![]()

PART One

Foundations of Investor Behavior

![]()

CHAPTER 1

Investor Behavior: An Overview

H. Kent Baker

University Professor of Finance, Kogod School of Business, American University

Victor Ricciardi

Assistant Professor of Financial Management, Department of Business Management, Goucher College

INTRODUCTION

In the 1990s, the terms behavioral finance and behavioral economics started to appear in academic journals for finance professors, practitioner publications for investment professionals, investing magazines for novice investors, and everyday newspapers read by the general public (Ricciardi and Simon 2000). The foundation of behavioral finance and the subtopic of investor behavior, however, can be traced back throughout financial history in events such as the speculative behavior during tulip mania in the 1600s. Books published in the 1800s and early 1900s about psychology and investing marked the beginning of the theoretical basis for today's theories and concepts about investor behavior (Ricciardi 2006). Finance and the role of money are fundamental underpinnings of many important events throughout history (Ferguson 2008) and the development of financial innovations (Goetzmann and Rouwenhorst 2005). For example, Bernstein (1996) provides an extensive time line of risk throughout history and its application in the world of finance. Another important work in this arena is Rubinstein (2006), who depicts a historical anthology of investment theory. In recent times, the Internet stock market bubble of the late 1990s and the financial crisis of 2007 and 2008 demonstrate the importance of understanding investment behavior (Reinhart and Rogoff 2011).

Relevant Books in the History of Finance and Investment Thought

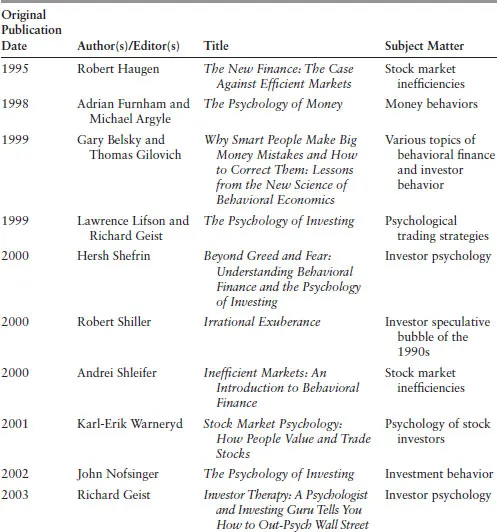

Understanding the history of finance and the development of investment theory is important for all types of investors. Goetzmann and Rouwenhorst (2005), Rubinstein (2006), and Ferguson (2008) offer extensive discussions of books and other publications in financial history and investment theory. The next section provides a discussion of important books in the history of finance and the natural progression of understanding investor theory and behavior. Exhibit 1.1 provides a chronological timeline of a sample of noteworthy books in financial history and investment theory from 1841 to 1978. This list of books is merely illustrative of classic or seminal works.

Period: 1841 to 1912

Initially published in 1841, Extraordinary Popular Delusions and the Madness of Crowds (MacKay 1980) depicts the role of bubbles and panics that is still applicable for investor psychology. Published in the late 1800s, The Crowd: A Study of the Popular Mind (Le Bon 1982) describes the role of group behavior in different environments and markets. Published in 1903, Trust Finance: A Study of the Genesis, Organization, and Management of Industrial Combinations (Meade 2003) describes the importance of trust in a wide range of areas including corporate finance, financial services, and investments. Where the Money Grows and Anatomy of the Bubble (Garrett 1998), published in 1911, presents the role of different stakeholders involved in the investment management process on Wall Street. The Psychology of the Stock Market (Selden 1996), published in 1912, represents one of the first books that applied psychology to the decision-making process of investors. Selden's book describes the behavioral and emotional issues that influence traders and investors in the stock market.

Period: 1922 to 1938

Published in 1922, The Stock Market Barometer (Hamilton 1998) discloses the approach known as the Dow Theory, which is based on stock price movements as a predictive investment tool. Published in 1923, Reminiscences of a Stock Operator (Lefèvre 1994) depicts the life of a Wall Street trader and different approaches to trading in the markets. The author interviews traders to build the portrait of the fictional stock trader in the novel. The Common Sense of Money and Investments (Rukeyser 1999), published in 1924, provides a discussion of various personal finance and investment topics that are still relevant. Published in 1930, The Art of Speculation (Carret 1997) offers a thorough discussion of the speculation process involving financial markets and investment products. Only Yesterday: An Informal History of the 1920s (Allen 2010), first published in 1931, provides a general narrative description of life during the 1920s and also examines that decade's bull market, stock market crash, and the early years of the Great Depression.

