing less.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Part I

Change—Why the Need and How to Lead

Chapter 1

Getting Your Finance Team Future Ready

OVERVIEW

- Fully embraced all the lean finance team practices?

- An annual planning process that helps their organization prepare for the unexpected?

- Successfully adopted the tried and tested leading-edge technologies available in the twenty-first century?

A BURNING PLATFORM?

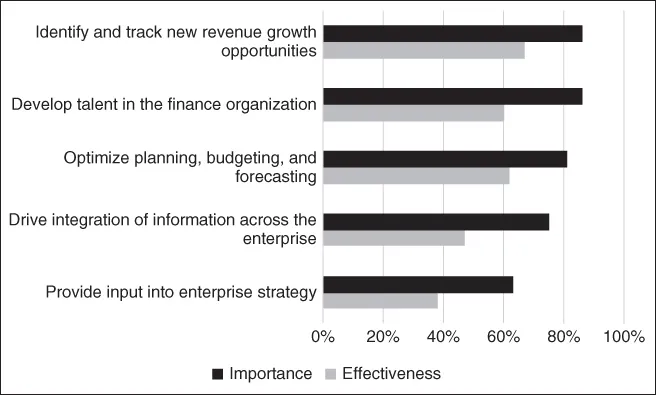

REPORTING HISTORY OR MAKING IT

| Area | Bad habit |

| Direct labor costs are variable | Treating direct labor costs as variable, yet we cannot go back to the Victorian times and hire staff on a daily basis. |

| Transferring operating costs to the balance sheet | Absorbing as many fixed costs into WIP and closing stock as possible, thereby transferring costs from the current period to subsequent periods. |

| Wedded to complexity | Installing one complex system after another (e.g., timesheets, work orders, detailed inventory tracking systems, and activity based costing). |

| Detail is good | Having a large chart of accounts with 200+ account codes for the P/L. |

| Slow month-ends | Overseeing a slow month-end reporting process as finance teams pursue the perfect number. Yet we are only required to get to a true and fair number, and the “right” month-end number does not exist. |

| Slow year-ends | Signing up with the auditors for a slow year-end accounts exercise with most of the finance team's time in the first quarter being spent endlessly adjusting the month 12 number. The final audited numbers often being within 5% of those reported at month 12. In other words, we have in reality come full circle. |

| Spreadsheet epidemic | A spreadsheet for everything, and most certainly, multiple versions of the truth. |

| Maintaining an annual planning process | Managing the annual planning process, believing that it must be of some use. Each year, thinking that this time the annual planning process... |

Table of contents

- Cover

- Title Page

- Copyright

- Table of Contents

- About the Author

- Testimonials

- Introduction

- Acknowledgments

- Part I: Change—Why the Need and How to Lead

- Part II: To Be Completed Before the Next Month-End

- Part III: Technologies to Adopt

- Part IV: Progress You Need to Make within the Next Six Months

- Part V: How Finance Teams can Help their Organizations get Future Ready

- Part VI: Areas where Costly Mistakes can be Made

- Appendix A: Useful Letters and Memos

- Appendix B: Rules for a Bulletproof Presentation

- Appendix C: Satisfaction Survey for a Finance Team

- Index

- End User License Agreement