Risk Analysis

About this book

A practical guide to the varied challenges presented in the ever-growing field of risk analysis.

Risk Analysis presents an accessible and concise guide to performing risk analysis, in a wide variety of field, with minimal prior knowledge required. Forming an ideal companion volume to Aven's previous Wiley text Foundations of Risk Analysis, it provides clear recommendations and guidance in the planning, execution anduse of risk analysis.

This new edition presents recent developments related to risk conceptualization, focusing on related issues on risk assessment and their application. New examples are also featured to clarify the reader's understanding in the application of risk analysis and the risk analysis process.

Key features:

- Fully updated to include recent developments related to risk conceptualization and related issues on risk assessments and their applications.

- Emphasizes the decision making context of risk analysis rather than just computing probabilities

- Demonstrates how to carry out predictive risk analysis using a variety of case studies and examples.

- Written by an experienced expert in the field, in a style suitable for both industrial and academic audiences.

This book is ideal for advanced undergraduates, graduates, analysts and researchers from statistics, engineering, finance, medicine and physical sciences. Managers facing decision making problems involving risk and uncertainty will also benefit from this book.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Chapter 1

What is a risk analysis?

| Main category | Type of analysis | Description |

| Simplified risk analysis | Qualitative | Simplified risk analysis is an informal procedure that establishes the risk picture using brainstorming sessions and group discussions. The risk might be presented on a coarse scale, for example, low, moderate or high, making no use of formalised risk analysis methods. |

| Standard risk analysis | Qualitative or quantitative | Standard risk analysis is a more formalised procedure in which recognised risk analysis methods are used, such as Hazard and Operability study (HAZOP) and coarse risk analysis, to name a few. Risk matrices are often used to present the results. |

| Model-based risk analysis | Primarily quantitative | Model-based risk analysis makes use of techniques such as event tree analysis and fault tree analysis to calculate risk. |

Reflection

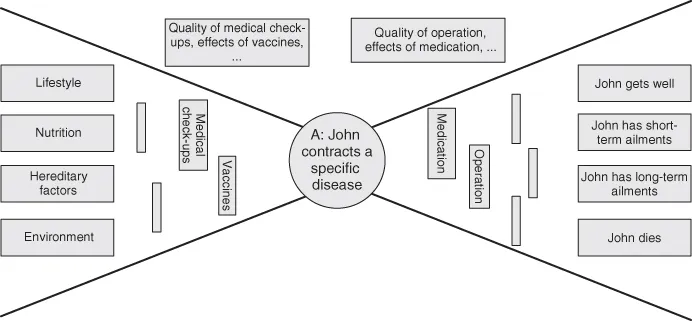

1.1 Why risk analysis?

- establish a risk picture;

- compare different alternatives and solutions in terms of risk;

- identify factors, conditions, activities, systems, components and so on that are important (critical) with respect to risk; and

- demonstrate the effect of various measures on risk.

- Choosing between various alternative solutions and activities while in the planning phase of a system.

- Choosing between alternative designs of a solution or a measure. What measures can be implemented to make the system less vulnerable in the sense that it can better tolerate loads and stresses?

- Drawing conclusions on whether various solutions and measures meet the stated requirements.

- Setting requirements for various solutions and measures, for example, related to the performance of the preparedness systems.

- Documenting an acceptable safety and risk level.

1.2 Risk management

Table of contents

- Cover

- Title Page

- Copyright

- Table of Contents

- Preface

- Chapter 1: What is a risk analysis?

- chapter 2: What is risk?

- Chapter 3: The risk analysis process: planning

- Chapter 4: The risk analysis process: risk assessment

- Chapter 5: The risk analysis process: risk treatment

- Chapter 6: Risk analysis methods

- Chapter 7: Safety measures for a road tunnel

- Chapter 8: Risk analysis process for an offshore installation

- Chapter 9: Production assurance

- Chapter 10: Risk analysis process for a cash depot

- Chapter 11: Risk analysis process for municipalities

- Chapter 12: Risk analysis process for the entire enterprise

- Chapter 13: Discussion

- Appendix A: Probability calculus and statistics

- Appendix B: Introduction to reliability analysis

- Appendix C: Approach for selecting risk analysis methods

- Appendix D: Terminology

- Bibliography

- Index

- End User License Agreement

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app