In 1934, Graham and Dodd (1996) published Security Analysis in which they developed the foundation for value investing by identifying undervalued companies based on accounting information and financial statements. The Battle for Investment Survival (Loeb 2010), published in 1935, provides an extensive approach for investing in all types of financial securities and markets. Published in 1938, The Theory of Investment Value (Williams 1997) describes how to value financial assets based on accounting data such as cash flow and profits. In particular, this approach uses the distribution of dividends as forecasting the stock price of a company known as stock valuation.

Period: 1940 to 1958

First published in 1940, Where Are the Customers' Yachts? or a Good Hard Look at Wall Street (Schwed 2006) depicts the questionable investment practices of Wall Street firms toward their clients. In 1949, Graham (2005) published The Intelligent Investor, which reveals the approach known as value investing (i.e., a method for evaluating and identifying stocks that an investor considers underpriced based on different types of accounting or financial information). Today, value investing is one of the most important investing strategies. Published in 1951, Other People's Money: A Study in the Social Psychology of Embezzlement (Cressey 1951) uses psychological theories to explain why individuals commit financial crimes and violate the trust of the public. Galbraith's (2009) The Great Crash 1929, published in 1954, serves as a reminder even today of how financial history repeats itself in understanding the financial crisis of 2007 and 2008.

Other notable books during this period include The Art of Contrary Thinking (Neill 1992), published in 1954, which describes why consensus investor group decision-making is sometimes wrong and how investors can use contrary strategies or trends to profit in the stock market. Published in 1957, Stock Market Behavior: A Descriptive Guidebook for the New Investor (Sargeant 1957) provides a perspective of the psychology underlying the stock market for novice investors. In 1958, Fisher (1997) published Common Stocks and Uncommon Profits, in which he reveals how to evaluate a firm's business prospects and financial health based on accounting data and financial statement information.

Period: 1969 to 1970

In the book first published in 1969, Once in Golconda: A True Drama of Wall Street 1920–1938 (Brooks 1999a) describes the time of economic expansion of the 1920s, the crash of 1929, and the aftermath of the 1930s Great Depression. The Winning Habit: How Your Personality Makes You a Winner or a Loser in the Stock Market (Appleman 1970) discloses an array of different personality types and connects them to how investors make decisions about stock investing. Published in 1970, Why Most Investors are Mostly Wrong Most of the Time (Scheinman 1991) describes the author's perspective of crowd psychology and the role of contrary opinions within the stock market during the 1960s.

Period: 1973 to 1978

In 1973, Brooks (1999b) authored The Go-Go Years: The Drama and Crashing Finale of Wall Street's Bullish 60s, in which he describes the speculative behavior during the bull market of the 1960s and the stock market crash in 1970. Malkiel (1973) published his highly popular A Random Walk Down Wall Street in which he discloses the importance of the random walk theory. Malkiel contends that investors cannot outperform stock market indexes on a regular basis because prices are random. Dreman's (1977) Psychology and the Stock Market: Investment Strategy beyond Random Walk depicts the importance of crowd psychology and group behavior within the stock market by highlighting topics such as bubbles, the social psychology of groups, groupthink, and herd behavior. This book also offers a counter argument to the random walk theory and efficient market hypothesis. First published in 1978, Manias, Panics and Crashes: A History of Financial Crisis (Kindleberger 1996) provides an extensive financial history of bubbles, frauds, crashes, contagions, and crises.

Investor Behavior

What is investor behavior? The field of investor behavior attempts to understand and explain investor decisions by combining the topics of psychology and investing on a micro level (i.e., the decision process of individuals and groups) and a macro perspective (i.e., the role of financial markets). The decision-making process of investors incorporates both a quantitative (objective) and qualitative (subjective) aspect that is based on the specific features of the investment product or financial service. Investor behavior examines the cognitive factors (mental processes) and affective (emotional) issues that individuals, financial experts, and traders reveal during the financial planning and investment management process. In practice, individuals make judgments and decisions that are based on past events, personal beliefs, and preferences.

