eBook - ePub

Strategy for the Corporate Level

Where to Invest, What to Cut Back and How to Grow Organisations with Multiple Divisions

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Strategy for the Corporate Level

Where to Invest, What to Cut Back and How to Grow Organisations with Multiple Divisions

About this book

A revised edition of the bestselling classic

This book covers strategy for organisations that operate more than one business, a situation commonly referred to as group-level or corporate-level strategy. Corporate-level strategy addresses four types of decisions that only corporate-level managers can make: which businesses or markets to enter, how much to invest in each business, how to select and guide the managers of these businesses, and which activities to centralise at the corporate level. This book gives managers and executive students all the tools they need to make and review effective corporate strategy across a range of organisations.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Strategy for the Corporate Level by Andrew Campbell,Michael Goold,Marcus Alexander,Jo Whitehead in PDF and/or ePUB format, as well as other popular books in Business & Decision Making. We have over one million books available in our catalogue for you to explore.

Information

PART I

Introduction and History

Chapter One

Strategy for the Corporate Level: Summary of the Main Messages

Almost all companies need a strategy at the corporate level that is in addition to the strategies for products or markets or business divisions. So this book is for any manager with responsibilities for multiple business divisions. It is also for any student, adviser or more junior manager who wants to understand the challenges that corporate managers face and how they make decisions. The book will help answer two important questions that can only be addressed at the corporate level:

- What businesses or markets should a company invest in, including decisions about diversifying into adjacent activities, about selling businesses, about entering new geographies or markets and about how much money to commit to each area of business?

- How should the group of businesses be managed, including how to structure the organisation into divisions or units or subsidiaries, how to guide each division, how to manage the links and synergies between divisions, what activities to centralise or decentralise and how to select and guide the managers of these divisions?

We will refer to the first as “business” or “portfolio” strategy and the second as “management” or “parenting” strategy. The combination of these two types of strategy makes up corporate-level strategy.

Terms like business division, corporate headquarters or corporate-level strategy may suggest that this book is only relevant to managers running old-fashioned conglomerates. Far from it. This book is just as relevant for focused companies like Apple or Google. It is also relevant for public sector organisations, although much of the language used is commercial.

Blacklock 1

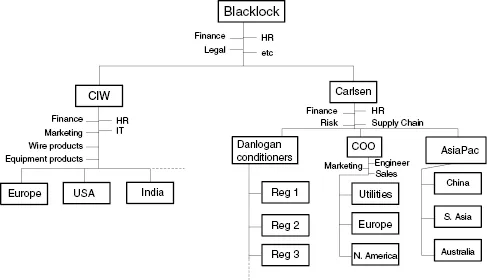

In 2010, Blacklock Inc., a US engineering company, was being threatened with hostile takeover approaches from two companies: Vantex, another US engineering company, and Molsand, a Scandanavian company skilled at turnarounds and business improvement. Blacklock had two business divisions: Carlsen, a company manufacturing pumps, water equipment and air conditioners, and CIW, a company supplying wire, wire equipment and related consumables (see Figure 1.1).

The Carlsen division was itself organised into business divisions. Some of the business divisions were focused on products, such as a type of equipment or conditioner. Some were focused on market segments, such as the utilities sector. Some were focused on regions, such as AsiaPac or Europe. All business divisions contained both manufacturing and sales. Linking the business divisions together were processes for sharing technology, manufacturing and purchasing as well as typical group functions, such as finance, HR and IT.

Some of Carlsen's business divisions also contained business units. For example, Danlogan, a division focused on con ditioners and acquired in 2005, was divided into seven geographic regions. Also, the AsiaPac division included business units in Australia, China and South Asia.

CIW (originally Commercial & Industrial Wire) was also organised into business divisions. CIW's business divisions were geographic: Europe, North America, South America, China, India, etc. Each division had its own manufacturing and sales, but technology and product development were centralised at the CIW level, along with group marketing. Also at the CIW level were typical group functions covering finance, HR, IT, Safety and Lean.

At the Blacklock level, there were a handful of managers covering legal and financial issues.

