- English

- ePUB (mobile friendly)

- Available on iOS & Android

The Heston Model and Its Extensions in VBA

About this book

Practical options pricing for better-informed investment decisions.

The Heston Model and Its Extensions in VBA is the definitive guide to options pricing using two of the derivatives industry's most powerful modeling tools—the Heston model, and VBA. Light on theory, this extremely useful reference focuses on implementation, and can help investors more efficiently—and accurately—exploit market information to better inform investment decisions. Coverage includes a description of the Heston model, with specific emphasis on equity options pricing and variance modeling, The book focuses not only on the original Heston model, but also on the many enhancements and refinements that have been applied to the model, including methods that use the Fourier transform, numerical integration schemes, simulation, methods for pricing American options, and much more. The companion website offers pricing code in VBA that resides in an extensive set of Excel spreadsheets.

The Heston model is the derivatives industry's most popular stochastic volatility model for pricing equity derivatives. This book provides complete guidance toward the successful implementation of this valuable model using the industry's ubiquitous financial modeling software, giving users the understanding—and VBA code—they need to produce option prices that are more accurate, and volatility surfaces that more closely reflect market conditions.

Derivatives pricing is often the hinge on which profit is made or lost in financial institutions, making accuracy of utmost importance. This book will help risk managers, traders, portfolio managers, quants, academics and other professionals better understand the Heston model and its extensions, in a writing style that is clear, concise, transparent and easy to understand. For better pricing accuracy, The Heston Model and Its Extensions in VBA is a crucial resource for producing more accurate model outputs such as prices, hedge ratios, volatilities, and graphs.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

CHAPTER 1

The Heston Model for European Options

AbstractHere, we present the European call price under the Heston model. We first present the model and then illustrate that the call price in the Heston model can be expressed as the sum of two terms that each contains an in-the-money probability but obtained under a separate measure, a result demonstrated by Bakshi and Madan (2000). We then show how to incorporate a continuous dividend yield and how to compute the price of a European put, and demonstrate that the numerical integration can be speed up by consolidating the two numerical integrals into a single integral. Finally, we derive the Black-Scholes model as a special case of the Heston model.CIR process, European call, characteristic function, dividend yield, put-call parity, Black-Scholes

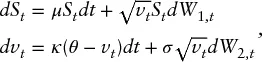

MODEL DYNAMICS

- μ the drift of the process for the stock;

- κ > 0 the mean reversion speed for the variance;

- θ > 0 the mean reversion level for the variance;

- σ > 0 the volatility of the variance;

- v0 > 0 the initial (time zero) level of the variance;

- ρ ∈ [ − 1, 1] the correlation between the two Brownian motion W1 and W2; and

- λ the volatility risk parameter (discussed below).

Table of contents

- Cover

- Series

- Title page

- Copyright

- Dedication

- Foreword

- Preface

- Acknowledgments

- About This Book

- VBA Library for Complex Numbers

- Chapter 1 The Heston Model for European Options

- Chapter 2 Integration Issues, Parameter Effects, and Variance Modeling

- Chapter 3 Derivations Using the Fourier Transform

- Chapter 4 The Fundamental Transform for Pricing Options

- Chapter 5 Numerical Integration Schemes

- Chapter 6 Parameter Estimation

- Chapter 7 Simulation in the Heston Model

- Chapter 8 American Options

- Chapter 9 Time-Dependent Heston Models

- Chapter 10 Methods for Finite Differences

- Chapter 11 The Heston Greeks

- Chapter 12 The Double Heston Model

- Bibliography

- About the Website

- Index

- EULA