The Customer-Funded Business

Start, Finance, or Grow Your Company with Your Customers' Cash

- English

- ePUB (mobile friendly)

- Available on iOS & Android

The Customer-Funded Business

Start, Finance, or Grow Your Company with Your Customers' Cash

About this book

Who needs investors?

More than two generations ago, the venture capital community – VCs, business angels, incubators and others – convinced the entrepreneurial world that writing business plans and raising venture capital constituted the twin centerpieces of entrepreneurial endeavor. They did so for good reasons: the sometimes astonishing returns they've delivered to their investors and the astonishingly large companies that their ecosystem has created.

But the vast majority of fast-growing companies never take any venture capital. So where does the money come from to start and grow their companies? From a much more agreeable and hospitable source, their customers. That's exactly what Michael Dell, Bill Gates and Banana Republic's Mel and Patricia Ziegler did to get their companies up and running and turn them into iconic brands.

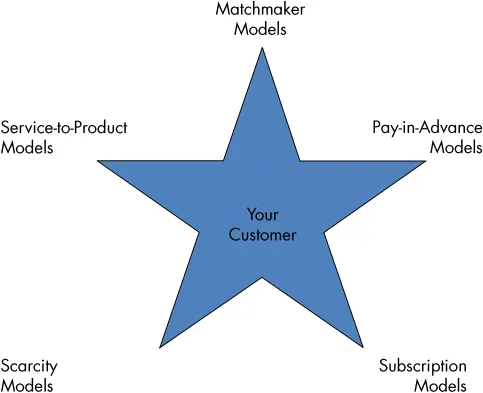

In The Customer Funded Business, best-selling author John Mullins uncovers five novel approaches that scrappy and innovative 21st century entrepreneurs working in companies large and small have ingeniously adapted from their predecessors like Dell, Gates, and the Zieglers:

- Matchmaker models (Airbnb)

- Pay-in-advance models (Threadless)

- Subscription models (TutorVista)

- Scarcity models (Vente Privee)

- Service-to-product models (GoViral)

Through the captivating stories of these and other inspiring companies from around the world, Mullins brings to life the five models and identifies the questions that angel or other investors will – and should! – ask of entrepreneurs or corporate innovators seeking to apply them. Drawing on in-depth interviews with entrepreneurs and investors who have actually put these models to use, Mullins goes on to address the key implementation issues that characterize each of the models: when to apply them, how best to apply them, and the pitfalls to watch out for.

Whether you're an aspiring entrepreneur lacking the start-up capital you need, an early-stage entrepreneur trying to get your cash-starved venture into take-off mode, an intrapreneur seeking funding within an established company, or an angel investor or mentor who supports high-potential ventures, this book offers the most sure-footed path to starting, financing, or growing your venture.

John Mullins is the author of The New Business Road Test and, with Randy Komisar, the widely acclaimed Getting to Plan B.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

1

Craving Crowdfunding? Pandering to VCs? Groveling to Your CFO?: The Magic of Traction and the Customer-Funded Revolution

A Customer-Funded Model

Customer Funding: The Vermas Are Not Alone

A Problem: Financing Your Startup

- Most of the time, the Plan A that you have so lovingly conceived is unlikely to work, as most any experienced early-stage investor, whether a VC or a business angel, will tell you. Do you look forward to explaining to your investors why your Plan A didn't work, as you ask them for more money for your newer, brighter, and inevitably still-optimistic Plan B? I don't think so! As Peter Drucker, arguably the leading management thinker of the twentieth century, observed, “If a new venture does succeed, more often than not it is

- in a market other than the one it was originally intended to serve

- with products and services not quite those with which it had set out

- bought in large part by customers it did not even think of when it started

- and used for a host of purposes besides the ones for which the products were first designed.”2

- There are material drawbacks to raising capital too early. Among the most daunting of them is that raising capital—whether by pandering to VCs or groveling to your CFO, if you're seeking to start something inside an established company—is a full-time job. Getting your venture underway is a full-time job, too. If you try to do both, one of them will inevitably suffer.

- As you'll see later in this chapter, the evidence is compelling that the odds of success for VC-backed companies are far worse than most entrepreneurs realize. Is joining tomorrow's failure statistics what you had in mind in pursuing your venture? Definitely not!

A Solution: The Magic of Traction

- First, waiting to raise capital forces the entrepreneur's attention toward his or her customers, where it should be in the first place. Customers matter, and as Peter Drucker also noted,...

Table of contents

- Cover

- Praise for The Customer-Funded Business

- Title Page

- Copyright

- Why This Book?

- Chapter 1: Craving Crowdfunding? Pandering to VCs? Groveling to Your CFO?: The Magic of Traction and the Customer-Funded Revolution

- Chapter 2: Customer-Funded Models: Mirage or Mind-Set? Old or New?

- Chapter 3: Buyers and Sellers, but Not Your Goods: Matchmaker Models

- Chapter 4: Ask for the Cash: Pay-in-Advance Models

- Chapter 5: Recurring Revenue: Subscription and SaaS Models

- Chapter 6: Sell Less, Earn More: Scarcity and Flash Sales Models

- Chapter 7: Build It for One, Then Sell It to All: Service-to-Product Models

- Chapter 8: Make It Happen: Put a Customer-Funded Model to Work in Your Business

- Acknowledgments

- Notes

- About the Research

- About the Author

- Index

- End User License Agreement