- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

"In the next 10 years, we'll see more disruption and changes to the banking and financial industry than we've seen in the preceding 100 years" — Brett King

Breaking Banks: The Innovators, Rogues, and Strategists Rebooting Banking is a unique collection of interviews take from across the global Financial Services Technology (or FinTech) domain detailing the stories, case studies, start-ups, and emerging trends that will define this disruption.

- Features the author's catalogued interviews with experts across the globe, focusing on the disruptive technologies, platforms and behaviors that are threating the traditional industry approach to banking and financial services

- Topics of interest covered include Bitcoin's disruptive attack on currencies, P2P Lending, Social Media, the Neo-Banks reinventing the basic day-to-day checking account, global solutions for the unbanked and underbanked, through to changing consumer behavior

Breaking Banks is the only record of its kind detailing the massive and dramatic shift occurring in the financial services space today.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Breaking Banks by Brett King in PDF and/or ePUB format, as well as other popular books in Economics & Banks & Banking. We have over one million books available in our catalogue for you to explore.

Information

Chapter 1

A New Take on Credit and Lending

The Global Financial Crisis saw the first decline in household debt in countries like the United States and the United Kingdom in over a decade, but in the past months we’ve started to see the lending business warm up again, getting closer to its pre-Financial Crisis levels.

When it comes to loan origination, traditional lenders increasingly are finding difficulty in competing with digital services and platforms that are providing more information and options in a more dynamic manner. Approval times have been slashed, built on newly designed processes with far less friction than the typical lender’s loan application. As mistrust of the traditional banking system has increased and as lending has become more expensive, entrepreneurs have been turning to tools of the digital age to offer new solutions to those such as the unbanked, or to those looking for more transparent or cost effective options.

Lending has been around for a very long time. In fact, lending predates formal currency and the formalized banking system by thousands of years.

Archeological digs over the past 150 years or so have found literally hundreds of thousands of these tablets from as far back as 3000 BC. These tablets reveal that silver and barley (and sometimes gold as well) were used as the primary currencies and stores of wealth at the time. Mesopotamian merchants and lenders granted loans of silver and barley, at rates of interest fixed by law1 to avoid usury. The yearly interest on loans of silver was regulated at 20 percent and on loans of barley at 33.3 percent.

Close to 4,000 years later, we’re still using this same basic construct for lending purposes—a principal, a term, and an interest rate.

Access to lending has today become cheap and ubiquitous. Credit in the form of auto loans, student loans, payday loans, mortgages, and credit cards has sprung up across the developed world in increasing variety. Microcredit and lending systems, most recently popularized by the likes of Grameen Bank2 in Bangladesh, and new online social platforms, such as Kiva.org,3 have given broader access to credit in communities that have traditionally not had access to such.

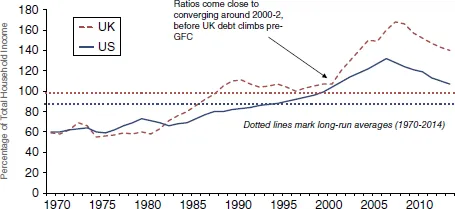

Our dependence on credit and the way we use credit has also changed in recent years. In the early 1980s, U.S. household debt as a share of income was around 60 percent. By the time of the 2008 financial crisis, that share had grown to exceed 100 percent. In fact, at its peak just prior to the financial crisis, U.S. household debt as a share of income had ballooned to almost 140 percent, but in the United Kingdom that figure was almost 170 percent of household income. Today, U.S. household credit card debit alone averages $15,185 per household, but that is down from around $19,000 in mid-2008 (Figure 1.1).

FIGURE 1.1 UK & US Household Debt as a % of Total Income

Source: Federal Reserve, BLS, Office of National Statistics (UK).

The good news (for consumers) is that after the financial crisis we’re using debt less in countries like the United States and the United Kingdom. In fact, we’ve seen a roughly 20 percent decrease in household debt as a percentage of income since the financial crisis, bringing use of household debt back to around 2002 levels. The bad news is that with default rates skyrocketing during the financial crisis, this reduction is less about people saving money, and more about the fact that defaults increased dramatically.

