Part I

The ABCs of ETFs

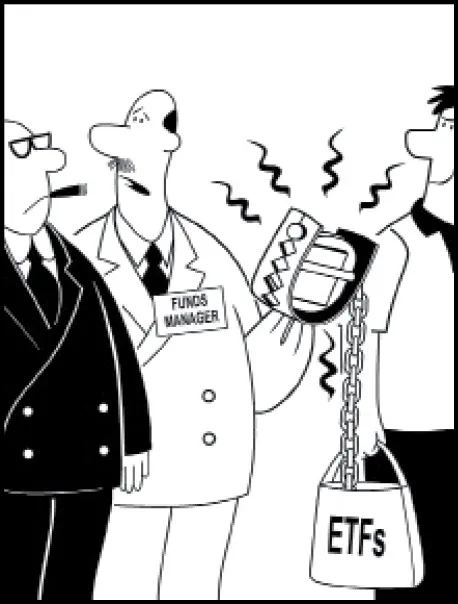

‘I just tried to slip some index managed funds into his portfolio.’

In this part . . .

In these first few ground-laying chapters, you find out what makes exchange-traded funds different from other investment vehicles. You discover the rationale for their being, why they’re popular with institutional investors, why they’re rapidly becoming so popular with non-institutional folk, and why both authors of this book like them almost as much as they do chocolate (almost!).

Although the art and science of building an ETF portfolio come later in the book, this first part introduces you to how ETFs are bought and sold, and helps you ponder whether you should even be thinking about buying them.

Chapter 1

The (Relatively) New Kid on the Block

In This Chapter

Discovering the origin of ETFs

Understanding their role in the world of investing today

Getting a handle on how they are administered

Calculating their phenomenal growth

No doubt, a good number of pinstriped ladies and gentlemen in and around the central business districts of Australia and New Zealand froth heavily at the mouth when they hear the words exchange-traded fund (ETF). In a world of very pricey investment products and very lucratively paid investment-product salespeople, ETFs are the ultimate killjoys.

Hallelujah.

In this chapter, we cover the rise (and rise) of ETFs, and the advantages they offer Australian and New Zealand investors.

Tracking the Birth and Growth of ETFs

The first ETF was created in 1990 and, since then, various versions have emerged in different countries and the popularity of this product type has grown. In the following sections, we track the birth and migration of ETFs around the world.

In the beginning

When Russell was a lad growing up in the ’burbs of New York City, his public school educators taught him how to read, write, and learn the capitals of the 50 states of America. He also learned that anything and everything of any importance in this world was, ahem, invented in the United States of America. Russell’s since learned that, well, that isn’t entirely true. Take ETFs. The first ETF was introduced in Canada. It was a creation of the Toronto Stock Exchange — no Wall Streeters were anywhere in sight!

We’re afraid that the story of the development of ETFs isn’t quite as exciting as, say, the story behind penicillin or the cochlear ear implant. As one Toronto Stock Exchange insider once explained to Russell, ‘We saw it as a way of making money by generating more trading’. And so, thus was born the original ETF — known as TIP, which stood for Toronto Index Participation Unit. It tracked an index of large Canadian companies (Bell Canada, Royal Bank of Canada, Nortel and 32 others) known as the Toronto 35. That index was then the closest thing that Canada had to the Dow Jones Industrial Average index that exists in the United States.

Enter the traders

The Canadian TIP ETF (refer to preceding section) was an instant success with large institutional stock traders, who saw that they could now trade an entire index in a flash. The Toronto Stock Exchange got what it wanted — more trading — and the world of ETFs got its start.

TIP has since morphed to track a larger index, the S&P/TSX 60 Index, which — you probably guessed — tracks 60 of Canada’s largest and most liquid companies. The fund also has a new name, the iShares S&P/TSX 60 Index Fund, and it trades under the stock code XIU (an investment product’s stock code is the three-letter code used to list the product on stock exchanges). The product is now managed by iShares, which is owned by BlackRock — one of the largest fund managers in the world and the biggest player in ETFs in Europe, Canada and the United States. Interestingly, iShares isn’t yet the biggest ETF provider (in terms of funds under management) in Australia or New Zealand — State Street Global Advisors (SSgA) claims that title in Australia, with over 60 per cent of ETF assets. The largest provider in New Zealand is Smartshares, owned by the New Zealand Stock Exchange (NZX). (Note: iShares has since introduced another ETF in the United States that uses the ticker TIP, but it has nothing to do with the original TIP. The present-day TIP invests in US Treasury Inflation-Protected Securities.)

Crossing the border and migrating Down Under

The United States had to wait for three or so more years for ETFs to arrive on its shores after their Canadian birth. On 29 January 1993, the Mother of All US ETFs was born on the American Stock Exchange. Called the S&P Depositary Receipts Trust Series 1, commonly known as the SPDR (or Spider) 500 — which tracks the S&P500 index in the US — it traded (and still does) under the ticker symbol SPY. This ETF is managed by State Street Global Advisors, with mammoth funds under management (FUM) of $88 billion.

After the United States, New Zealand was quite quick to join the fun, launching its first ETF product in 1996. Called the NZX 10 (TENZ), this product tracks the top 10 shares by size listed on the New Zealand Stock Exchange (NZX). New Zealand has six ETFs, five of them managed by the New Zealand Stock Exchange and known as Smartshares. The other one is operated by AMP Investments.

Australia had to wait until the start of the new century for its first ETF product — the first and now the largest Australian ETF — listed in March 2001. Called the SPDR S&P/ASX 200 Fund (STW), this product tracks the S&P/ASX 200 Accumulation Index — an index of the largest 200 companies listed on the Australian Securities Exchange (ASX). Like its American cousin, the SPDR S&P/ASX 200 is managed by State Street Global Advisors. While the popularity of ETFs in Australia took a while to take off, recent years since the global financial crisis (GFC) have seen enormous growth, with FUM increasing at 50 per cent per annum between 2009 and 2011.

Fulfilling a Dream

ETFs were first embraced by institutions, and those institutions very much continue to use ETFs to this day. They’re constantly buying and selling ETFs and occasionally options on ETFs for various institutional purposes, which we touch on in Chapter 16. For us non-institutional types, the creation and expansion of ETFs has allowed for the construction of portfolios of institutional-like sleekness.

Goodbye, ridiculously high managed fund fees

A managed fund investor with a $100,000 portfolio filled with actively managed funds is likely to spend $1,650 (1.65 per cent) or more in annual expenses. By switching to an ETF portfolio, that investor is set to incur trading costs (because trading ETFs costs the same as trading stocks) of, oh, perhaps $100 or so. But he can then lower his ongoing annual expenses to about $400 (0.4 per cent). That’s a difference, ladies and gentlemen of the jury, of $1,150, ...