Foundations of Financial Risk

An Overview of Financial Risk and Risk-based Financial Regulation

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Foundations of Financial Risk

An Overview of Financial Risk and Risk-based Financial Regulation

About this book

Gain a deeper understanding of the issues surrounding financial risk and regulation

Foundations of Financial Risk details the various risks, regulations, and supervisory requirements institutions face in today's economic and regulatory environment. Written by the experts at the Global Association of Risk Professionals (GARP), this book represents an update to GARP's original publication, Foundations of Banking Risk. You'll learn the terminology and basic concepts surrounding global financial risk and regulation, and develop an understanding of the methods used to measure and manage market, credit, and operational risk. Coverage includes traded market risk and regulation, treasury risk and regulation, and much more, including brand new coverage of risk management for insurance companies. Clear explanations, focused discussion, and comprehensive relevancy make this book an ideal resource for an introduction to risk management.

The textbook provides an understanding of risk management methodologies, governance structures for risk management in financial institutions and the regulatory requirements dictated by the Basel Committee on Banking Supervision. It provides thorough coverage of the issues surrounding financial risk, giving you a solid knowledgebase and a practical, applicable understanding.

- Understand risk measurement and management

- Learn how minimum capital requirements are regulated

- Explore all aspects of financial institution regulation and disclosure

- Master the terminology of global risk and regulation

Financial institutions and supervisors around the world are increasingly recognizing how vital sound risk management practices are to both individual firms and the capital markets system as a whole. Savvy professionals recognize the need for authoritative and comprehensive training, and Foundations of Financial Risk delivers with expert-led education for those new to risk management.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Information

CHAPTER 1

Functions and Forms of Banking

- 1.1 Banks and Banking

- 1.2 Different Bank Types

- 1.3 Banking Risks

- 1.4 Forces Shaping the Banking Industry

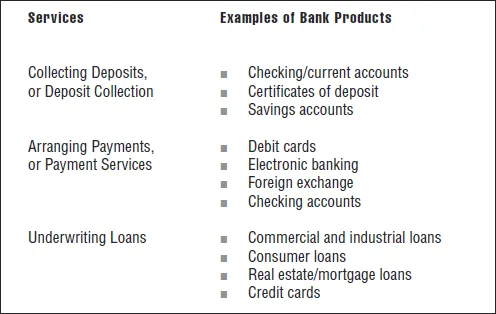

- Banks provide three core banking services: deposit collection, payment arrangement, and loan underwriting. Banks may also offer financial services such as cash, asset, and risk management.

- Banks play a central role in facilitating economic activity through three interrelated processes: financial intermediation, asset transformation, and money creation.

- Retail banks primarily serve retail customers, and wholesale banks primarily serve corporate customers. A country's central bank sets monetary policy on behalf of the country's government, liaises with other central banks, and may act as the bank regulator. Sometimes a body other than the central bank is responsible for the regulation of individual banks.

- The main risks that banks face are credit, market, operational, and liquidity risks. Other types of risk include business, and reputational risk. As economies, banks, and societies as a whole develop and change, the risks faced by banks may also change, and new risks may emerge.

- Multiple forces shape the banking industry, including regulation, competition, product innovation, changing technology, and the uncertainty surrounding future interest and inflation rates.

1.1 Banks and Banking

1.1.1 Core Bank Services

- Deposit collection—the process of accepting cash or money (deposits) from individuals and businesses (depositors) for safekeeping in a bank account, available for future use.

- Payment services—the process of accepting and making payments on behalf of the customers using their bank accounts.

- Loan underwriting—the process of evaluating and deciding whether a customer (borrower) is eligible to receive credit and then extending a loan or credit to the customer.

1.1.2 Banks in the Economy

- Banks channel savings from depositors to borrowers, an activity known as financial intermediation.

- Banks create loans from deposits through asset transformation.

- Banks, through financial intermediation and asset transformation, engage in money creation.

1.1.3 Money Creation

Table of contents

- Cover

- Title page

- Copyright

- Dedication

- Preface

- Acknowledgments

- Introduction

- CHAPTER 1 Functions and Forms of Banking

- CHAPTER 2 Managing Banks

- CHAPTER 3 Banking Regulation

- CHAPTER 4 Credit Risk

- CHAPTER 5 Credit Risk Management

- CHAPTER 6 Market Risk

- CHAPTER 7 Operational Risk

- CHAPTER 8 Regulatory Capital and Supervision

- CHAPTER 9 Insurance Risk

- Glossary

- Index

- EULA