- English

- ePUB (mobile friendly)

- Available on iOS & Android

A Guide to Creating A Successful Algorithmic Trading Strategy

About this book

Turn insight into profit with guru guidance toward successful algorithmic trading

A Guide to Creating a Successful Algorithmic Trading Strategy provides the latest strategies from an industry guru to show you how to build your own system from the ground up. If you're looking to develop a successful career in algorithmic trading, this book has you covered from idea to execution as you learn to develop a trader's insight and turn it into profitable strategy. You'll discover your trading personality and use it as a jumping-off point to create the ideal algo system that works the way you work, so you can achieve your goals faster. Coverage includes learning to recognize opportunities and identify a sound premise, and detailed discussion on seasonal patterns, interest rate-based trends, volatility, weekly and monthly patterns, the 3-day cycle, and much more—with an emphasis on trading as the best teacher. By actually making trades, you concentrate your attention on the market, absorb the effects on your money, and quickly resolve problems that impact profits.

Algorithmic trading began as a "ridiculous" concept in the 1970s, then became an "unfair advantage" as it evolved into the lynchpin of a successful trading strategy. This book gives you the background you need to effectively reap the benefits of this important trading method.

- Navigate confusing markets

- Find the right trades and make them

- Build a successful algo trading system

- Turn insights into profitable strategies

Algorithmic trading strategies are everywhere, but they're not all equally valuable. It's far too easy to fall for something that worked brilliantly in the past, but with little hope of working in the future. A Guide to Creating a Successful Algorithmic Trading Strategy shows you how to choose the best, leave the rest, and make more money from your trades.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

CHAPTER 1

A Brief Introduction: The Ground Rules

Everything should be made as simple as possible, but not simpler.—Albert Einstein

MY OBJECTIVE

THE GROUND RULES

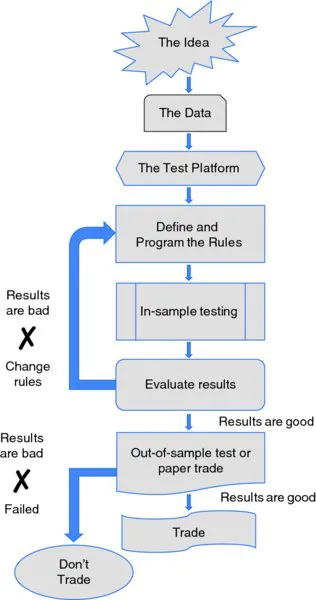

THE PROCESS

BASIC TRADING SYSTEMS

The Trend System

Short-Term Systems

CHAPTER 2

The Idea

BEGIN AT THE BEGINNING

- Trends based on interest rate policy set by the Fed.

- Seasonal patterns that exist in agriculture, airline stocks, vacation resorts, heating oil, and other stocks and commodities.

- Exploiting the difference between two similar stocks, such as two chip manufacturers, pharmaceutical companies, or home builders. That’s called stock arbitrage, or pairs trading.

- Buying or selling price volatility before an earnings report or after a price shock.

- Fading an upgrade announcement by a major firm (old news by the time it prints on the screen).

- Same-time-next-month patterns, when f...

Table of contents

- Cover

- Series

- Title Page

- Copyright

- Acknowledgments

- Chapter 1: A Brief Introduction: The Ground Rules

- Chapter 2: The Idea

- Chapter 3: Don’t Make It Complex

- Chapter 4: Why Should I Care about “Robust” If I’m Trading Only Apple?

- Chapter 5: Less Is More

- Chapter 6: If You’re a Trend Follower, Don’t Use Profit-Taking or Stops

- Chapter 7: Take Your Profit If You’re a Short-Term Trader

- Chapter 8: Searching for the Perfect System

- Chapter 9: Equal Opportunity Trading

- Chapter 10: Testing—The Fork in the Road

- Chapter 11: Beating It into Submission

- Chapter 12: More on Futures

- Chapter 13: I Don’t Want No Stinkin’ Risk

- Chapter 14: Picking the Best Stocks (and Futures Markets) for Your Portfolio

- Chapter 15: Matching the Strategy to the Market

- Chapter 16: Constructing a Trend Strategy

- Chapter 17: Constructing an Intraday Trading Strategy

- Chapter 18: Summary

- Resources

- Index

- EULA

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app