For a company like Blacklock, this book is about the following questions. Should Blacklock own both Carlsen and CIW? What other business divisions should Blacklock seek to develop or acquire, if any? Should Blacklock resist the acquisition approaches by Molsand and Vantex? If not, which company should they seek to align with? What should be the main focus of the management team at the Blacklock level? Which activities should be centralised at the Blacklock level? How should Blacklock appoint, interact with and guide the management teams running Carlsen and CIW? How much collaboration should Blacklock encourage between Carlsen and CIW?

Blacklock is a parent company and this book is helpful to managers at this level in the organisation. But this book is just as relevant for managers at the Carlsen and CIW levels. The management teams of Carlsen and CIW are both running organisations with multiple business divisions. For Carlsen, this book will help with the following questions. Why does it make sense for Carlsen to own businesses involved in both pumps and conditioners? What other products should Carlsen seek to develop or acquire, if any? Does it make sense for Carlsen to be involved in bespoke equipment for the water industry as well as off-the-shelf equipment for general industrial uses? Is it necessary for Carlsen to have a global footprint? How should Carlsen group its business units into business divisions: by geography, by market sector, by product or by a combination of all of these? How should Carlsen manage the links and overlaps among divisions? Which activities should be centralised at the Carlsen level? How should Carlsen's top managers appoint, interact with and guide the managers running its business divisions?

Even within Carlsen, this book will help the management team running the Danlogan division or the Asia division. Why does it make sense for Danlogan to be a global company rather than focused in just one region? What other countries should Danlogan enter? How should Danlogan control or guide the links among its country-based business units? Which activities should be centralised at the Danlogan level? How should Danlogan appoint, interact with and guide the managers running its business units?

For CIW, this book helps answer similar questions. Should CIW own businesses in India and South America? What other geographies should CIW seek to expand into? Should CIW produce both wire products and wire equipment? What other products, if any, should CIW produce? Which activities should be centralised at the CIW level? Should CIW be organised into regional business units or should it be a global functional structure? How should CIW's top managers select, interact with and guide the management teams running its regional units?

Hence, it is important that readers do not presume that this book is only relevant for management teams at the parent company level of diversified companies. It is equally relevant for, and potentially has more to offer to, management teams trying to integrate closely linked businesses and for management teams running divisions that themselves contain sub-businesses.

Molsand was the winning bidder and acquired Blacklock. A similar set of questions then needed to be asked at the Molsand level. Why will Molsand benefit from paying a significant premium over the quoted market price for the Blacklock businesses? Why did it make sense for Molsand to outbid Vantex? Having acquired Blacklock, should Molsand retain the Blacklock level of management? Should Molsand keep both business divisions or should it sell either Carlsen or CIW or parts of these companies? Should Molsand retain Carlsen and CIW in their current shape or should Carlsen be divided, for example, into two companies each reporting directly to Molsand: conditioners and water equipment? What other companies should Molsand seek to acquire? What should be centralised at the Molsand level? (At the time of writing, Molsand had fewer than 20 people in its corporate centre.) How should Molsand appoint, interact with and guide the managers of Blacklock, Carlsen and CIW once they are under full ownership?

So, this book is for a wide range of managers and covers a wide range of decisions. Even a single hotel can be considered to have multiple businesses or profit centres – accommodation, business conferences, restaurant and spa – and hence needs a corporate-level strategy. Ashridge Business School, a charity, with revenues in 2012 of about £40 million, needs a corporate-level strategy. Ashridge has profit centres for open programmes, tailored programmes, conferences, hotel and facilities, qualification programmes, consulting and research centres. It needs a strategy that explains why these different activities are part of one organisation and how the leadership team is going to manage the organisation. So, this book is about more than diversified conglomerates, it is about the strategic thinking that is required to run any complex organisation.

Portfolio Strategy

How should managers make decisions about which businesses, markets or geographies to invest in and which to avoid, ha...

Table of contents

- Cover

- Table of Contents

- Endorsements

- Title page

- Copyright page

- Preface

- Acknowledgements

- PART I: Introduction and History

- PART II: Portfolio Strategy: Where to Invest and What to Avoid

- PART III: Ways of Adding and Subtracting Value from Corporate Headquarters

- PART IV: Management Strategy: How to Structure, How Much to Centralise and How to Grow the Business Divisions

- PART V: Retrospective

- Appendix: The Links between International Strategy and Corporate-level Strategy

- Index

- End User License Agreement