The Business of Venture Capital

Insights from Leading Practitioners on the Art of Raising a Fund, Deal Structuring, Value Creation, and Exit Strategies

Mahendra Ramsinghani

- English

- ePUB (mobile friendly)

- Available on iOS & Android

The Business of Venture Capital

Insights from Leading Practitioners on the Art of Raising a Fund, Deal Structuring, Value Creation, and Exit Strategies

Mahendra Ramsinghani

About This Book

The definitive guide to demystifying the venture capital business

The Business of Venture Capital, Second Edition covers the entire spectrum of this field, from raising funds and structuring investments to assessing exit pathways. Written by a practitioner for practitioners, the book provides the necessary breadth and depth, simplifies the jargon, and balances the analytical logic with experiential wisdom. Starting with a Foreword by Mark Heesen, President, National Venture Capital Association (NVCA), this important guide includes insights and perspectives from leading experts.

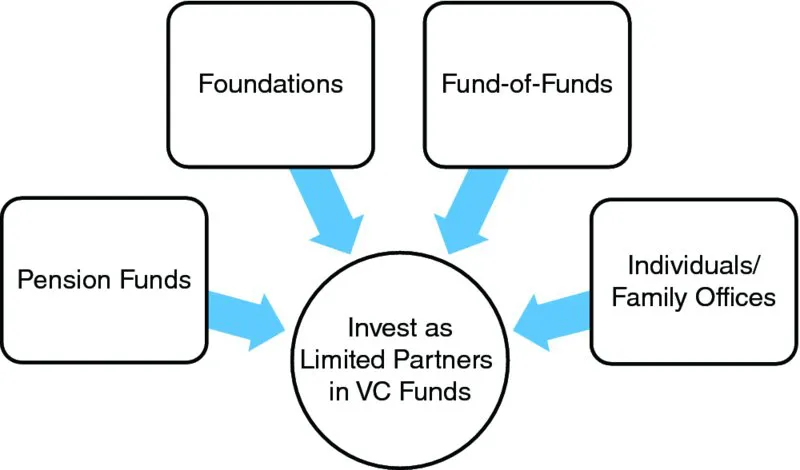

- Covers the process of raising the venture fund, including identifying and assessing the Limited Partner universe; fund due-diligence criteria; and fund investment terms in Part One

- Discusses the investment process, including sourcing investment opportunities; conducting due diligence and negotiating investment terms; adding value as a board member; and exploring exit pathways in Part Two

- Offers insights, anecdotes, and wisdom from the experiences of best-in-class practitioners

- Includes interviews conducted by Leading Limited Partners/Fund-of-Funds with Credit Suisse, Top Tier Capital Partners, Grove Street Advisors, Rho Capital, Pension Fund Managers, and Family Office Managers

- Features the insights of over twenty-five leading venture capital practitioners, frequently featured on Forbes' Midas List of top venture capitalists

Those aspiring to raise a fund, pursue a career in venture capital, or simply understand the art of investing can benefit from The Business of Venture Capital, Second Edition. The companion website offers various tools such as GP Fund Due Diligence Checklist, Investment Due Diligence Checklist, and more, as well as external links to industry white papers and other industry guidelines.

Frequently asked questions

PART One

Raising the Venture Fund

- Performance track record and background of fund managers

- Investment strategy and its relevance to (a) managers’ expertise and (b) market conditions

- Fifty-two percent of venture funds complete their fund-raising in 12 months. Others spend as much as 24 to 36 months on the road.

- Of the funds that successfully got off the ground, only 7 percent are first-time funds.

- About 70 percent of the funds successfully reach or exceed their targeted fund amount.

CHAPTER 1

The Basics

“The key to making great investments is to assume that the past is wrong, and to do something that's not part of the past, to do something entirely differently.”—Donald Valentine, Founder, Sequoia Capital1

RAISE THE VENTURE FUND