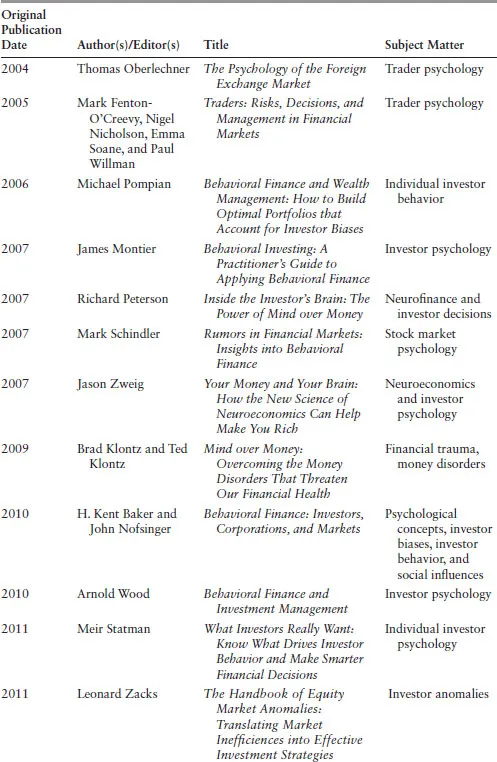

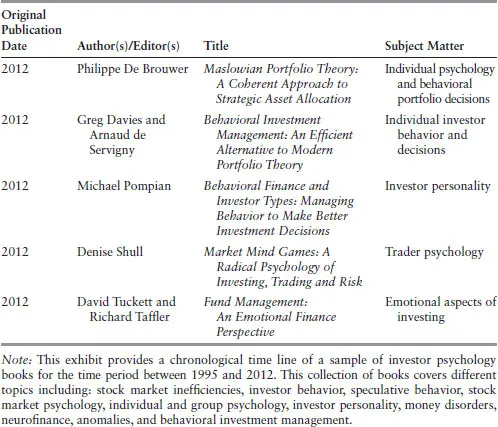

Since 1995, an increasing number of books on investor behavior have been published in tandem with the emerging research literature within the overall discipline of behavioral finance. Exhibit 1.2 provides a chronological time line of investor behavior books published between 1995 and 2012. This compilation of books covers different subject matter including: stock market inefficiencies (Haugen 1995; Shleifer 2000), stock market psychology (Warneryd 2001; Schindler 2007), speculative behavior (Shiller 2000), anomalies (Zacks 2011), neuroeconomics and neurofinance (Peterson 2007; Zweig 2007), money behaviors (Furnham and Argyle 1998), money disorders (Klontz and Klontz 2009), investor personality (Pompian 2012), behavioral investment management (De Brouwer 2012; Davies and de Servigny 2012), psychological trading strategies (Lifson and Geist 1999), trader psychology (Oberlechner 2004; Fenton-O'Creevy et al. 2005; Shull 2012), investor emotions (Tuckett and Taffler 2012), and investor behavior or psychology (Belsky and Gilovich 1999; Shefrin 2000; Nofsinger 2002; Geist 2003; Pompian 2006; Montier 2007; Baker and Nofsinger 2010; Wood 2010; Statman 2011). This collection of books and other academic literature, such as published academic papers, working papers, conference presentations, and dissertations, serves as a reference point for developing the current content in this book in order to identify the most important emerging topics in investor behavior and psychology.

The importance of documenting the past and current research is to assist individual investors and their financial advisors about these biases and improve the decision-making process in selecting investment services, products, and strategies. As a result of the financial crisis of 2007 and 2008, the discipline of psychology began to focus even more on the financial decision-making process of individuals. This renewed interest by the social sciences and business disciplines has spurred new research on investor behavior including financial therapy, money counseling, financial psychology, consumer finance, investor personality, and household finance.

Purpose of the Book

This book's main purpose is to provide readers with the emerging theoretical trends about investment behavior within the ever-changing and growing financial services and investment management industry. Readers of Investor Behavior—The Psychology of Financial Planning and Investing will gain an in-depth understanding of the major types and the latest trends within the field of investor behavior. The book features empirical evidence and current literature about each investment issue. Cited research studies are presented in a straightforward manner focusing on the comprehension of study findings, rather than on the details of mathematical frameworks. Authors contributing chapters consist of a mix of academics and practitioners.

Distinctive Features of the Book

Investor Behavior—The Psychology of Financial Planning and Investing has the following distinctive features.

- The book provides a detailed discussion of investor behavior including empirical evidence and practice within the various topics covered. It attempts not only to blend the conceptual world of scholars with the pragmatic view of practitioners, but also to synthesize relevant research studies including recent developments in a succinct and clear manner.

- The book contains contributions from numerous authors, which assures a variety of perspectives and a rich interplay of ideas.

- When discussing the results of empirical studies that link theory and practice, the objective is to distill them to their essential content so that they are understa...