At the heart of this increasing debt load we see in developed economies is a system that is built around lack of transparency on the real cost of lending, and lack of visibility on your money.

In the 1960s, when debt utilization was low, the bank account of the day was a Passbook, and there were no ATMs, credit cards, or debit cards. If you wanted to spend money, you had to take your passbook down to the branch, withdraw cash, and you would see very obviously how that withdrawal affected your overall financial position. You also couldn’t generally spend more money than you had in your bank account. Overdrafts were uncommon, checks would bounce if you didn’t have enough cash in your account, and the most common form of financing was a home mortgage (not a credit card).

Today, our use of credit cards and debit cards has actually decreased visibility on our velocity of spending. For the 68 percent of American households that live paycheck-to-paycheck,4 this can be problematic. Try as we might to keep a rough estimate of how we spend our money on a day-to-day basis, most of us are just not that accurate in keeping track of our running bank balance. Inevitably, then, consumers end up in a store shopping for the week’s groceries, they pull out that debit card, and the transaction is declined because they’ve simply spent more money than they were aware of. Or, worse, they suddenly are in overdraft and don’t find out until they next go to the ATM and find their account $300 in the red due to overdraft fees.

The way we use credit in our lives is going to have to change. Visibility on the real-cost of debt, whether student loans, mortgages, credit cards, or things like medical loans in the United States, is going to face demand for greater transparency when it comes to consumer awareness on the real costs involved. At the same time, credit decisioning is going to go through a rapid change in the next decade as most of these decisions become real-time—no longer based on some application form you fill out sitting in a branch, but triggered contextually and based on a risk methodology built more from consumer behavior than historical default.

WHEN YOUR CREDIT SCORE BECOMES MORE IMPORTANT THAN ACTUAL RISK

In 2010, I moved to the United States, and despite a healthy income profile,5 a spotless credit history outside of the United States, a healthy net cash position, a strong investment portfolio, and minimal ongoing credit exposure, I still couldn’t get basic credit for love or money.

The problem is that the U.S. system has become so dependent on credit scores that good risk decisions can no longer be made without reference to that score. In the minds of many, credit scores appear to have become more about punishing borrowers for perceived bad behavior than actually providing access to credit.6 Most credit scores often lag7 30 to 60 days behind consumer behavior (rather than accurately predicting the likelihood of default as they are supposed to), and consumers often see a markedly different credit score than what lenders see.8

With my income and risk profile I was a very safe bet for any lender or credit facility, but because I hadn’t meticulously crafted a credit score history, I was a nonentity as far as lenders were concerned—and that translated to a false negative, a presumed “guilty,” because I had what is known in the industry as a thin credit file. If a bank had examined my behavior, they would have seen that each month I save, and I spend considerably less money than I earn—and therefore my ability to service ongoing debt is very high. Additionally, my income has been improving consistently over the last four to five years, so that trend should mean that my ability to service debt is actually improving. None of that mattered. The logic of a sound credit decision based on actual risk had been replaced by another mechanism—a standardized score that was not a good predictor of risk without at least a two-to-three-year history or investment in building up that score specifically.

Now it is a fair argument that in a system that demand...

Table of contents

- Cover

- Contents

- Title

- Copyright

- Dedication

- Acknowledgments

- About the Author

- Introduction: An Industry Being Reborn and Reinvented

- Chapter 1: A New Take on Credit and Lending

- Chapter 2: The Era of the Faster, Smarter Payment

- Chapter 3: Banks That Build Their Brand without Branches

- Chapter 4: How the Crowd Is Changing Brand Advocacy in Banking

- Chapter 5: Not Your Father’s Banking Habits

- Chapter 6: Is Bitcoin the End of Cash?

- Chapter 7: Moving from Personal Financial Management to Personal Financial Performance

- Chapter 8: When Technology Becomes Humanlike, Does a Real Human Provide a Differentiated Experience?

- Chapter 9: Here Come the Neo-Banks!

- Chapter 10: Building Experiences Customers Love

- Chapter 11: Money Can Buy Happiness

- Conclusion: We’re Not Breaking Banking, We’re Rebooting and Rebuilding It

- Index

- End User License Agreement