- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

Learn all you need to know about trading and forecasting with technical analysis

Kase on Technical Analysis is the ultimate guide to forecasting and trading technically, a comprehensive "all you need to know" review of the topics. Award-winning instructor, Cynthia A. Kase, CMT 1, MFTA 2, engineer, veteran energy trader, and one of the world's preeminent market technicians, captures her 30 plus years of experience in thirteen half-hour sessions, for more than six in-depth hours on technical analysis essentials. Viewers will develop a better understanding of charting and technical indicators, and get an inside look at cutting edge material based on Kase's own unique indicators and innovative approaches to trading and forecasting. The video describes key techniques for interpreting market behavior and developing a technical approach to trading. The workbook provides practice exercises that reinforce the concepts learned as Kase guides viewers through the various methodologies and their real-life applications to successful market interactions.

Technical analysis is based on the premise that the behavior of a market reveals all that is known about it. Price action, volatility and rates of price changes may be harnessed by Kase's techniques to forecast future prices, identify low risk, high reward trading opportunities, and to cut losses while letting profits run. Kase on Technical Analysis shows how it's done, providing clear and wide-ranging instruction and expert insight that helps viewers to:

- Build a foundational understanding of charting and technical indicators, including an introduction to latest techniques

- Learn the most important technical methods for interpreting and analyzing market behavior

- Effectively apply technical analysis to trading strategy, risk management and market forecasting

- Formulate entry and exit strategies by using pattern recognition and properly applying technical indicators

Technical analysis is a core discipline used by successful traders to assess market conditions and time trades. This package covers the aspects of technical analysis needed for intelligent interaction with the markets, from theory to practice, with concrete guidance toward real-world application. For traders wanting to "come up to speed" on technical analysis, for those wanting a refresher on the topic, as well as for seasoned traders looking for new ideas, Kase on Technical Analysis provides deep insight from a global authority.

1 Chartered Market Technician awarded by the Market Technicians Association

2 Master of Financial Technical Analysis awarded by the International Federation of Technical Analysts

Trusted by 375,005 students

Access to over 1 million titles for a fair monthly price.

Study more efficiently using our study tools.

Information

CHAPTER 1

Introduction

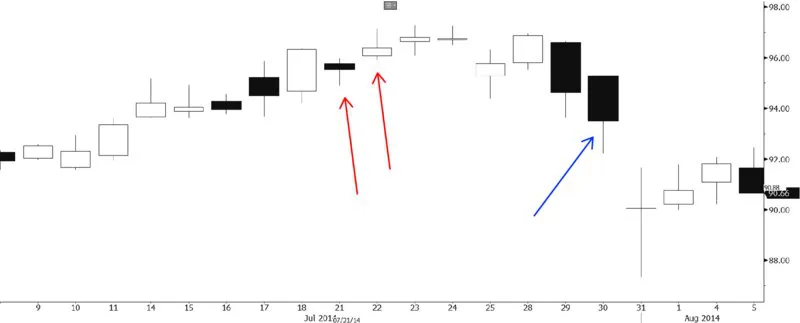

- Charts and Prices Viewed Visually: This includes the types of charts used in technical analysis; how they are used; new ways of looking at price charts, gaps, geometric, bar, and candlestick patterns; and some unique ways of using these patterns.

- Indicators and Studies: These are mathematical algorithms of varying complexity that are used for entries, exits, and risk management. Moving averages and the directional movement index and average directional index (DMI/ADX) are shown as entries or “stop-and-reverse” systems. Some special rules and patterns relating to DMI/ADX are addressed. Traditional momentum indicators such as Oscillators, MACD, Stochastic, RSI, and Ultimate Oscillator are taught, along with how periodicity impacts indicator performance, momentum divergence, overbought and oversold signals, and how to use momentum to enter trades. The math behind Kase's proprietary indicators, the Kase PeakOscillator and KaseCD, are discussed, and some performance studies are exhibited.

- Stops and Risk Management: Various sorts of stops are discussed, including fixed-value from entry, trailing fixed-value, trailing range-based, and Kase's DevStops and KaseX two-sided dashes, based on probability theory. Many chart examples show how stops fit into a trading system, leveraging from examples that had their origin earlier in the course. How to estimate the risk associated with a given trade is taught, along with how to set trade size, or how to calculate bar size, working backwards from risk tolerance. Additionally “gaming” math is taught, which gives insight into not only managing risk in a given trade, but also seeing how performance and risk interact.

- Trading Techniques: Most trading techniques involve combining indicators, stops, and patterns in sensible ways, so that the indicators confirm, correct, and augment one another. Additionally, the use of multiple time frame indicators simultaneously is discussed. Kase's Permission Stochastic and Screen, which provide moving window higher time frame filters, are discussed. Scaling up using multiple bar length charts is explained, as is scaling out of trades.

- Swings, Waves, and Forecasting: The definitions of a swing, a wave, and a wave cycle and how to draw and label them are discussed. Using waves and wave targets calculated using Fibonacci numbers and retracements, as well as the number Phi, are explained, along with a step-by-step explanation of how to succinctly develop a market view with particular target, expanded with real-life examples.

- Lots of Trading Examples: These are shown throughout, with the ending sessions focused on more advanced examples, putting some of the multiple indicator, multiple bar length techniques into practice. Kase's two study packages, Kase StatWare and KaseX, are also explained, and examples employing Kase studies along with bar length selection and scaling up and down are shown.

PART I

Questions

CHAPTER 2

Start with Charts

QUESTION 2.1 CI Chart

- What type of chart (plot type) is this?

- What increments or interv...

Table of contents

- Cover

- Series

- Title page

- Copyright

- Dedication

- Foreword

- Acknowledgments

- About the Author

- About the Video Course

- CHAPTER 1 Introduction

- PART I QUESTIONS

- PART II ANSWERS

- APPENDIX A FAQs

- APPENDIX B Recommendations for Further Reading

- APPENDIX C Legend of Symbols

- APPENDIX D Algorithms and Formulae for Public Domain Indicators and Studies

- APPENDIX E Contact Information for Kase and Company, Inc.

- Author's Disclaimer

- Continuing Education and Private Classes

- Access to an Online Video Course

- EULA

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app